The beauty industry is having its department store moment: US cosmetics giant Revlon Inc., controlled by billionaire Ron Perelman, filed for voluntary Chapter 11 bankruptcy late on June 15. The company had assets of $2.3 billion as of late April, and total debts of $3.7 billion, Bloomberg News reported on June 16. It’s the clearest indication yet of the impact of shifting consumer habits on the beauty industry.

Against the backdrop of Revlon’s heavy debt load, upstart brands are in the ascendancy — from those created by members of the Kardashian clan to luxe names such as Charlotte Tilbury, as well as trends that quickly go viral on Instagram or TikTok.

The situation is reminiscent of the maelstrom that hit department stores two years ago, when JC Penney Co. and Neiman Marcus filed for bankruptcy protection, as the pandemic exacerbated their struggles with online shopping and borrowings.

Mid-market beauty has been a tough place to be in recent years. Traditional names such as Revlon, L’Oreal SA’s Maybelline, as well as Coty Inc.’s Cover Girl have faced an onslaught of competition. Even more upmarket players such as Estee Lauder Cos.’s namesake brand have been challenged in the current landscape.

Declining interest in fashion has propelled more spending towards beauty. While apparel trends have been minimal over the past decade, there has been plenty of innovation in cosmetics, from contouring — using different shades to accentuate the bone structure — to statement bright eyeshadow and, most recently, eyelash serums.

The trouble is, consumers have turned to a raft of new entrants for these looks, including Kylie Jenner’s Kylie Cosmetics business, purchased by Coty in 2019, and Rihanna’s Fenty Beauty, backed by LVMH Moet Hennessy Louis Vuitton SE. The luxury industry has also doubled down on beauty, with Hermes International most recently selling blusher alongside Birkin bags.

The fresh faces of the industry used Instagram and TikTok to reach consumers and showcase their ranges, which, as in the case of Fenty, included a much broader selection of skin tones. A raft of beauty influencers helped spread the word, too.

Change wasn’t confined to make-up. Revlon’s portfolio includes a number of celebrity fragrances, including those from Britney Spears and Christina Aguilera. The trouble is, millennials and Generation Z don’t want to smell like celebrities anymore, preferring niche scents or those blended for them individually.

It didn’t help that Revlon was up against giants L’Oreal and Estee Lauder, which were able to snap up many of the upstarts, including IT Cosmetics and NYX, which went to L’Oreal, and Too Faced and Deciem, which joined the Estee Lauder stable.

The pandemic dealt another blow, as consumers stuck at home spent on skincare rather than colour cosmetics. Travel retail was also hurt by people being grounded. Supply chain snarls have been another peril.

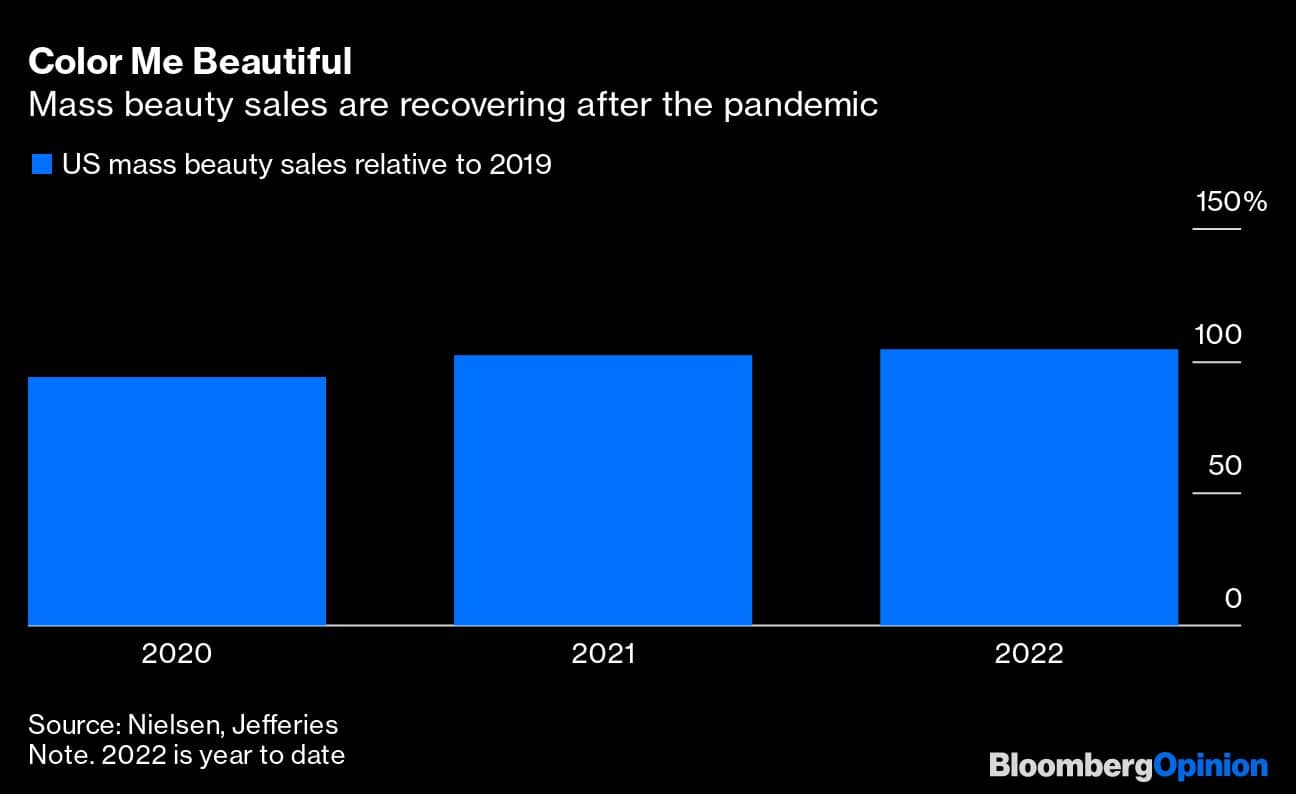

Still, if Revlon can restructure its debt and emerge from Chapter 11 in better shape, there is hope of a makeover. Economies are reopening again, which should boost cosmetics spending, both in stores and airports. Estee Lauder said recently that there had been a make-up “renaissance”.

Graph

But there is another factor at work: The Lipstick Index. Leonard Lauder— then chairman of Estee Lauder— coined the term during the 2001 recession. He noted that in the autumn of that year lipstick sales rose, indicating that women facing an uncertain environment turn to beauty products as an affordable indulgence while cutting back on more-expensive items. With US inflation at a 40-year high, crimped consumers could head to the beauty counter rather than the clothing store once more.

But a reinvented Revlon will have to be nimble. This time round the items to buy might equally emerge from TikTok as the drugstore aisle. Just witness the clamour for Black Honey, a shade of lipstick developed by Estee Lauder’s Clinique 50 years ago, which went viral on TikTok.

Unilever Plc’s Vaseline, which emerged in the 19th Century, has found a Gen Z audience. Revlon will need a similar formula if it is to achieve its own glow-up.

Andrea Felsted is a Bloomberg Opinion columnist covering consumer goods and the retail industry. Views are personal, and do not represent the stand of this publication.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.