Where is the NSE Nifty 50 headed in December? And, what should investors do in a historically indifferent month for the benchmark index? Analysts advise to watch out for the election outcomes on December 3. In terms of sectors, investors must keep an eye on auto, real estate, infrastructure, hotels, jewellery, and such areas that are the flavour of the season, and also on some recent outperformers for better buying opportunities.

Investors, though, have multiple reasons to celebrate. The Nifty has reclaimed the 20,000-mark, and is back near its all-time high after a month when returns reached their 2023 highest at 5.4 percent.

Also read: November records the best Nifty 50 returns of 2023

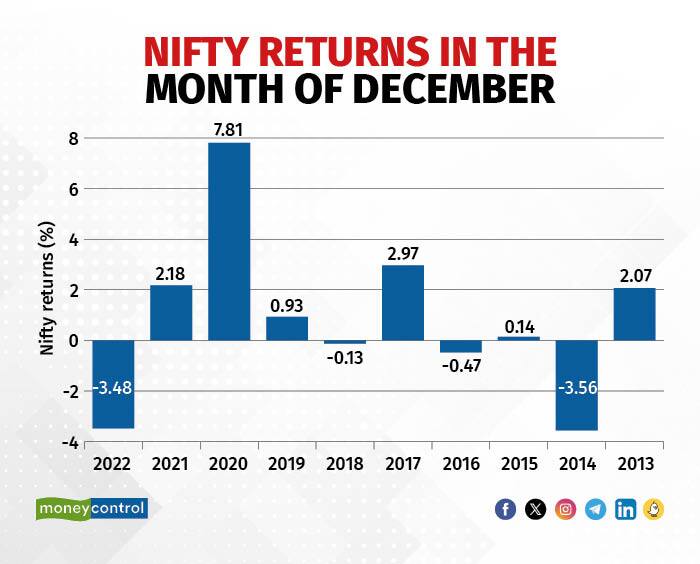

Historically, however, December has been a month of low returns for the Nifty 50. In the last five years, the average return has been mildly negative - around minus-0.69. So, is this going to be a different December?

Nifty Returns in December

Nifty Returns in December

FII shortfall to be filled by domestic investors

December is the month when FPIs normally take holidays. But, since most of the rally has been driven by DIIs and retail investors, foreign funds may not affect the market that much this time around, says Kranthi Bathini, director of equity strategy at WealthMills Securities.

Outcomes of the state elections will help the market build its outlook in the first couple of weeks, said Shrikant Chouhan, head of equity research at Kotak Securities, pointing out that the country is heading for the general elections a few months down the line. He said if the result favours the ruling central government, there will be more up-moves, while some short corrections can't be ruled out if it goes the other way.

Bathini of WealthMills has a positive bias on the Nifty due to strong macro factors. “We expect the Nifty to be in the 500-point range of 19,800-20,300. As the domestic macros are in line and the external tensions are receding right now, our outlook is very positive,” he said.

Chouhan of Kotak said that if the market tops the all-time high of 20,225, the next resistance level is seen at 20,750 to 21,000.

Sectors to watch

Siddhartha Khemka, head of retail research at Motilal Oswal, picked sectors that run largely on seasonal demand such as jewellery, retail and hospitality. “There is expectation of a strong wedding season. That should benefit the jewellery and retail companies. Hotels are talking about high room rates due to the holiday season,” he said. He is also bullish on sectors like real estate due to strong demand.

Also read: Medanta share jump lifts its chief and surgeon Naresh Trehan to billionaire list

Automobile, too, has caught the attention of investors with the BSE Auto index zooming at all-time high levels.

Shrikant Chouhan said the valuations across companies are expensive, and that investors should buy if there is correction in the stocks. He also advised in favour of largecap companies, adding that those stocks haven’t performed in a long time, and should start gaining now.

Capital goods and infrastructure are among his other picks, thanks to their healthy order wins. He also pointed out that FIIs also preferred these sectors in the last 12 months.

Disclaimer: The views and investment tips expressed by experts on Moneycontrol are their own and not those of the website or its management. Moneycontrol advises users to check with certified experts before taking any investment decisions.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!