Bears further tightened their control over Dalal Street on February 28, with the benchmark indices falling half a percent and continuing a southward journey for the eighth consecutive session.

The BSE Sensex fell 326 points to 58,962, while the Nifty50 dropped 89 points to 17,304 and formed a bearish candle on the daily charts, making lower highs and lower lows for the eighth day in a row.

This candle pattern has negated the positive candle like Hammer of the previous session. The new swing low was formed at 17,255 levels.

"After the downside breakout of immediate support of ascending trend line at 17,490 levels on February 24, the market has been showing weakness in the next two sessions thereby confirming a validity of downside breakout," Nagaraj Shetti, Technical Research Analyst at HDFC Securities, said.

Hence, the next downside levels to be watched are around 17,150-17,050 in the short term, whereas immediate resistance is at 17,450 levels, the expert said.

However, the broader markets outperformed frontline indices. The Nifty Midcap 100 and Smallcap 100 indices were down 0.7 percent and 0.4 percent respectively.

We have collated 15 data points to help you spot profitable trades:

Note: The open interest (OI) and volume data of stocks in this article are the aggregates of three-month data and not just the current month.

Key support and resistance levels on the Nifty

As per the pivot charts, the Nifty has support at 17,262, followed by 17,219 and 17,148. If the index moves up, the key resistance levels to watch out for are 17,404, followed by 17,448 and 17,518.

The Nifty Bank remained an outperformer again, falling just 38 points to 40,269, forming a Doji kind of pattern on the daily scale, indicating indecisiveness among bulls and bears.

"The buying in Nifty Bank is visible at lower zones but finding multiple hurdles near 40,400 levels. Now it has to continue to hold above 40,250 levels for a bounce towards 40,500 then 40,750 levels, while on the downside, support is expected at 40,000 and then 39,800 levels," Chandan Taparia, Vice President, Analyst-Derivatives at Motilal Oswal Financial Services said.

The important pivot level, which will act as a support, is at 40,123, followed by 40,048 and 39,926. On the upside, key resistance levels are 40,366, followed by 40,441, and 40,563.

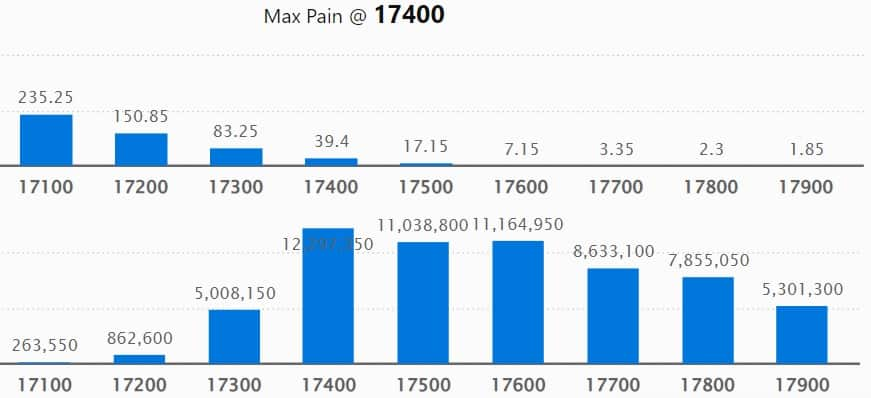

On a weekly basis, the maximum Call open interest (OI) was seen at 17,400 strike, with 1.22 crore contracts, which may remain a crucial resistance level for the Nifty in the coming sessions.

This is followed by a 17,600 strike, comprising 1.11 crore contracts, and a 17,500 strike, where there are more than 1.1 crore contracts.

Call writing was seen at 17,400 strike, which added 47.82 lakh contracts, followed by 17,300 strike which added 37.08 lakh contracts and 17,500 strike which added 30.86 lakh contracts.

We have seen Call unwinding at 18,200 strike, which shed 10.06 lakh contracts, followed by 18,500 strike which shed 6.59 lakh contracts, and 17,900 strike which shed 5.76 lakh contracts.

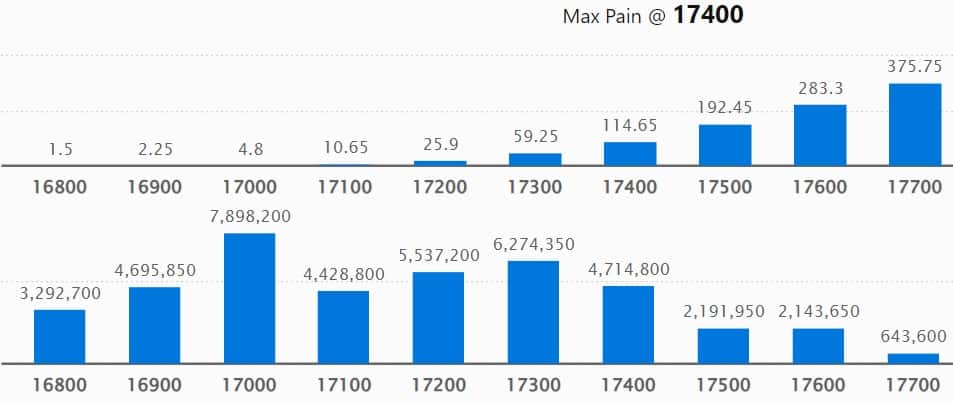

On a weekly basis, we have seen the maximum Put OI at 17,000 strike, with 78.98 lakh contracts, which is expected to act as a crucial support zone for the Nifty50 in the March series.

This is followed by the 17,300 strike, comprising 62.74 lakh contracts, and the 17,200 strike, where we have 55.37 lakh contracts.

Put writing was seen at 17,300 strike, which added 22.85 lakh contracts, followed by 17,100 strike, which added 12.35 lakh contracts and 17,200 strike which added 10.66 lakh contracts.

We have seen Put unwinding at 17,400 strike, which shed 16.11 lakh contracts, followed by 17,600 strike which shed 8.12 lakh contracts, and 17,500 strike which shed 5.8 lakh contracts.

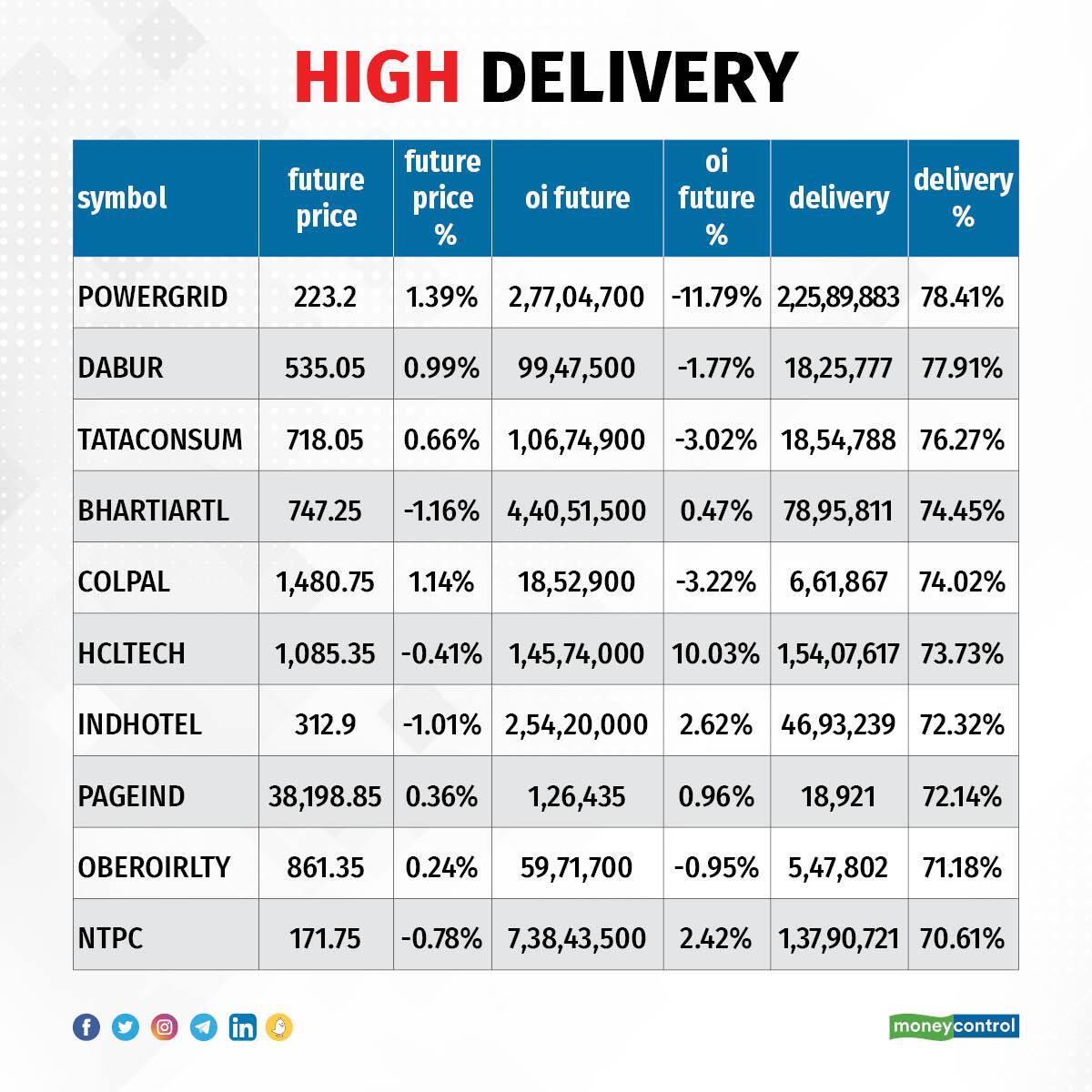

Stocks with high delivery percentage

A high delivery percentage suggests that investors are showing interest in these stocks. The highest delivery was seen in Power Grid Corporation of India, Dabur India, Tata Consumer Products, Bharti Airtel, and Colgate Palmolive, among others.

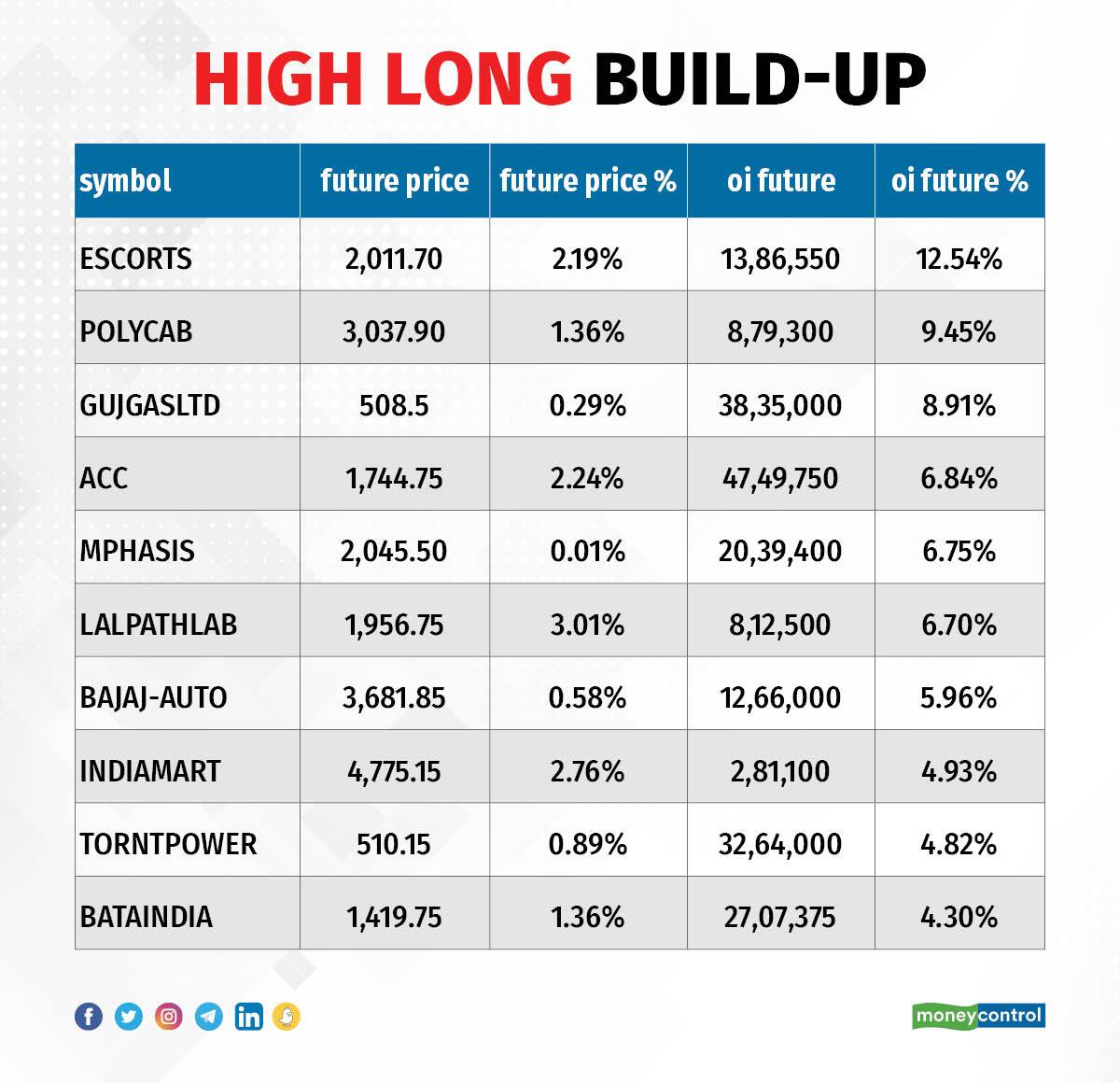

An increase in open interest (OI) and an increase in price mostly indicate a build-up of long positions. Based on the OI percentage, 56 stocks including Escorts, Polycab India, Gujarat Gas, ACC, and Mphasis, saw a long build-up.

A decline in OI and a decrease in price, in most cases, indicate long unwinding. Based on the OI percentage, 19 stocks including Alkem Laboratories, Nestle India, ICICI Bank, ITC, and SBI Life Insurance Company, witnessed a long unwinding.

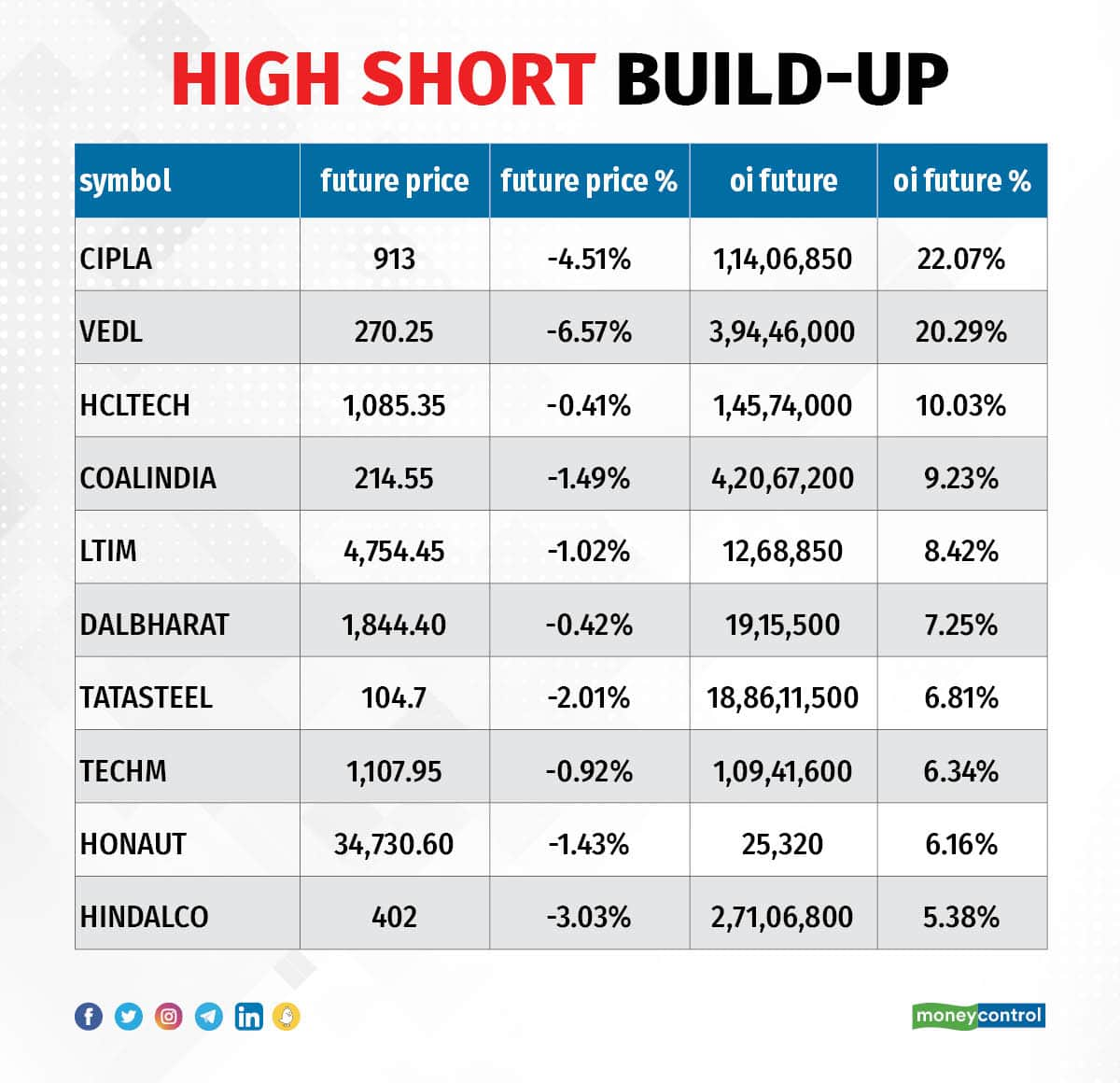

64 stocks see a short build-up

An increase in OI accompanied by a decrease in price mostly indicate a build-up of short positions. Based on the OI percentage, 64 stocks including Cipla, Vedanta, HCL Technologies, Coal India, and LTIMindtree, saw a short build-up.

A decrease in OI along with an increase in price is an indication of short-covering. Based on the OI percentage, 54 stocks were on the short-covering list. These included Adani Enterprises, Power Grid Corporation of India, City Union Bank, MCX India, and REC.

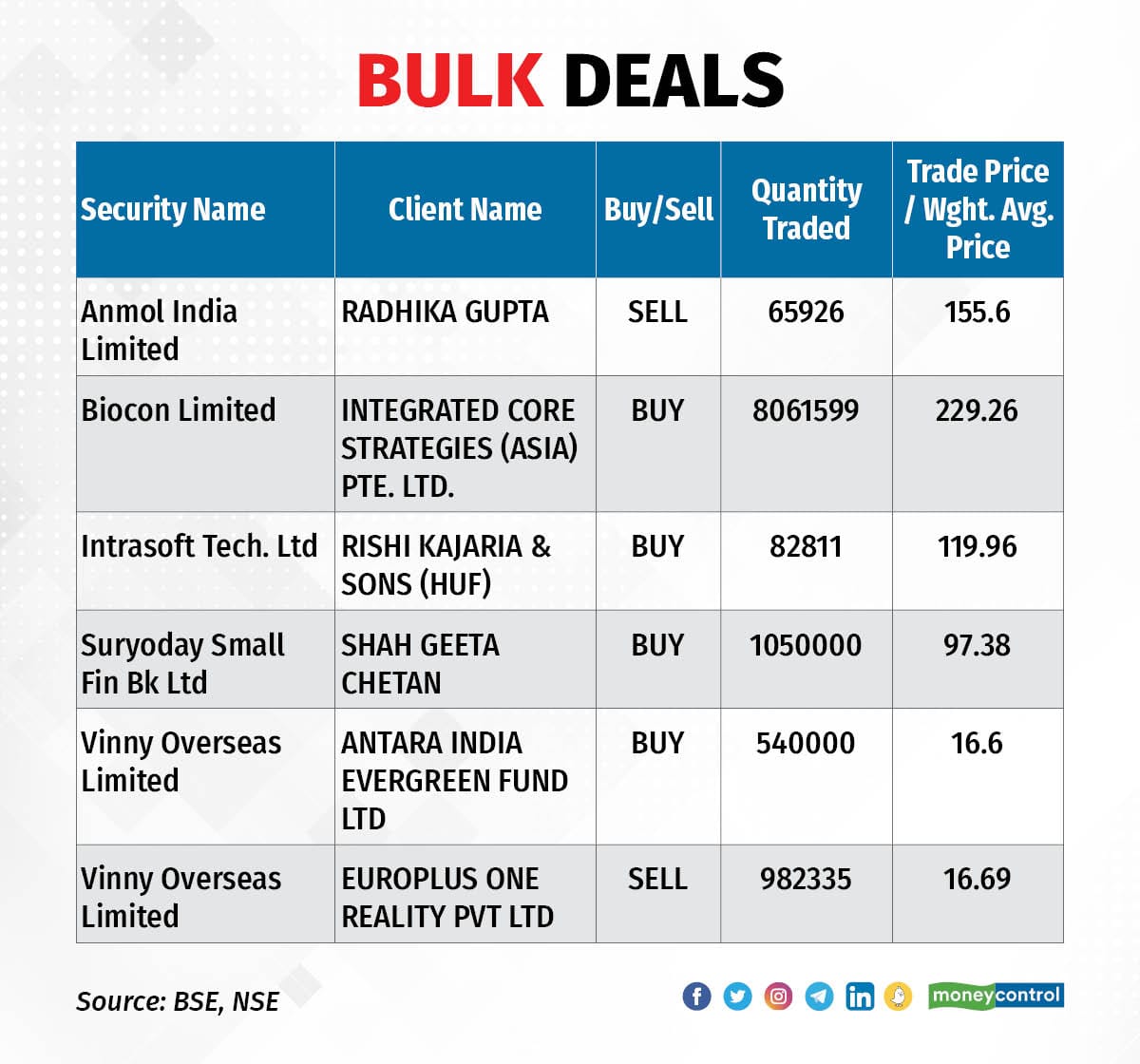

Biocon: Integrated Core Strategies (Asia) Pte Ltd acquired 80.61 lakh shares in the biopharmaceutical company via open market transactions, at an average price of Rs 229.26 per share.

(For more bulk deals, click here)

Investors' meetings on March 1

HCL Technologies: The company's officials will participate in Global IT Services Virtual Investor Trip hosted by Citi.

Anupam Rasayan India: The management team of the company will participate in Investment Promotion Roadshow in Japan.

Crompton Greaves Consumer Electricals: The company's officials will meet Franklin Templeton.

Indian Energy Exchange: Officials of the company will interact with Investec.

Aurobindo Pharma, Medplus Health Services: The officials of these companies will participate in BofA Healthcare Tour.

Escorts Kubota: Officials of the company will interact with Lord Abbett.

Clean Science and Technology: The company's officials will meet several funds and investors in a non-deal roadshow in Singapore.

Siemens: Officials of the company will be meeting Blackrock Asset Management, North Asia.

Persistent Systems: The company's officials will interact with New Vernon, RVX Asset Management, Sandglass Capital, Amiral Gestion, Oberweis Asset Management, and JP Morgan Asset Management.

Sapphire Foods India: Officials of the company will interact with Arisaig Partners, and Citadel.

Eicher Motors: The company's officials will interact with JP Morgan Asset Management.

Bharat Forge: Officials of the company will interact with LIC Mutual Fund.

Stocks in the news

Power Grid Corporation of India: Power Grid is declared as the successful bidder to establish an inter-state transmission system for the “establishment of Khavda pooling station-3 (KPS3) in Khavda RE Park, on a build, own operate and transfer (BOOT) basis. The company has received a Letter of Intent for the said project. The project comprises establishment of a new 765/400kV GIS substation, 765kV D/C transmission line and associated works in Gujarat.

Zydus Lifesciences: Zydus has received approval from the United States Food and Drug Administration (USFDA) for Apixaban tablets which block the activity of certain clotting substances in the blood. The drug will be manufactured in the formulation manufacturing facility at Moraiya in Ahmedabad. Apixaban tablets had annual sales of $18,876 million in the United States. Further, the company has also received approval from USFDA for Olmesartan Medoxomil and hydrochlorothiazide tablets, which are used to treat high blood pressure (hypertension). The drug will be manufactured at a formulation manufacturing facility in Ahmedabad SEZ, and had annual sales of $41.7 million in the US.

Tata Power: Subsidiary Tata Power Renewable Energy has approved the allotment of 20 crore compulsorily convertible preference shares at a face value of Rs 100 each, amounting to Rs 2,000 crore on a preferential basis to GreenForest New Energies Bidco. GreenForest is incorporated under the laws of England and Wales. With this, both the tranches of investment of Rs 2,000 crore each in Tata Power Renewable Energy made by GreenForest are completed.

Vodafone Idea: The telecom operator has allotted the balance 4,000 optionally convertible debentures (OCDs) with a face value of Rs 10 lakh each to ATC Telecom Infrastructure. With this, the company has completed the entire transaction of allotment of 16,000 OCDs to ATC. Shareholders of the company had approved the OCDs allotment at the extraordinary general meeting on February 25.

Bharat Electronics: The Navratna defence PSU, at Aero India 2023, has signed a frame supply agreement with Thales Reliance Defence Systems (TRDS), Nagpur, for the manufacture and supply of TR modules, radar LRUs (line replaceable units) and micro modules.

Samvardhana Motherson International: The automotive components manufacturer has announced the completion of the purchase of assets of frame manufacturing and assembly operations of Daimler India Commercial Vehicles (DICV). In September last year, it signed a strategic agreement to acquire those assets, and also entered into a long-term agreement with DICV for the supply of the complete frame assembly.

Seamec: The company has entered into a charter party with HAL Offshore for the charter hire of the vessel 'Seamec Paladin' for an ONGC contract for a period of 5 years. The charter rate is $35,000 per day for marine activities. The vessel has completed the modification and arrived in India and is getting ready for mobilization for the ONGC contract. The total contract value for 5 years will be approximately $64 million.

Adani Enterprises: Subsidiary Mundra Aluminium is declared as the preferred bidder and subsequently received a Letter of Intent from the Odisha government for the Kutrumali bauxite block in Odisha.

Delhivery: Japanese tech conglomerate Softbank Group is planning to sell its stake worth around Rs 600 crore in Delhivery via block deals on March 1, CNBC Awaaz reported. The shares are likely to be offered at a discount of 3-5 percent against the current market price.

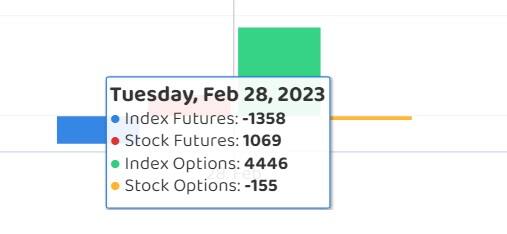

Fund Flow

Foreign institutional investors (FII) sold shares worth Rs 4,559.21 crore, whereas domestic institutional investors (DII) bought shares worth Rs 4,609.87 crore on February 28, the National Stock Exchange's provisional data showed.

Stocks under F&O ban on NSE

The National Stock Exchange has not added any stock in its F&O ban list for March 1. Securities banned under the F&O segment include companies where derivative contracts have crossed 95 percent of the market-wide position limit.

Disclaimer: The views and investment tips expressed by experts on Moneycontrol.com are their own and not those of the website or its management. Moneycontrol.com advises users to check with certified experts before taking any investment decisions.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.