Jitendra Kumar GuptaMoneycontrol Research

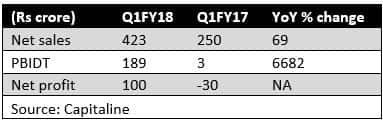

We had initiated coverage on IMFA (Indian Metals & Ferro Alloys) sometime ago and the stock continues to impress us post its quarterly earnings report. The company reported a turnaround performance with a net profit of Rs 100 crore in Q1 of FY18 as against a loss of Rs 30 crore in the year ago period which was impacted due to production disruption and lower realisation.

The performance for the quarter gone by was largely driven by recovery in chrome prices. Despite a 6 percent drop in sales volumes to 48,500 tonnes, the company saw 69 percent year-on-year growth in revenues as sales realisations stood at close to Rs 87,000 per tonne as against Rs 51,600 a tonne in Q1 of FY17.

The benefits of operating leverage also kicked in and, consequently, costs actually declined by 2 percent to Rs 247 crore. This translated to higher profitability. The company also saw 328 percent increase in other income thanks to the increasing cash in the books.

We estimate cash to reach around Rs 660 crore (currently about Rs 300 crore) or about 40 percent of its current market capitalisation by the end of FY18. Our estimates suggest that the company should be reporting an annual net profit of close to Rs 290 crore in the current financial year. At the current market price of Rs 465, the stock is still attractively valued at about 4 times its FY18 estimated earnings. The attractive valuation is in addition to other fundamental strengths like high margin and return ratios and a strong balance sheet.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.