Anubhav Sahu Moneycontrol Research

Baba Ramdev’s Patanjali is making headlines once again. This time it is entering the underpenetrated but promising product category of bottled water. But the targets are by no means fluid: on the contrary, the company is targeting a well-defined — and chunky — market share.

Incumbents have reasons to feel uncomfortable, given the experience in other product categories where the company has made a foray. They include two giant MNCs (Coca-Cola and Pepsi), one large unlisted Indian firm (Bisleri) and Tata Global Beverages.

Patanjali’s entry into water will be under the brand name “Divya Jal”. Never short of ambition or hyperbole, the group has set itself a sales target of Rs 1,000 crore for FY19 suggesting a grand execution plan.

This target translates to 6% share of the total turnover (estimated sales: Rs 17,000 crore) in the first year of operations. It has hinted at economical pricing catering to a broad range of “masses to classes”.

It is expected that by Diwali, the packaged water would be available in North India and within six months it would be available pan-India. The product, which the company is positioning as Himalayan water, would be bottled from its Haridwar and Lucknow plants.

Secular growth — lack of availability of drinking water

As per Euromonitor (2015), India’s per capita consumption is about 13 litres — about 1/5th of China’s per capita consumption (62 litres). While this in itself underlines the potential growth opportunity for the bottled drinking water, increasing health awareness and lack of availability of clean drinking water are the key factors to support its secular growth.

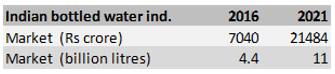

Bottled water industry size to grow by 25% CAGR

Source: Moneycontrol, Euromonitor

In the year 2016, bottled water sales in India were estimated to be Rs 7,040 crore with the trade volume of 4.4 billion litres. As per Euromonitor, the Indian bottled water industry is expected to grow at 20% CAGR (2016-21) in volume terms. In value terms, as per our assessment, this segment is expected to post a CAGR of 25% for the same period leading to a market size of Rs, 21,500 crore. Going by this measure, in the calendar year 2018, the industry could clock about Rs 11,000 crore in sales and Patanjali in its first full year of operations could capture about 9% of the market share.

Who would feel the heat?

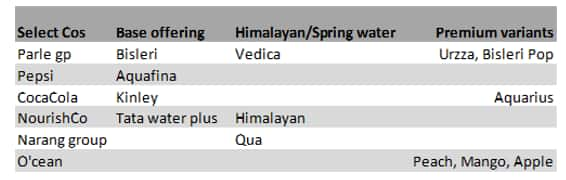

Currently, industry estimates suggest Bisleri continues to be the leading brand in Indian bottled water industry with about 40% market share. Together with Kinley (Coca Cola) and Aquafina (Pepsi), these three brands have a cumulative market share of 65%. The remaining 35% market is quite fragmented and ruled by unorganised players in tier-2, tier-3 cities.

Going by Patanjali’s product positioning, “Divya Jal” is expected to be a value play with a strong positioning on its natural/herbal theme.

Predatory pricing strategy can’t be ruled out

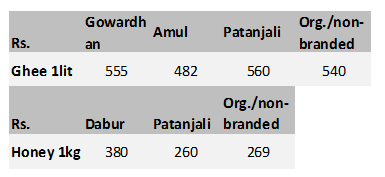

Patanjali’s pricing strategy has been varied depending on the product category under question. While for Ghee, Patanjali enjoys a certain premium pricing with respect to other national players. In case of honey, Patanjali has resorted to predatory pricing. In case of bottled drinking water, we expect Patanjali to opt for the latter, as the product segment is reasonably commoditised.

Premiumisation could partially rescue

A few of the major industry players in the segment have moved up the value chain by offerings value-added products like enriched vitamins, flavoured drinks and so on. While such premiumisation could help in defending margins to an extent, incumbents should brace for tough competition, especially in the value segment.

Currently, NourishCo (a JV between Tata Global Beverages and PepsiCo) has a similar offering under the brand “Himalayan”, with the same being bottled in Himachal Pradesh. Tata Global Beverages has recently introduced new variants and entered new markets (including the USA). However, this JV of Tata is still waiting to turn profitable (loss of Rs 21 crore in FY17).

In the coming days, it won’t be surprising if we witness a significant change in the 3Ps of marketing for the bottled water category — which is in terms of product pricing, place (distribution, logistics) and brand promotions.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.