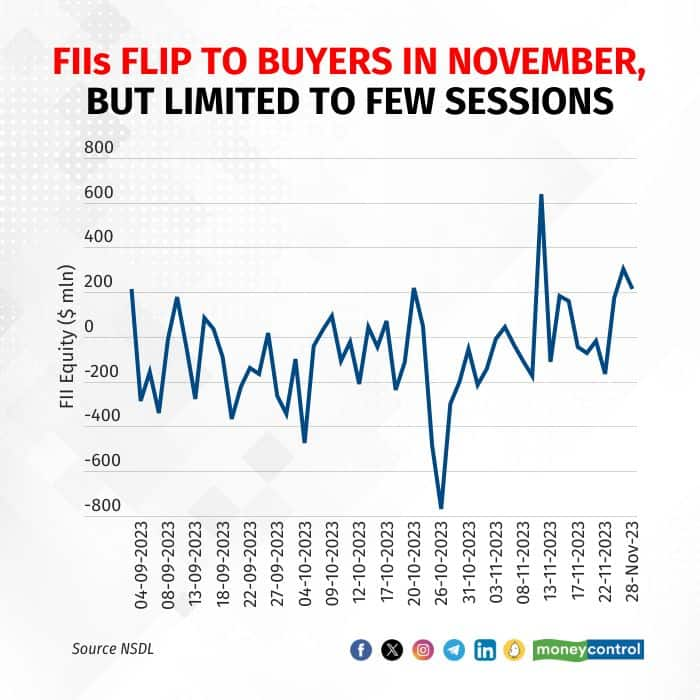

Foreign investors, who were net sellers in September and October, reportedly turned buyers in November, purchasing around $640 million, as per NSDL data. Notably, this positive trend occurred on specific days in November, such as the 10th, 15th, 16th, 23rd, 24th, and 28th, while on the remaining days, they remained net sellers.

According to NSDL data, in October, FII sold around $2.66 billion while in September they sold around $2.19 billion.

FII selling in September and October was driven by rising US treasury bond yields, geopolitical concerns, and SEBI's new FPI guidelines effective from 1 November. These rules demand granular details of all entities holding ownership, economic interest, or exercising control in the FPI, up to the level of all natural persons, by those FPIs which have over 50 percent of their Indian assets under management in a single Indian corporate group, and those which have investments in Indian equity more than Rs 25,000 crore.

These rules followed the Hindenburg research report on Adani Group, alleging indirect ownership links between 12 FPIs and Gautam Adani or his close family members.

Some analysts advocate SEBI's firm stance on these rules, crucial for improving the foreign portfolio system. The guidelines boost transparency and reveal ownership details for similar concentrated holdings by foreign investors in other groups.

Meanwhile, US bond yields declined as the dollar reached a three-month low recently and geopolitical tension reduced. With this, analysts now anticipate the US Federal Reserve, having paused interest rate hikes, might move towards potential rate cuts soon.

"Macro backdrop has become favourable for the emerging markets (EMs) with the US Fed pausing and yields falling in the US. Within the EMs, India is in a better position with weights doubling to over 16% in the MSCI EM index in the last four years and earnings momentum remaining strong", said Jitendra Gohil, Chief Investment Strategist, Kotak Alternate Asset Managers.

Analysts also observe a robust market scenario overall, with broader markets actively involved. Small and mid-cap stocks have outperformed larger peers in the current rebound. Strong domestic flows provide stability amid global volatility. There don't appear to be immediate short-term risks to the market outlook. The recent sharp decline in crude oil could positively impact the markets if sustained. Long-term prospects for the Indian economy and markets look promising, poised to achieve further milestones ahead, they added.

Deepak Jasani analysts with HDFC Securities said as the top of the rate cycle seems to be behind and China is taking too long to revive its economy, India could continue to be favourites for FPI inflows in the next few weeks unless we have a very adverse outcome from state elections.

Disclaimer: The views and investment tips expressed by investment experts on Moneycontrol.com are their own and not those of the website or its management. Moneycontrol.com advises users to check with certified experts before taking any investment decisions.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.