The stock market gained strength after a two-day correction and closed at a three-week high on February 14, led by a rally in banking & financial services, FMCG, technology, metal and select oil & gas stocks.

The BSE Sensex soared 600 points to 61,032, while the Nifty50 jumped 159 points to 17,930 and formed a bullish candle on the daily charts, making higher high-higher low formation. The index hit an intraday high of 17,955, which is a cluster of 50-day EMA (exponential moving average - 17,960), the Budget Day's high, and the point of downward sloping resistance trendline adjoining previous major swing highs.

"Nifty is now placed at the hurdle of ascending trend line around 17,950-18,000 levels. Hence, a decisive upside above 18,000 is likely to open a quick follow-through upside towards 18,250 levels in the near term," Nagaraj Shetti, Technical Research Analyst at HDFC Securities said.

Shetti feels having placed at the important downtrend line resistance around the 18,000 mark, there is a possibility of minor consolidation in the coming sessions before showing any decisive upside breakout. Immediate support is placed at the 17,750 level, the research analyst said.

The broader markets remained under pressure with the Nifty Midcap 100 and Smallcap 100 indices declining 0.3 percent and 0.4 percent, respectively.

We have collated 15 data points to help you spot profitable trades:

Note: The open interest (OI) and volume data of stocks in this article are the aggregates of three-month data and not just the current month.

Key support and resistance levels on the Nifty

As per the pivot charts, the Nifty has support at 17,836 followed by 17,799 and then 17,740. If the index moves up, the key resistance levels to watch out for are 17,954, followed by 17,990 and 18,049.

The Nifty Bank rallied 366 points to 41,648 and formed a bullish candle with a long lower shadow on the daily charts, indicating support-based buying. It has made higher high higher low formation.

"The index has surpassed the immediate hurdle of 41,500 which had the highest open interest build-up on the Call side. The index's next hurdle is at 42,000 and once surpassed will witness sharp short covering towards 43,000-43,500 levels," Kunal Shah, Senior Technical Analyst at LKP Securities said.

The important pivot level, which will act as a support, is at 41,321 followed by 41,198 and 40,999. On the upside, key resistance levels are 41,720, followed by 41,843, and 42,043.

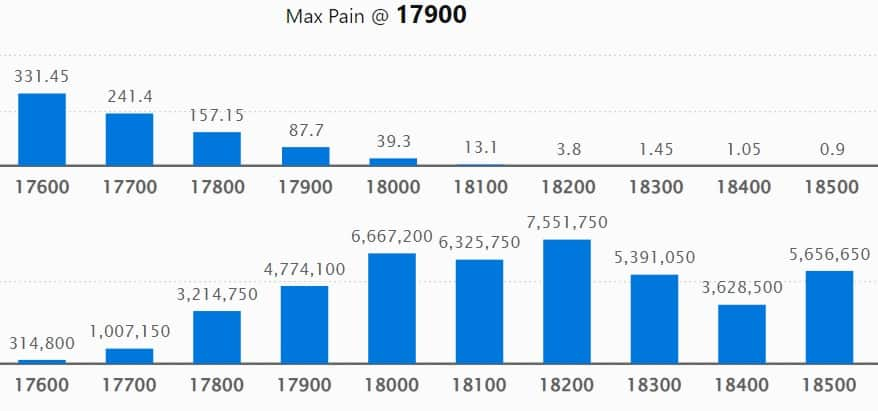

On a weekly basis, the maximum Call open interest (OI) remained at 18,200 strike, with 75.51 lakh contracts, which may be a crucial resistance in the coming sessions.

This is followed by an 18,000 strike, comprising 66.67 lakh contracts, and an 18,100 strike, where there are more than 63.25 lakh contracts.

Call writing was seen at 18,200 strike, which added 26.44 lakh contracts.

We have seen Call unwinding in 17,800 strike, which shed 46.93 lakh contracts, followed by 18,000 strike, which shed 36.61 lakh contracts, and 17,900 strike which shed 30.04 lakh contracts.

On a weekly basis, the maximum Put OI is at 17,800 strike, with 92.57 lakh contracts, which is expected to act as a crucial support area for the Nifty50 in coming sessions.

This is followed by the 17,900 strike, comprising 64.35 lakh contracts, and the 17,700 strike, where we have 61.69 lakh contracts.

Put writing was seen at 17,900 strike, which added 49.61 lakh contracts, followed by 17,800 strike, which added 44.11 lakh contracts, and 17,700 strike which added 21.46 lakh contracts.

Put unwinding was seen at 16,800 strike, which shed 3.4 lakh contracts, followed by 16,700 strike, which shed 1.34 lakh contracts, and 16,600 strike, which shed 1.09 lakh contracts.

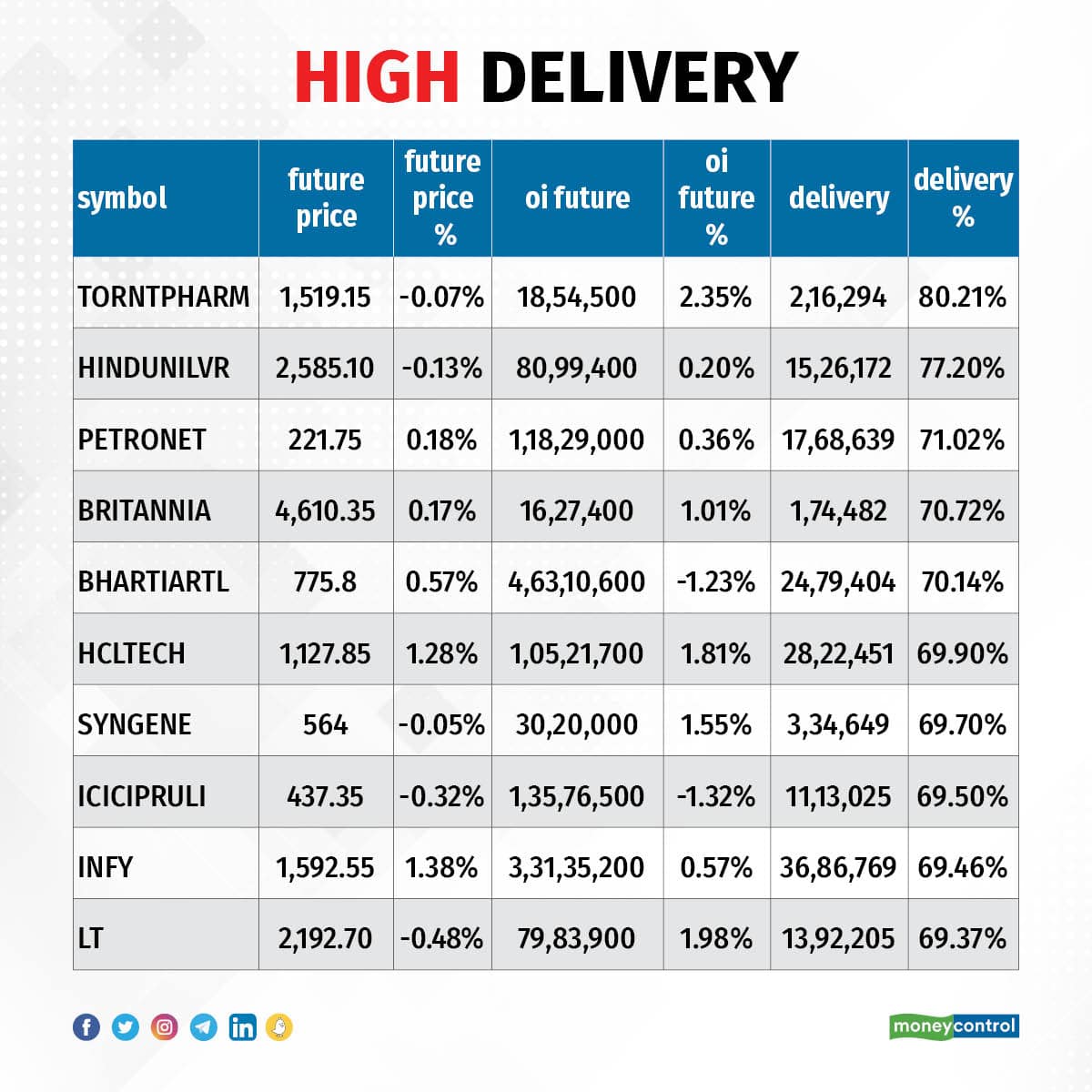

Stocks with high delivery percentage

A high delivery percentage suggests that investors are showing interest in these stocks. The highest delivery was seen in Torrent Pharma, Hindustan Unilever, Petronet LNG, Britannia Industries, and Bharti Airtel, among others.

An increase in open interest (OI) and an increase in price mostly indicate a build-up of long positions. Based on the OI percentage, 52 stocks, including ITC, Polycab India, Metropolis Healthcare, Dr Lal PathLabs, and Marico, saw a long build-up.

A decline in OI and a decrease in price, in most cases, indicate long unwinding. Based on the OI percentage, 36 stocks including BHEL, Max Financial Services, National Aluminium Company, Indraprastha Gas, and Bajaj Auto, witnessed long unwinding.

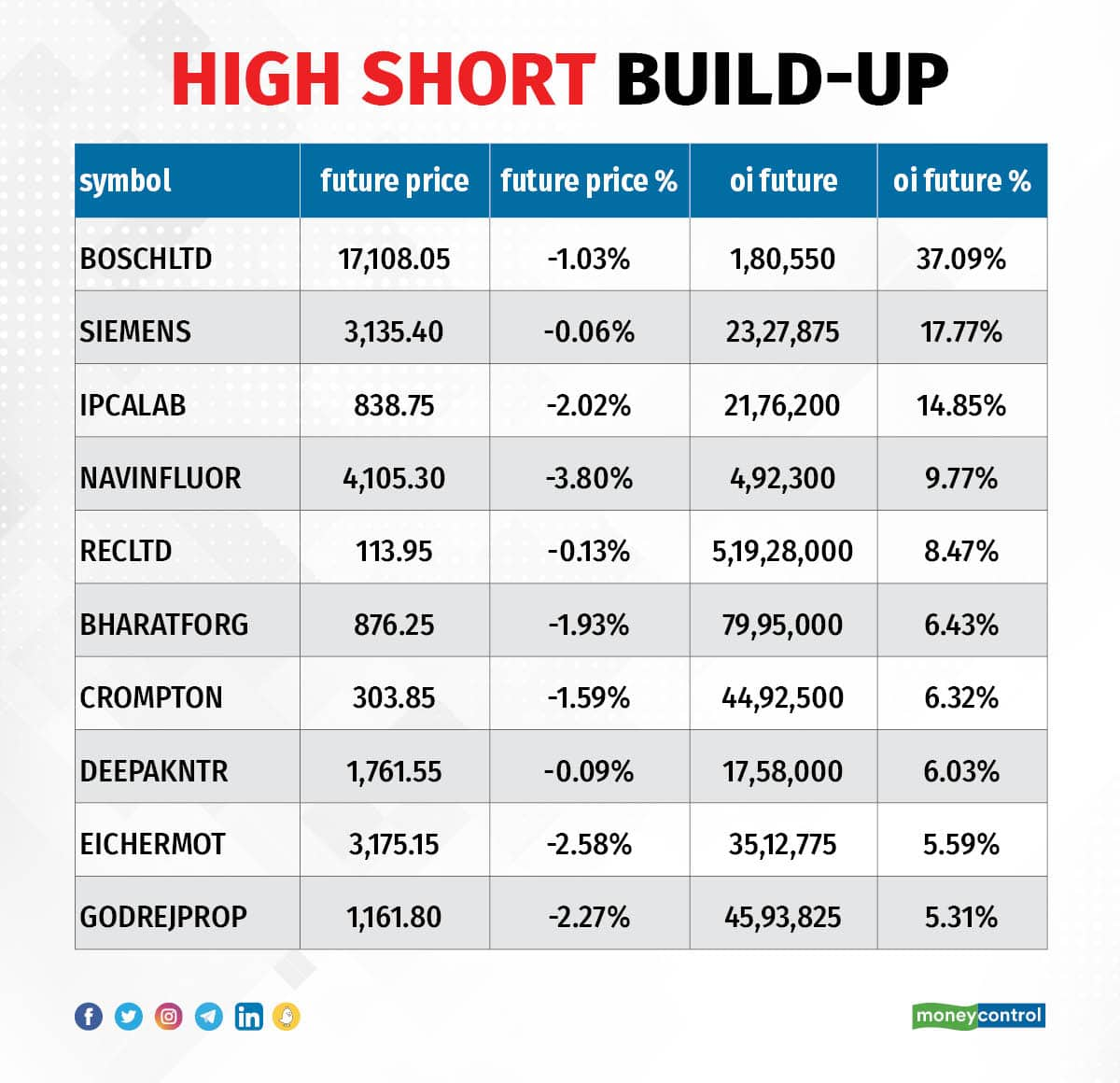

57 stocks see a short build-up

An increase in OI accompanied by a decrease in price mostly indicate a build-up of short positions. Based on the OI percentage, 57 stocks, including Bosch, Siemens, Ipca Laboratories, Navin Fluorine International, and REC, saw a short build-up.

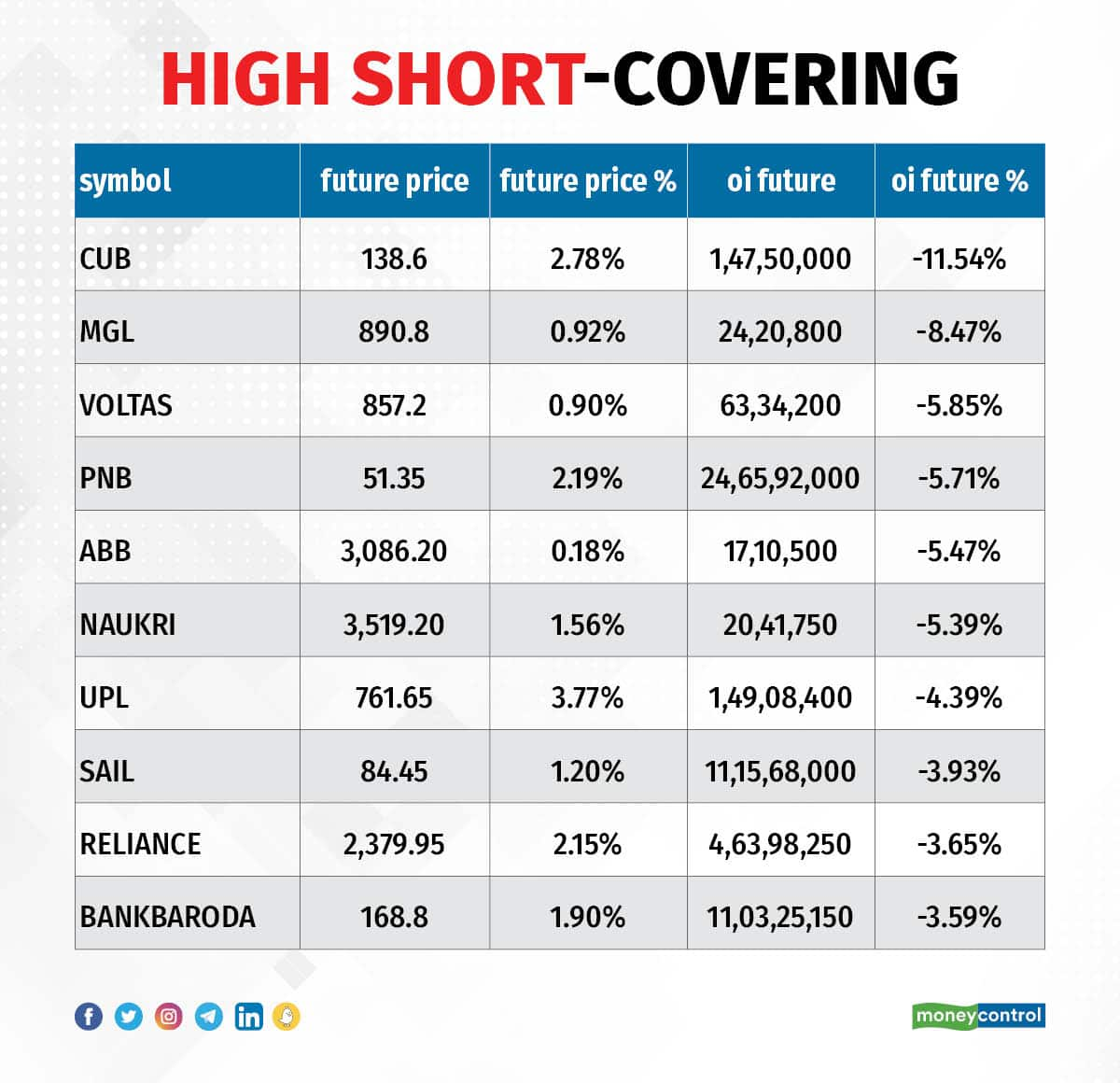

A decrease in OI along with an increase in price is an indication of short-covering. Based on the OI percentage, 49 stocks were on the short-covering list. These included City Union Bank, Mahanagar gas, Voltas, Punjab National Bank, and ABB India.

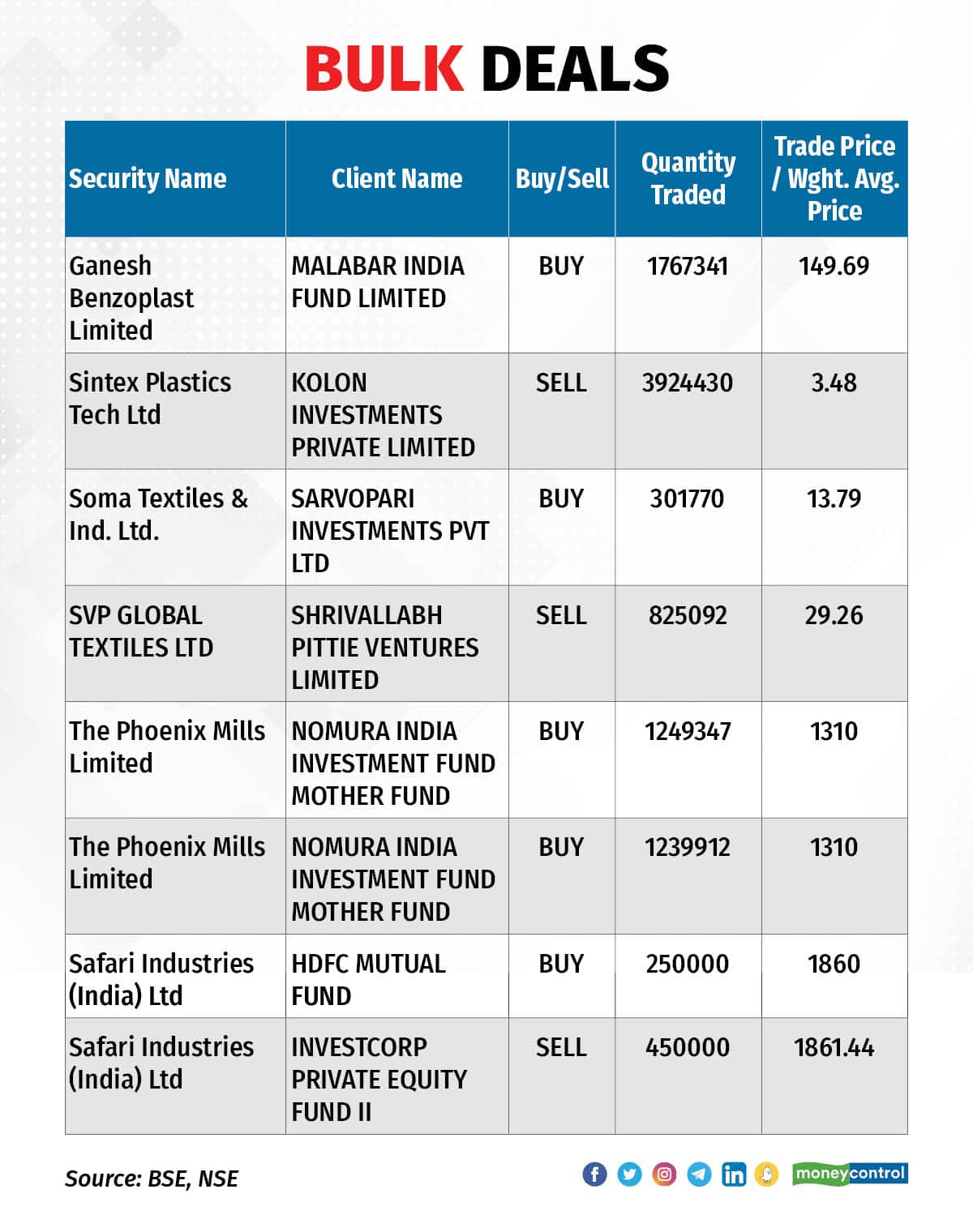

The Phoenix Mills: Nomura India Investment Fund Mother Fund bought 24.89 lakh shares in the company via open market transactions, at an average price of Rs 1,310 per share. The stake buy was worth Rs 329.09 crore.

Safari Industries (India): HDFC Mutual Fund bought 2.5 lakh shares in the company at an average price of Rs 1,860 per share, whereas Investcorp Private Equity Fund II sold 4.5 lakh shares at an average price of Rs 1,861.44 per share.

(For more bulk deals, click here)

JBF Industries, Crazy Infotech, Velox Industries, Vision Cinemas, and Vantage Knowledge Academy will be in focus ahead of their quarterly earnings on February 15.

Stocks in the news

LT Foods: The Competition Commission of India has approved the acquisition of certain equity shares of consumer food company LT Foods by SALIC International Investment Corporation based in Saudi Arabia. SALIC is an investment company with holdings in various international companies specialising in the fields of agriculture and trading of food commodities both in Saudi Arabia and internationally.

Prestige Estates Projects: The real estate developer has recorded a massive 47.6 percent year-on-year growth in consolidated profit at Rs 127.8 crore for the quarter ended December FY23, supported by healthy topline and operating income. Revenue from operations grew significantly by 74.5 percent YoY to Rs 2,317 crore for the quarter. On the operating front, EBITDA jumped 57.5 percent YoY to Rs 574.2 crore in Q3FY23, but the margin fell by 268 bps YoY to 24.78 percent.

Bata India: The footwear company has reported a 15 percent year-on-year growth in profit at Rs 83.1 crore for the quarter ended December FY23, supported by operating performance. Revenue for the quarter at Rs 900.2 crore grew by 7 percent over a year-ago period. At the operating level, EBITDA jumped 22.2 YoY to Rs 206 crore with a margin expansion of 284 bps in Q3FY23. Numbers were lower than analysts' expectations. Strong portfolio evolution and strong footprint expansion across touchpoints coupled with improving cost efficiencies helped drive revenue growth and increase margins despite significant inflationary pressure.

Apollo Hospitals Enterprise: The healthcare services provider has registered a 33.3 percent year-on-year decline in consolidated profit at Rs 162.3 crore for the third quarter of FY23, impacted by weak operating performance. The higher purchase of stock-in-trade and employee expenses impacted operating numbers. Revenue for the quarter at Rs 4,264 crore increased by 17.2 percent over a year-ago period. On the operating front, EBITDA fell 14 percent YoY to Rs 505.35 crore with a margin down by 428 bps for the quarter. The board declared an interim dividend of Rs 6 per share.

Torrent Power: The power utility company has recorded a whopping 86 percent year-on-year growth in consolidated profit at Rs 685 crore for the three-month period ended December FY23 as revenue grew by 71 percent YoY to Rs 6,443 crore during the quarter. On the operating front, EBITDA for the quarter at Rs 1,444 crore increased by 54.6 percent over a year-ago period, but the margin declined 239 bps in the same period. The company declared an interim dividend of Rs 22 per share including Rs 13 per share as a special dividend for FY23.

Biocon: The biopharmaceutical company posted a consolidated loss of Rs 41.8 crore for the December FY23 quarter against a profit of Rs 187.1 crore in the corresponding period of the last fiscal as there was a one-time loss of Rs 271.4 crore during the quarter. Consolidated revenue grew 35.3 percent YoY to Rs 2,941 crore driven by growth across key segments (generics, biosimilars and research services). At the operating level, EBITDA surged 32 percent YoY to Rs 644.3 crore but the margin declined 55 bps on higher input costs for the quarter. Biocon has entered into a definitive agreement with Kotak Strategic Situations Fund for structured funding up to Rs 1,200 crore.

ONGC: The state-owned oil & exploration company has recorded a 26 percent year-on-year growth in standalone profit at Rs 11,045 crore for the quarter ended December FY23. Revenue for the quarter at Rs 38,583.3 crore increased by 35.5 percent over a year-ago period, with crude oil prices realisation growing 26 percent. The board members have declared a second interim dividend of Rs 4 per share.

EID Parry (India): The sugar manufacturer has reported a consolidated profit of Rs 250.89 crore for the quarter ended December FY23, rising 10.1 percent YoY impacted by a lower operating margin. Consolidated revenue grew by 52 percent YoY to Rs 9,917 crore for the quarter. At the operating level, EBITDA jumped 49 percent YoY to Rs 914.4 crore but the margin fell by 17 bps YoY to 9.22 percent for the quarter on higher input costs.

Fund Flow

Foreign institutional investors (FII) bought shares worth Rs 1,305.30 crore, while domestic institutional investors (DII) purchased shares worth Rs 204.79 crore on February 14, NSE's provisional data showed.

Stocks under F&O ban on NSE

The National Stock Exchange has retained BHEL, Punjab National Bank, Ambuja Cements and Indiabulls Housing Finance on its F&O ban list for February 15. Securities banned under the F&O segment include companies where derivative contracts have crossed 95 percent of the market-wide position limit.

Disclaimer: The views and investment tips expressed by experts on Moneycontrol.com are their own and not those of the website or its management. Moneycontrol.com advises users to check with certified experts before taking any investment decisions.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.