The world economy is slowing down, the risks are rising, and a new cloud of uncertainty weighs heavy on economic policymakers across geographies. These are the predictions and findings of the July 2022 World Economic Outlook of the International Monetary Fund (IMF), the sense of which was known to all clear-headed people. There are three points to be studied here. First, the extent of the slowdown and the place of individual nations in it. Second, the risks ahead. And third, the narratives being cobbled together in a never-seen-before public relations exercise that betrays the principles, the definitions, the very essence of economics. All of which converge and test the intellectual leadership of India’s Group of 20 (G20) presidency.

The Data

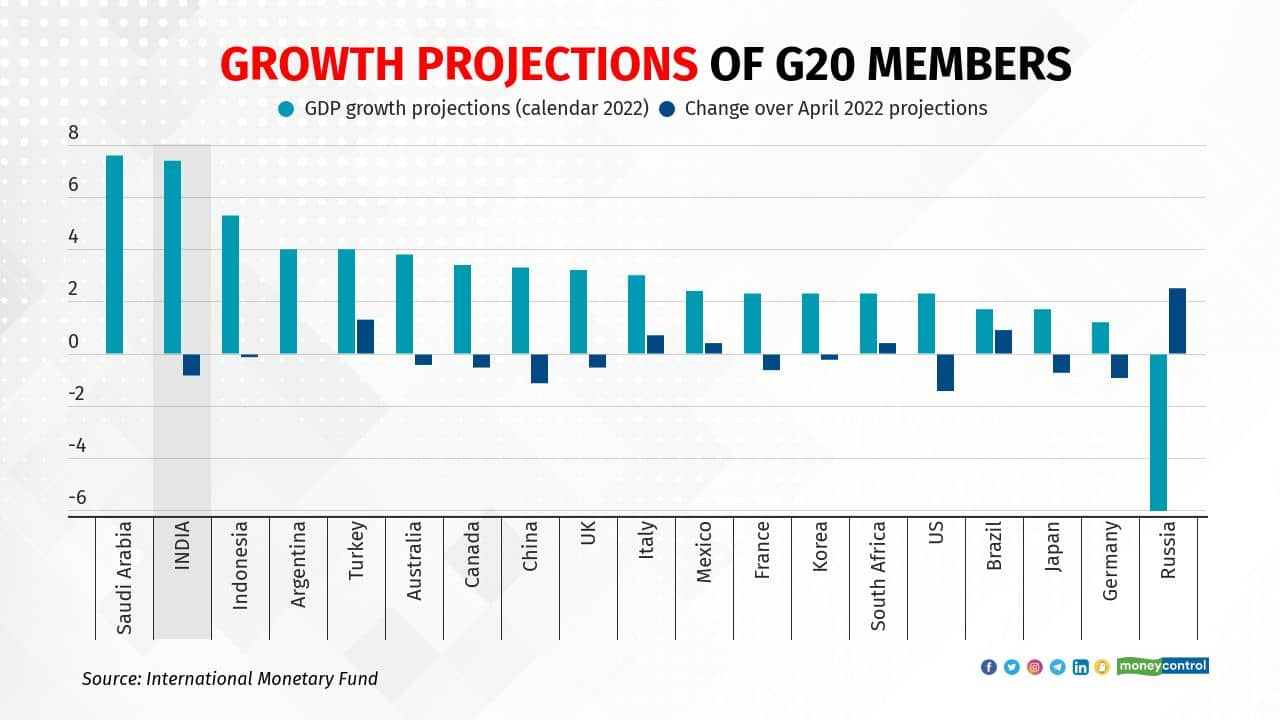

The 19 countries that comprise the G20 and command 80 percent of the global GDP, 75 percent of international trade and holds three-fifths of the world’s people were examined. According to the IMF, the five fastest-growing economies in 2022 are going to be Saudi Arabia, India, Indonesia, Argentina, and Turkey. Of these, Saudi Arabia and India lead by huge margins.

Among large economies, the growth rate of India is more than 4 percentage points over China and the United Kingdom (UK), more than 5 percentage points over the United States (US), Japan, and France, and more than 6 percentage points over Germany. Further, even though the global economy is slowing down, not all countries are seeing a downward revision; eight of them—Saudi Arabia, Argentina, Mexico, South Africa, Italy, Brazil, Turkey, Russia—are seeing positive change in growth projections (See table below).

Call it an admixture of policies or the advantage of a lower base, the fact is India as the world’s sixth-largest economy is large enough to command policy examination. A growth of $236 billion in absolute terms is more than the GDPs of Iran, Greece, or Ukraine. But it’s not yet as large as China or the US to be a driver of global growth.

To put India’s absolute growth in perspective, a 7.4 percent rise on a $3.2 trillion GDP is less than half of what a 3.3 percent growth China can deliver on its $17.7 trillion GDP or the 2.3 percent growth the US can create on its $23 trillion economy.

The other point of interest is the extent of the downward revision of growth in the G20 countries. The six largest economies are seeing the six largest downward revisions—the US by 1.4 percent, China by 1.1 percent, Germany by 0.9 percent, India by 0.8 percent, Japan by 0.7 percent, France by 0.6 percent, and the UK by 0.5 percent.

On the other side, the $1.7 trillion Russia, currently facing the harshest economic sanctions, is seeing an upward revision of 2.5 percent to a GDP contraction of 6 percent, while the $815 billion Turkey that has been under pressure on the inflation and currency fronts is seeing an upward revision of 1.3 percent to 4 percent. Counter intuitive as they may seem, the numbers are there for all to see.

The Risks

According to the IMF, there are six major risks that could impact growth. One, the Russia–Ukraine conflict and the impact of energy prices as a result. Already, Russian gas supplies to Europe are down 40 percent. A fall in supply without a commensurate fall in demand means higher prices that will trickle down into the economies through inflation.

Two, rising energy prices will get powered by food shortages, magnifying inflation. If it continues for a long period, there is an imminent danger of stagflation—slowing growth or recession combined with inflation. The demand for higher wages by labour will push policy attention to the politics of stability rather than the economics of growth.

Three, to control inflation by raising interest rates, policymakers face the danger of creating disinflation. The Outlook warns policymakers of misjudging the appropriate policy stance and warn that “the coming disinflation adjustment could be more disruptive than currently expected.”

Four, the possibility of triggering debt distress due to tighter financial conditions in emerging markets and developing economies. Led by central banks of advanced economies, increased interest rates will spiral higher across the world. Apart from raising the cost of doing business, this could “put pressure on international reserves and cause depreciation versus the dollar, inducing balance sheet valuation losses among economies with dollar-denominated net liabilities.”

Five, the slowdown in China. The IMF worries that Beijing’s zero-COVID-19 strategy and the resultant lockdowns combined with larger-scale outbreaks of more contagious viruses could impact growth. Add to this the delayed “price and balance sheet adjustments in the property sector,” which could lead to a slowdown that “would have strong global spillovers.”

And six, a further fragmentation of the world economy following the Russia–Ukraine conflict that will divide the world into “geopolitical blocs with distinct technology standards, cross-border payment systems, and reserve currencies.”

The Narratives

The two straight quarters of negative growth in the US are visible to all, but economists are refusing to call a recession ‘a recession’—the world’s most powerful country gets away with the support of a media that terms itself ‘liberal’ while belying basic definitions. China is slowing down, and sharply, but again, headlines are missing the event—Beijing has the privilege of the same extreme-Left woke intellectuals powered by corporations with business interests in the world’s second-largest economy.

In contrast, even though India remains the world’s second-fastest growing economy among G20 nations, the knives are out, cutting and slicing data to yield what their handles demand—the fall in India’s growth is because of ‘divisive’ politics. These narratives come at a time when the IMF notes that, “For India, the revision reflects mainly less favourable external conditions and more rapid policy tightening.” But for the tragic display of a professional betrayal, such a statement would have been hilarious.

Going forward, the joke will be on us if we, the three-fifths of the global population that comprise the G20, start believing these narratives. Thankfully, even though narratives are entering the domain of economics through the backdoor of politics, the field is gaining ground and widening the front door of the field. Robert J. Shiller’s Narrative Economics (Princeton University Press, 2019), for instance, offers fresh insights into the subject.

Between the data, the risks and the narratives lies a future that’s as disruptive as it is uncertain. As the Outlook notes, “A plausible alternative scenario in which risks materialise, inflation rises further, and global growth declines to about 2.6 percent and 2.0 percent in 2022 and 2023, respectively, would put growth in the bottom 10 percent of outcomes since 1970.” It is here that that we need to lean on responsible politics to even out the risks and deliver growth.

(This article first appeared in the ORF)

Gautam Chikermane is Vice President at ORF. Views are personal, and do not represent the stand of this publication.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.