Nifty 50 recorded its highest-ever returns in November since the start of the year, after a dovish Fed commentary, falling bond yields, and returning of Foreign Institutional Investors (FIIs) increased gains. Nifty on November 29 touched 20,000 level for the first time after September 18, on positive global cues and gains in heavyweights such as HDFC Bank, Infosys and Reliance Industries.

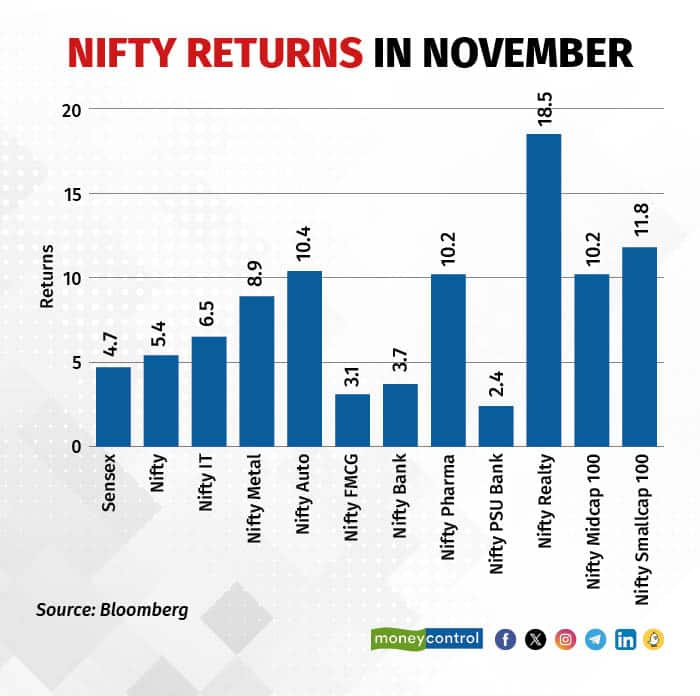

Nifty 5o index gave 5.4 percent returns in November, while Sensex recorded a 4.7 percent gain in the same period.

The positive sentiment was driven by dovish comments from the Federal Reserve which kept rates unchanged in November for the second time. The FOMC maintained its interest rate at its current target range of between 5.25 percent and 5.5 percent. “We’ve seen progress, and we welcome that, but we need to see more progress" before concluding that it's appropriate to end the rate hikes,” said Fed chair Jerome Powell in the FOMC meeting. The Federal Reserve has raised interest rates 11 times since March 2022, but since the last two FOMC meetings, it has kept the rates unchanged.

Also read: With Nifty above 20k, time to move money from smallcap to large stocks, say fund managersThe US bond yields, which went till five percent in October, came off by around 50 basis points in November. When US bond yields increase, investors remove money from riskier assets like markets, and put money in safe assets like bonds, and vice-versa. In October, the US Treasury bond yields rose above 5 percent for the first time since 2007.

FIIs turned net buyers in November after being net sellers in October and September. FIIs bought $640 million in November as per data by NSDL. Interestingly, the positive trend occurred on specific days in November, such as the 10th, 15th, 16th, 23rd, 24th, and 28th, while on the remaining days, they remained net sellers.

Also read: FIIs turn buyers in November, but limited to few sessionsMoreover, the start of Samvat also saw benchmark indices going higher. Investors’ wealth jumped more than Rs 2.22 lakh crore which was reflected in the total market cap of BSE-listed companies.

Among sectoral indices, Nifty Realty gave the highest returns of 18.5 percent in November. The Nifty Realty index was followed by Nifty Smallcap and Nifty Auto index, giving 11.8 percent and 10.4 percent returns in the same period, respectively.

Real estate companies registered their second-best quarter ever despite the second quarter generally being considered to be the weakest quarter in terms of seasonality.

Nifty Bank gave 3.7 percent returns in November. The lower returns were a result of the central bank increasing the risk weightage on consumer loans. The Reserve Bank of India on November 16 increased risk weight by 25 percent on consumer credit exposure of commercial banks and non-banking finance companies. Consumer credit of commercial banks and NBFCs attracts a risk weight of 100 percent, which now has been revised to 125 percent.

The top five gainers of the month were Hero Motocorp, Bharat Petroleum Corporation, Eicher Motors, Bajaj Auto, and Apollo Hospitals.

Disclaimer: The views and investment tips expressed by experts on Moneycontrol.com are their own and not those of the website or its management. Moneycontrol.com advises users to check with certified experts before taking any investment decisions.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.