By Siddharth Iyer

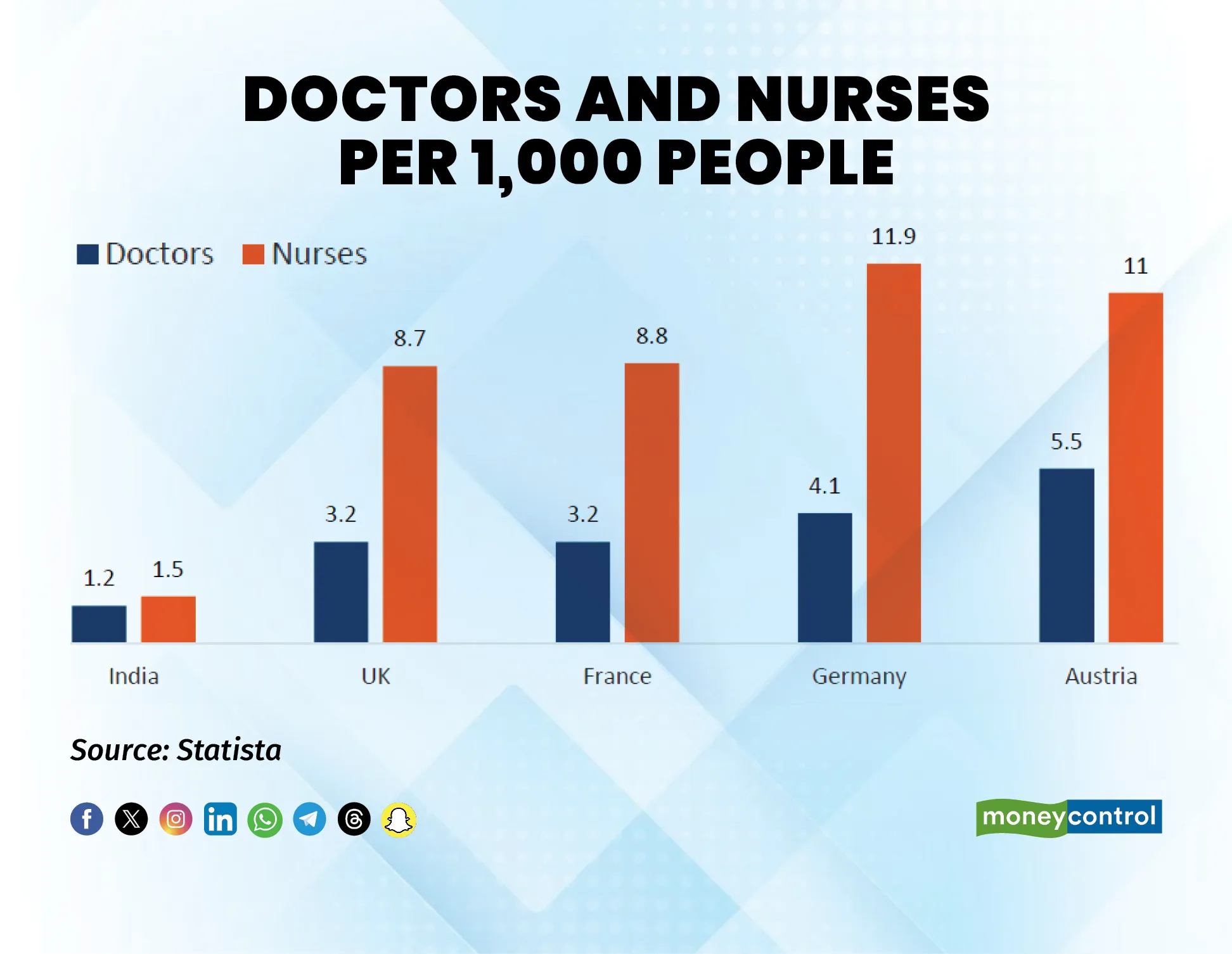

India’s healthcare sector is a tale of two extremes. On one side, government-run facilities struggle with limited resources and basic infrastructure. On the other, high-end private hospitals rival global standards with advanced clinical protocols. The untapped potential of this market is evident from the per capita penetration of key indicators such as beds and medical personnel per capita (see graph below).

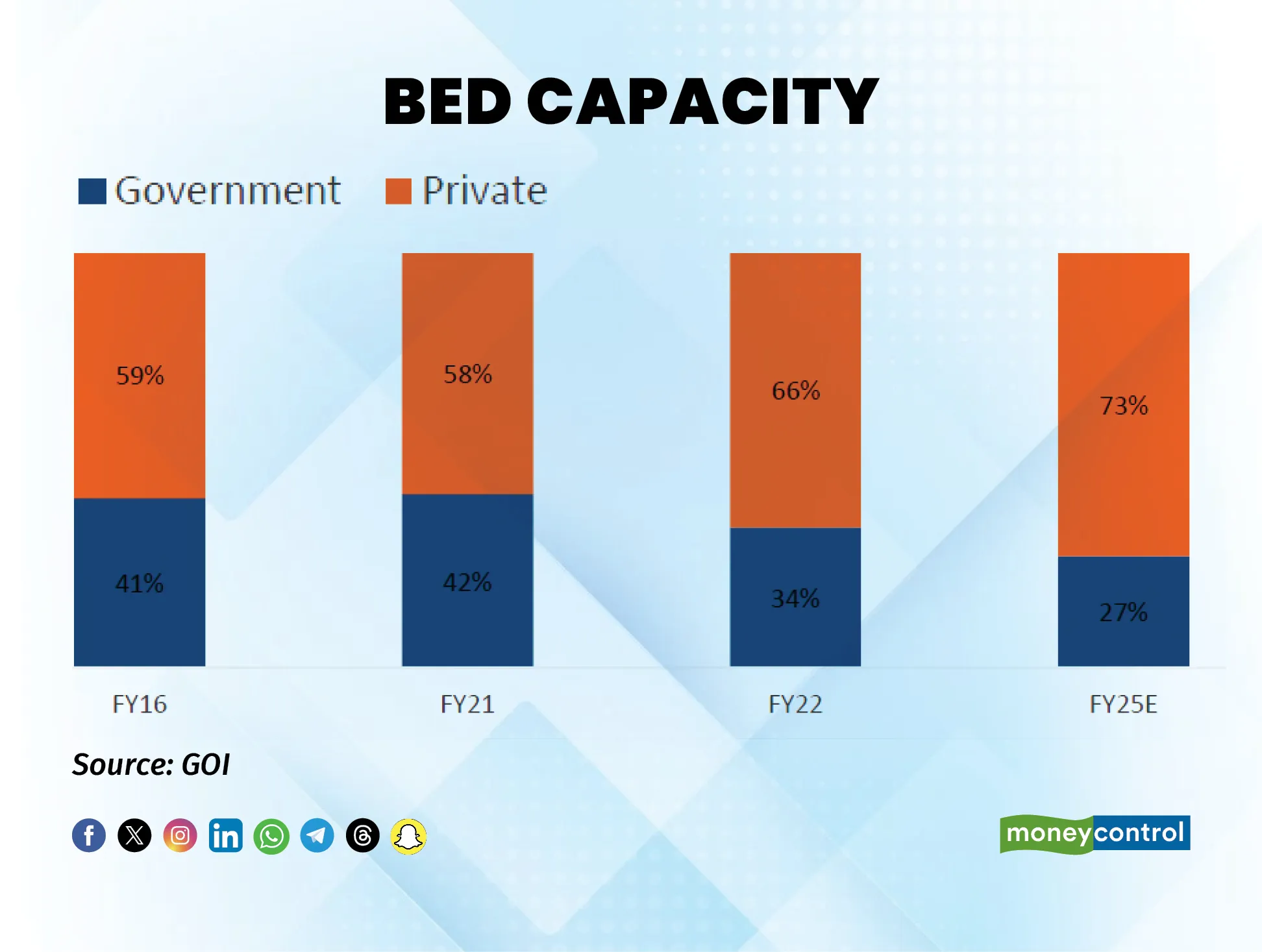

The growing burden of chronic diseases—diabetes, hypertension, cancer—paired with rising prosperity has turned healthcare into a magnet for private capital. The private sector now dominates bed capacity and continues to widen the gap, with the government increasingly playing the role of payer through schemes like Ayushman Bharat.

This privatisation wave has transformed private equity (PE) participation in the sector. Initially minority investors focused on growth capital. However, PE funds have now evolved into control-oriented buy-out specialists. They bring more than capital; they drive operational efficiencies, professional management, and scale.

Three key trends are shaping India’s hospital sector

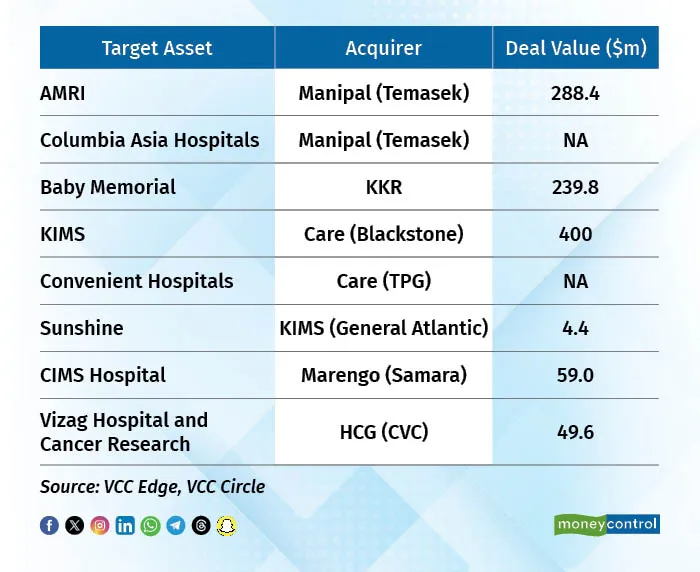

Consolidation of fragmented markets: India’s ~2 million hospital beds are largely controlled by small and medium-sized enterprises (SMEs). While large private hospital chains manage just 15–20% of private beds, the rest are fragmented across independent setups. PE funds are aggressively acquiring regional leaders to build multi-location platforms and establish dominant positions.

Deals like Manipal-Temasek's acquisition of AMRI and Columbia Asia, and KKR's investment in Baby Memorial, illustrate this trend (see table below).

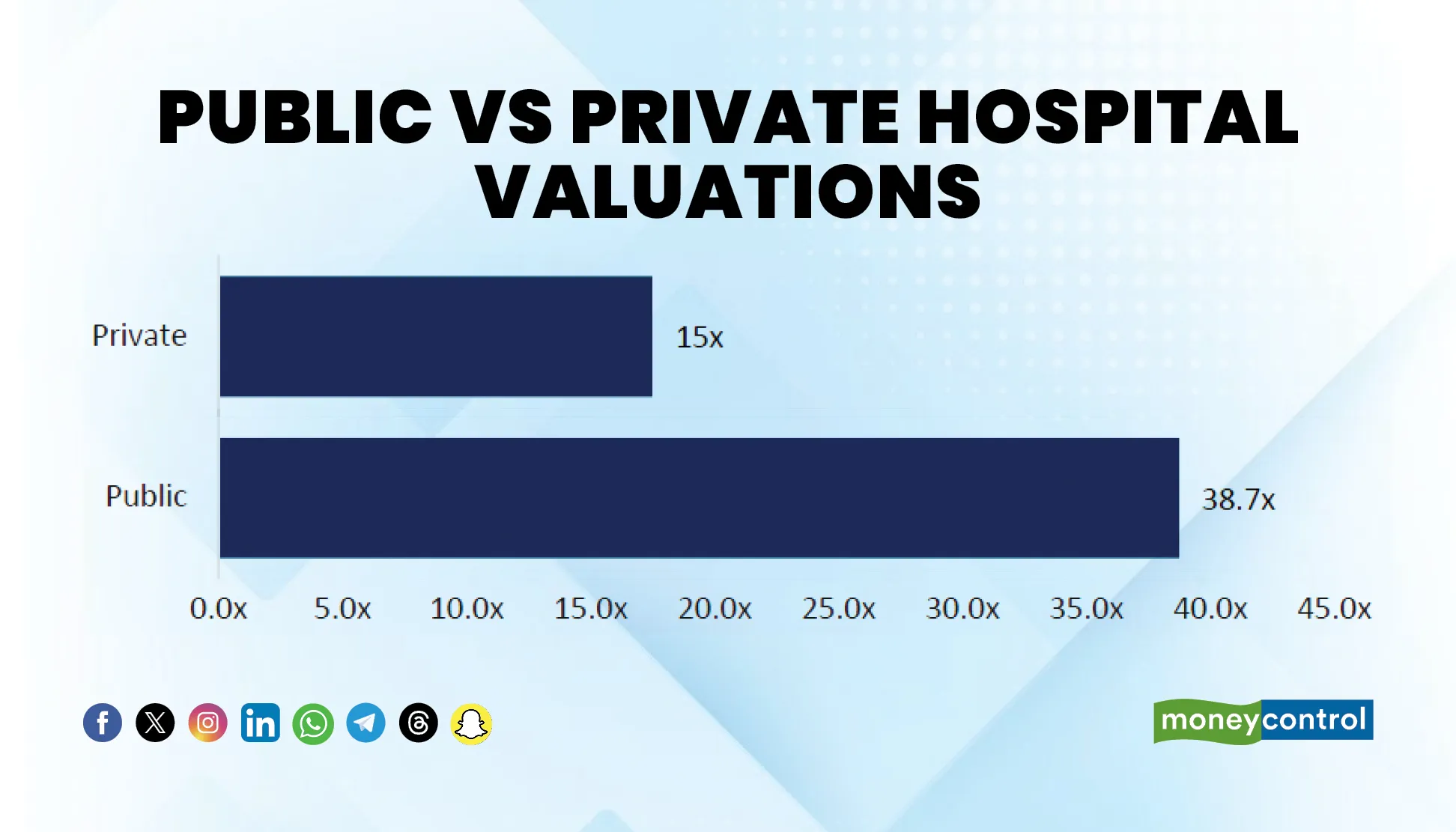

Valuation arbitrage through buyouts: Publicly listed hospital chains command significantly higher valuations than their unlisted peers.

Buy-out funds exploit this gap by acquiring regional hospitals at lower valuations, improving performance, and unlocking value through scale. These buyouts often become candidates for IPOs at premium valuations. By investing in tech, hiring marquee doctors, and boosting brand perception, funds engineer rapid growth and profitability.

Capital-intensive modernisation: Healthcare delivery is becoming more capital-intensive. Investments in electronic health records, robotic surgeries, high-end imaging, and telemedicine require deep pockets. PE-backed hospital chains—with stronger balance sheets and easier access to both debt and equity—are better positioned to adopt such technologies. This leads to higher throughput per bed, improved patient experience, and ultimately better margins.

The future of single-doctor promoted hospitals

The traditional doctor-promoter model is under pressure. These small chains are squeezed between government hospitals’ affordability and the premium offerings of PE-backed chains. With limited capital and long break-even timelines, many have shifted to asset-light expansion through leasing, while others are embracing scalable models like single-specialty and ambulatory care.

Collaboration, not competition, is emerging as the new normal. Strategic mergers—such as the recent Aster-Care tie-up (with Care backed by Blackstone)—demonstrate how doctors and financial sponsors can jointly scale operations, drive efficiency, and improve care quality.

Conclusion

India’s hospital sector is entering a phase of professionalisation, consolidation, and capital-led transformation. PE funds, with their operational acumen and financial muscle, are emerging as catalysts for change—bridging gaps in healthcare infrastructure while enabling scale and sustainability. For the docpreneurs who built these businesses from scratch, partnering with institutional capital may be the most pragmatic way forward in this capital-heavy, tech-driven new era of healthcare delivery.

(Siddharth Iyer is Director, Equirus Capital.)

Views are personal and do not represent the stand of this publication.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.