Ruchi Agrawal

Moneycontrol Research

Natural gas transmission companies and end users have been clamouring for the inclusion of natural gas in the Good and Services Tax mechanism for a while now. The oil ministry too is favour of the move. Since bringing gas under the GST ambit does not have major revenue implications for the exchequer, Moneycontrol Research sees it as a near term possibility. Such a move would benefit both transmission companies as well user industries.

Current regime

At present, natural gas excluding LPG is taxed according to the old taxation regime of VAT and excise duty ranging from 5 percent to 26 percent. LPG is taxed at 5 percent under GST.

Why the shift to GST?

Non-inclusion of natural gas products under GST has impacted profits and volumes for the gas companies and industry on the whole. On one hand, the expenditure for downstream gas companies has gone up due to the non-availability of the input tax credit (ITC); on the other, absence of ITC to end users has hurt sales volumes. Moreover, it has led to dual compliance pressures and increased costs due to multiple tax systems. Overall, there has been a substantial impact on the margin which has left medium and small enterprises at a disadvantage.

The revenue angle

Unlike oil, tax rates on gas products falls close to the GST tax slabs. Given the limited compromise on revenues for the exchequer, we believe inclusion of gas products under GST is only logical. It is a win-win for both the gas companies as well as firms using gas as raw material. Improved volume off-take and reduced costs would be key benefits for major gas companies. Availability of ITC would make LNG an attractive alternate fuel option and attract increased off-take from the industrial and commercial users who would be able to claim credit for input taxes paid. Also, it will help the government in its push for cleaner fuels.

Key stocks

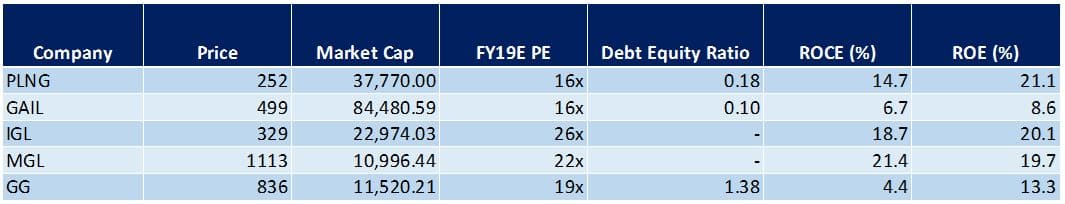

For Petronet LNG, increased demand from industrial consumers would improve plant utilization levels and provide benefits of operating leverage thereby improving margins. With renegotiation of Gorgon LNG contracts and high crude oil prices, we see a further uptick in volumes. The stock has run up around 36 percent since the start of the year and is currently trading at a 16x FY19 PE which is below industry multiples and gives comfort for further upside.

Apart from leverage benefit from volume uptick, GAIL stands to benefit significantly from input tax claim for taxes paid for gas purchased as a raw material for its various verticals. This saving would help push up earnings and provide further valuation comfort. The company has been posting a good performance and is trading at a 16x FY19 PE with an EV/EBITDA of 9x which makes it attractive. We like the business model and see significant re rating and upside with GST inclusion.

The next in line of beneficiaries would be the city gas distribution companies which would also gain from both reduced costs and uptick in volumes. Even after 18 to 28 percent expected GST rate, CNG would remain cheaper than alternate fuel options. Moreover, availability of ITC would enhance industrial demand.

After prolonged volume pressure, the GST inclusion could provide some respite to Gujarat Gas and help push up volumes as more than 70 percent of the company’s sales are to industrial consumers. The inclusion would also benefit IGL and MGL though the degree of benefit would be limited due to limited exposure in the industrial segment for both these companies. Current valuations for CGD companies seem heady but push on earnings could provide valuation cushion in the medium term.

Overall, gas stocks are a quality play and definitely worth keeping on the radar and we recommend entering whenever good buying opportunities come. We see inclusion of natural gas under GST as a much awaited positive move which would provide additional tailwinds for the gas sector companies along with proving beneficial for other enterprises which are end users of gas.Follow @Ruchiagrawal

For more research articles, visit our Moneycontrol Research Page.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!