Krishna KarwaMoneycontrol Research

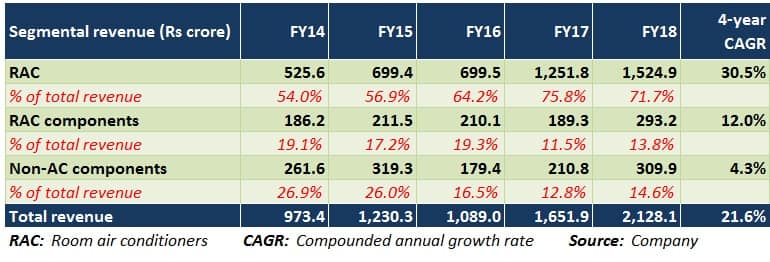

Amber Enterprises is an OEM (original equipment manufacturer) and ODM (original design manufacturer) for room air conditioners (RACs) and components thereof (excluding compressors). The company also manufactures parts for washing machines, refrigerators and microwaves.

(Also read: Amber Enterprises – a cool stock to look at)

Capabilities to cater to marquee Indian RAC companies (serves 8 out of 10), 80 percent of revenues coming from margin-accretive ODM processes, and market leadership in the RAC manufacturing space should benefit Amber. Notwithstanding the steep valuation, we are bullish on the stock.

Performance review

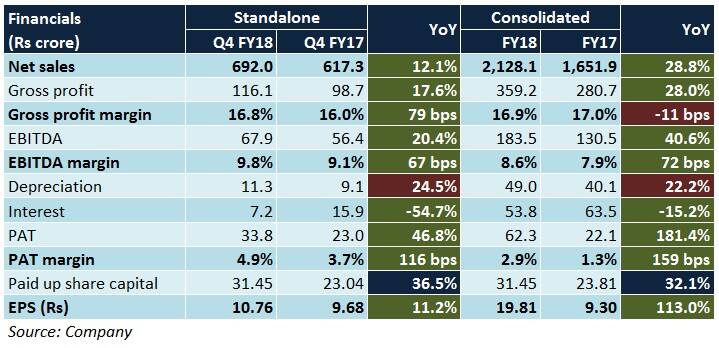

Amber reported strong year-on-year (YoY) top-line growth, led by a 26.2 percent increase in RAC volumes sold. Of this 26 percent, 46/38/16 percent was attributable to indoor/outdoor/window ACs, respectively. The company’s bottom-line margins improved due to debt repayments.

Organic growth levers

Operating leverage

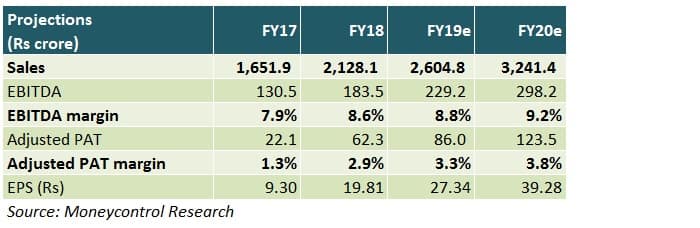

Capacity utilisation at Amber’s existing manufacturing facilities is likely to increase from 40 percent in FY17 to 70 percent in FY20. Consequently, higher asset turns should boost the company’s operating margins in due course by virtue of economies of scale.

Product expansion

To achieve product differentiation, Amber aims to introduce new models of IoT (internet of things) inverter RACs. To facilitate backward integration and save costs, RAC components such as brushless DC (direct current) motors, resin-core motors and inverter controllers will be added too.

Exports

To ensure geographical diversification, Amber targets exports from nations in the Middle East, South-East Asia and Europe over the next three years. Since the product approval process at the clients’ end typically takes 2-3 years, it’ll take a while for international sales to add noticeably to Amber's top-line growth.

Working capital

Pre-buying due to RAC rating changes and subdued demand in north India (35-40 percent of Amber’s market) caused an inventory buildup in Q4FY18, thus causing the company’s working capital cycle to extend from 29 in FY17 to 35 in FY18. These issues are anticipated to regularise during FY19.

Sales traction

In FY19, most of Amber’s planned 20 percent YoY revenue growth will be driven by RAC volumes. Sales to four new clients, which were added in Q4FY18, will commence during FY19. RAC launches such as 1-ton indoor unit, 2-ton outdoor unit, and other inverter models are expected to gain traction too.

Capex

Capital outlays for FY19, pegged at Rs 45 crore, will be allocated towards fuelling organic and inorganic growth. While Rs 32 crore will be incurred for Amber’s own operations, investments worth Rs 13 crore will be made in ‘IL JIN’ and ‘Ever’ to leverage their client base and technical expertise.

Inorganic growth on track

‘IL JIN’

‘IL JIN Electronics’ is the Indian branch of the South Korea-based ‘IL JIN’ Group. ‘IL JIN’ manufactures and deals in electronically-assembled printed circuit boards for consumer electronics. Its clientele includes the likes of Panasonic, LG and Samsung, among others.

Amber acquired 70 percent in ‘IL JIN Electronics’ in H2FY18. In FY18, ‘IL JIN’ contributed Rs 100 crore to Amber’s consolidated operating revenue.

‘Ever Electronics’

On similar lines as ‘IL JIN’, ‘Ever Electronics’ is one of India’s leading electronic printed circuit board manufacturers. LG, LS Automotive, Powercraft Electronics, Godrej and Intangibles Labs are among Ever's major clients.

After acquiring a 19 percent stake in ‘Ever’ in H2FY18, Amber is scheduled to acquire an additional 51 percent stake in the company by FY19 end.

How do these deals help Amber?

The acquisitions will bolster Amber’s revenues through the ODM route. Amber will be able to offer advanced printed circuit boards and other components, particularly for inverter RACs, the demand for which is growing at a brisk pace.

Revenues from ‘IL JIN/Ever’ could grow by 15/20 percent in FY19, respectively. Operating margins of these two companies, that stood at around 3.5 percent in FY18, can improve by 100-150 basis points in FY19 due to operational synergies. This will have a positive rub-off on Amber’s financials as well.

The key bottlenecks

Though Amber can offset the disadvantage of rising raw material prices (copper, plastic) by passing on the same to its clients, unforeseen rains in northern India in a seasonally strong Q1 has dampened demand for RACs to some extent.

'PICL', a subsidiary of Amber that was acquired in FY12, manufactures induction motors for RACs, coolers and washing machines. Of late, 'PICL' has been facing challenges due to a high degree of dependence on some Middle-East clients and contraction in supply of some crucial components from China.

Should you invest?

Low penetration of RACs in India, high entry barriers, growing share of inverter RACs in the overall RAC market, and increasing disposable incomes, among other tailwinds, suggest that Amber is well-positioned to reap the benefits that India’s white goods industry has to offer.

(Also read: Why is the Indian consumer durables space promising?)

After a stellar rally post-listing, Amber hit its 52-week high at the fag end of the bull run, which ended in January 2018. Since then, the stock has corrected by 19.2 percent and presently trades at 27.3 times FY20 projected earnings. In spite of the rich valuation, Amber has all the elements to re-rate further.

For more research articles, visit our Moneycontrol Research page

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!