There’s a scene in Walter Isaacson’s biography of Elon Musk in which the billionaire angrily discovers just how few workers are on-site at Twitter Inc.’s lavish 11-story headquarters despite its shrinking revenue and widening losses. He orders a burning-hot coffee, bats away fears of deep job cuts (only to carry them out later), and in his first missive to staff bans remote work.

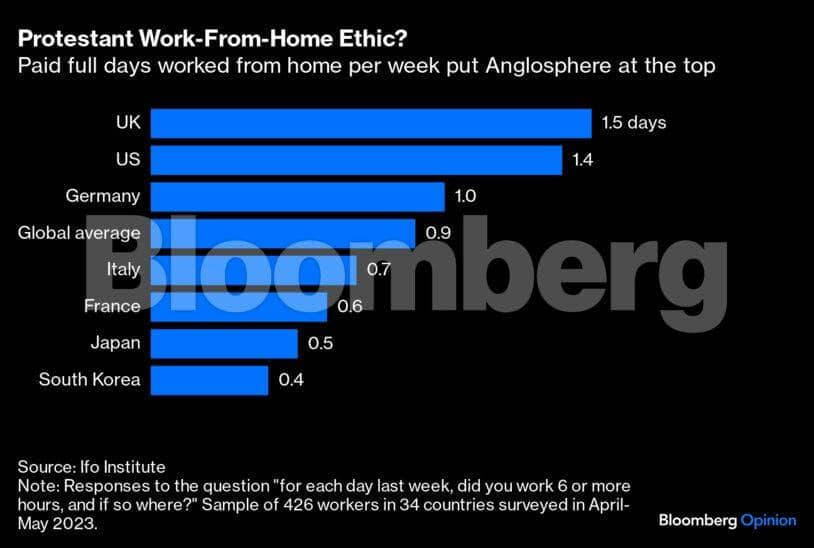

This is how a growing number of bosses have started to see remote work: A pandemic-era “aberration,” a drag on productivity and a potential marker of management complacency at a time of economic slowdown. Banks like Goldman Sachs Group Inc and JPMorgan Chase & Co are shouting the loudest about returning to the office, with tech not far behind — maybe because finance and IT are the sectors with the most days worked from home, according to WFH Research.

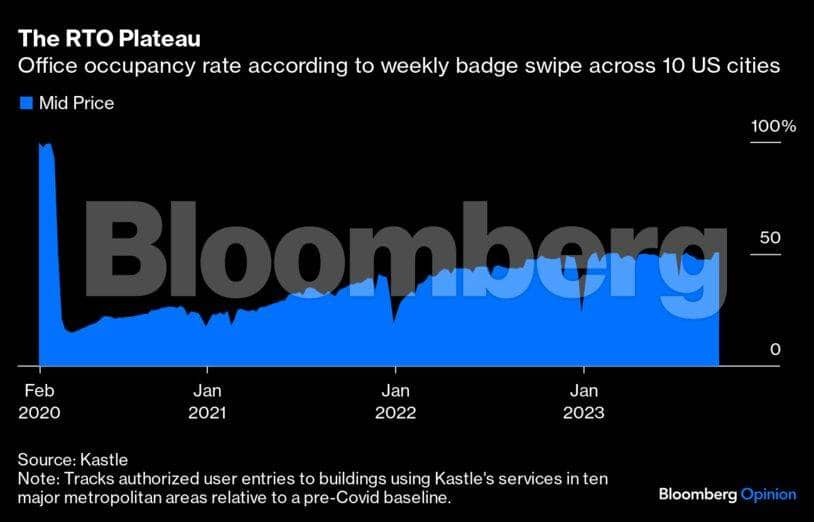

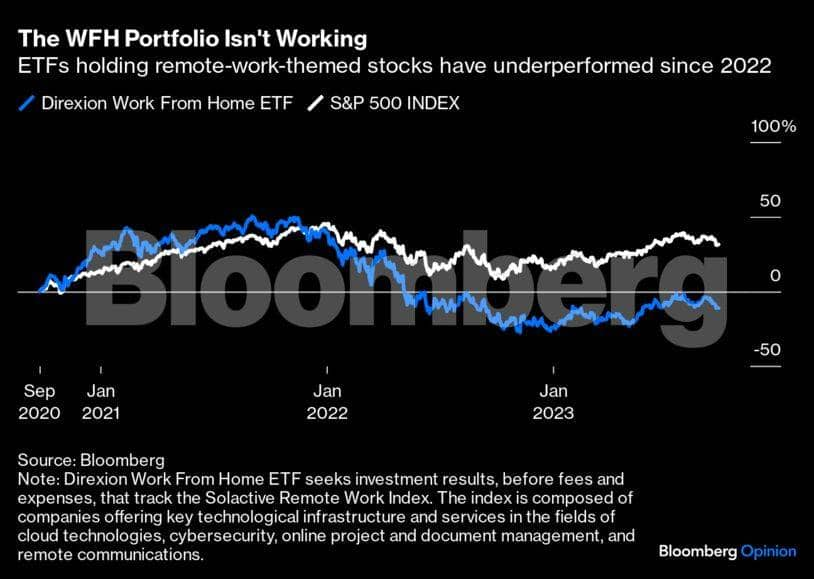

I am no fan of WFH myself — the time saved commuting always seems to transform into more work — and much of the early rhetoric was far too upbeat. But the growing disillusionment surrounding this once-hyped “future of work” led me to think about those still sticking with it: Are they the last of a dying breed, or, given some WFH habits seem very sticky indeed — as the chart below shows — do they know something we office-goers don’t?

I spoke to Benoit Grisoni, chief executive officer of French digital bank Boursorama, which is sticking with work from home — both with a hybrid three-days-in-office model and a nearly 100 percent remote option taken up by around half of its 900-plus staff. The way it works is that the options are divided according to job type: Tasks like sales, customer service or back office can go fully remote, with two days set aside for in-office team-building every month, while more collaborative jobs like marketing or legal stick with hybrid.

Grisoni is no remote-work zealot: He admits that when the idea came up during Covid-19, he was “pretty much against it.” Today, he’s a convert. This is not because productivity has improved; in fact, he says, the impact has been neutral. Maybe that’s because Boursorama, a subsidiary of Societe Generale SA, is a digital bank anyway, more used to tracking metrics like cost per employee and client acquisition. All things being equal, they wouldn’t depend on presenteeism.

WFH’s real advantage, he says, is being able to expand the bank’s talent pool as it ramps up hiring. The remote jobs are no longer tied to the Boursorama headquarters in the western suburbs of Paris, and as a result they’re no longer tied to the costs of commuting to or living in the French capital. That could mean offering out-of-town hires the chance of a better work-life balance without having to pay a top Parisian wage. (A 2020 Banque de France study on remote work noted people were on average ready to sacrifice 8 percent of their salary to work from home, although in practice, as the above chart shows, France has not been a haven for WFH.)

Meanwhile, fewer on-site workers have helped the bank save on office space while still overhauling the workplace to promote collaboration and communication to ensure culture doesn’t suffer.

Rather than preach one model over another, Boursorama’s example suggests remote work should be about analysing tradeoffs, not culture wars. After too much “drinking of the Kool-Aid” in the early WFH boom, says Mark Mortensen, a professor at business school INSEAD, companies are in a better position to do due diligence. For some firms — not all — that might mean the benefits of attracting talent outweigh risks such as alienation and isolation among remote workers, which need to be taken seriously.

It’s not just niche digital lenders — other banks are making similar calculations. Deutsche Bank AG is seeking to cut office space by 40 percent at its Frankfurt base as a rising number of employees work from home, which is a chunky saving. Spain’s Banco Bilbao Vizcaya Argentaria SA last year committed “indefinitely” to WFH up to 40 percent of the time; in Madrid, they’ve even ended some lease agreements and sold one building, according to a spokesperson. If US banks sound more skittish, it may be because they’re under less profit pressure and have a more pressing urgency to revive city centers Stateside — where a record 963 million square feet of office space stood unoccupied at end-March.

These experiences echo the conclusions of a July paper co-authored by Stanford University’s Nicholas Bloom. The research generated buzz by associating fully remote work with 10 percent-20 percent lower productivity, but went on to say that it would nonetheless remain attractive because it saved on office-space and wage costs. As for the hybrid model, it appeared to have small positive effects on productivity.

Remote work remains a lot of work. Hyping it or glamorising it flies in the face of data, but equating it purely with “laptop classes living in la-la land” (as Musk once described it) ignores the benefits that even some whip-cracking CEOs can appreciate. The apprehension about WFH is real, but judging by the companies that still see it as good business sense, it may not be fatal.

Lionel Laurent is a Bloomberg Opinion columnist writing about the future of money and the future of Europe. Views are personal, and do not represent the stand of this publication.

Credit: Bloomberg

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.