Over the years, white and brown goods have caught the fancy of consumers across India at an unprecedented pace. Therefore, it isn’t baffling to see consumer durable manufacturers deliver healthy long-term price returns in tandem with the growth in this sector, as seen in the exhibit below:-

Economic growth, availability of more employment/business opportunities, changing lifestyles, and better brand awareness have led to an uptick in discretionary spending in India in the past few years. The trend, apparently, doesn’t show any signs of slowing down just yet.

ElectrificationDue to the government’s initiatives towards urbanisation and transmission network augmentation, electric supply channels have been able to cover the previously underserved/unserved regions of India pretty considerably. Clearly, this bodes well for electronic appliance manufacturers.

Shorter replacement cycleNew variants of products, particularly those with unique specifications, are frequently visible on the shelves of electronics stores periodically. After a medium to long-term span (typically 4-5 years or more), most consumers, that face major technical issues with their existing products, choose to buy a new one.

Low penetrationCompared to developed nations, India’s consumer durables market offers immense growth potential. It remains underpenetrated despite the quick pace of advancement. Electronic items, that were formerly considered as luxury goods for a long period of time, have become basic necessities of sorts today.

Financing schemesLenders’ kiosks have been set up in almost every electronic outlet in India in a bid to encourage aspirational and price-sensitive consumers to buy products at minimal or no interest costs without furnishing any collateral. This makes it significantly hassle-free to own expensive assets like these.

Organised retailIncreased visibility of products in tier 2/3/4 cities has been largely attributable to the inroads made by big retailers. White goods manufacturers are bullish on making their presence felt in such areas in due course given the low base and optimistic prospects.

Consumer durables are one of the most sought-after products, especially during the festive season. To cash in on the demand spike, manufacturers have been upping the ante through introduction of promotional campaigns (through discounts, freebies, offers etc) and extending the sale season too.

Easy maintenanceOn account of improved availability of spare parts and better after-sales services, technical glitches in electronic items can be addressed far more easily than before at a reasonable cost (in most cases). Therefore, consumers don’t mind loosening their purse strings for minor expenses in the short-term.

Consumption boostExpectations of a good monsoon, steps to increase the minimum selling price for farmers, and measures to double farmers’ income by FY20 will be crucial in driving demand growth from rural zones. Additionally, increments to government employees under the 7th pay commission will be equally decisive in this regard.

Seasonality reducingAppliance companies, that bore the brunt of a weak demand scenario in the ‘off-season’ every fiscal (for example – negligible/subdued AC sales in winter), don’t face challenges to the same extent anymore. Though demand may vary from time to time, consumer durables are purchased throughout the year.

A few roadblocksWithin a particular product category, multiple brands are available to prospective buyers at varied price points, thus increasing the competitive intensity in this sector. Reputational risks could have serious repercussions as well. Therefore, brand and customer loyalty, more often than not, is hard to retain.

Technological obsolescence is a big cause of concern. Consequently, companies have little choice besides spending heavily in innovations and launching new products (or existing products with new features) at regular intervals throughout the year. Advertisement costs simultaneously go up too.

An escalation in raw material prices (plastics, copper) and high import duties on certain pivotal inputs may dilute margins. This is because the entire increase in cost is hard to pass on to the consumers in light of the market share rivalry among players.

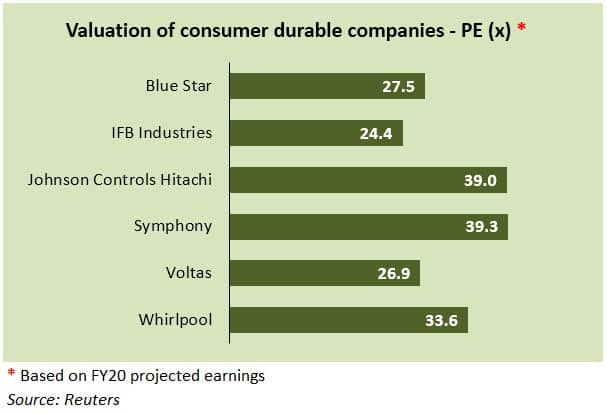

The path aheadThe fact that companies in the consumer durables domain continue to trade at steep valuation multiples is indicative of how bullish the bourses are on this secular growth space in general.

Notwithstanding some minor hurdles, the sector remains in a sweet spot and is undoubtedly worth banking on. However, since the near-term positives seem to be more than comprehensively discounted in the prices of all stocks, investing on corrections amid the volatile market sentiment is advisable.

For more research articles, visit our Moneycontrol Research Page.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.