The market made a new record high and closed higher but failed to sustain above the 21,000 mark on the Nifty50 due to profit-taking and rangebound trade on December 11. Experts expect the consolidation to continue as long as the Nifty stays below 21,000 with immediate support at 20,850 but sees the 21,500 mark on the higher side if the index closes firmly above 21,000 in the coming days.

On December 11, the benchmark indices started off the week on a positive note, though it was a rangebound session. The BSE Sensex climbed 103 points to 69,929, while the Nifty50 gained 28 points to 20,997 and formed a small-bodied bullish candlestick pattern with upper & lower shadows, which resembles the Spinning Top kind of candlestick pattern on the daily charts, indicating indecisiveness among bulls and bears about the future market trend, though higher highs, higher lows formation continued for the second consecutive session.

"This is indicating a narrow range movement in the market for the last three sessions, after a sharp up move of the early part of December," Nagaraj Shetti, senior technical research analyst at HDFC Securities said.

He feels the overall positive chart pattern of Nifty remains intact and there is a possibility of Nifty continuing its upward journey without showing any major breakdown in the near term.

A decisive move above the 21,000 mark could open the next upside target of 21,550, while immediate support is placed at 20,850 levels, he said.

The broader markets outperformed frontline indices on positive breadth. The Nifty Midcap 100 and Smallcap 100 indices gained 0.7 percent and 0.8 percent respectively.

We have collated 15 data points to help you spot profitable trades:

Key support and resistance levels on the Nifty

The pivot point calculator indicates that the Nifty is likely to see immediate resistance at 21,021, followed by 21,046 and 21,085, while on the lower side, it can take support at 20,943, followed by 20,919 and 20,880 levels.

On December 11, the Bank Nifty hit a fresh record high of 47,588 in the morning, but saw some profit-taking at higher levels and remained rangebound for the rest of the session. The index ended at a new closing high of 47,314, up 52 points and formed a Shooting Star kind of candlestick pattern on the daily charts at the high. It is a trend reversal pattern but needs confirmation in the following day's trade.

"Going ahead we can expect some consolidation. The range of consolidation is likely to be 46,800 – 47,500," Jatin Gedia, technical research analyst at Sharekhan by BNP Paribas said.

Overall, he feels the trend is positive and dips should be used as a buying opportunity.

As per the pivot point calculator, the index is expected to see resistance at 47,516, followed by 47,611 and 47,764, while on the lower side, it may take support at 47,210, followed by 47,115 and 46,962.

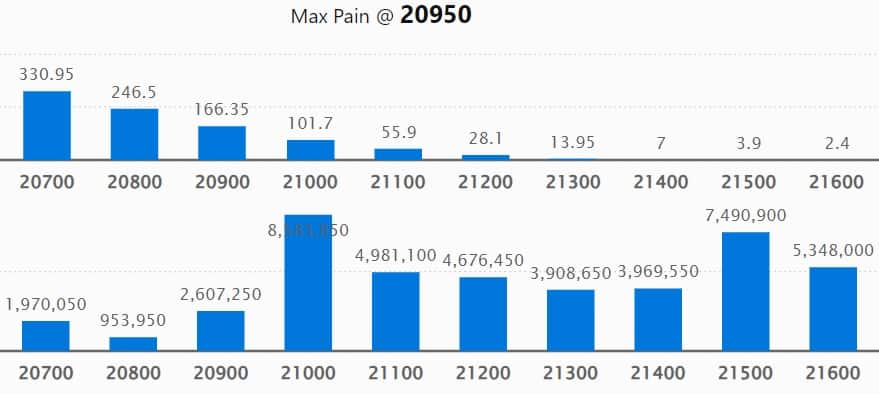

On the Call side, the maximum open interest (OI) remained at 21,000 strike with 85.83 lakh contracts, which can act as a key resistance level for the Nifty. It was followed by the 21,500 strike, which had 74.9 lakh contracts, while the 22,000 strike had 61.04 lakh contracts.

Meaningful Call writing was seen at the 21,500 strike, which added 19.73 lakh contracts followed by 21,000 and 21,200 strikes, which added 19.56 lakh and 14.76 lakh contracts.

The maximum Call unwinding was at the 20,600 strike, which shed 8.03 lakh contracts followed by 20,900 and 20,800 strikes, which shed 5.23 lakh and 3.3 lakh contracts.

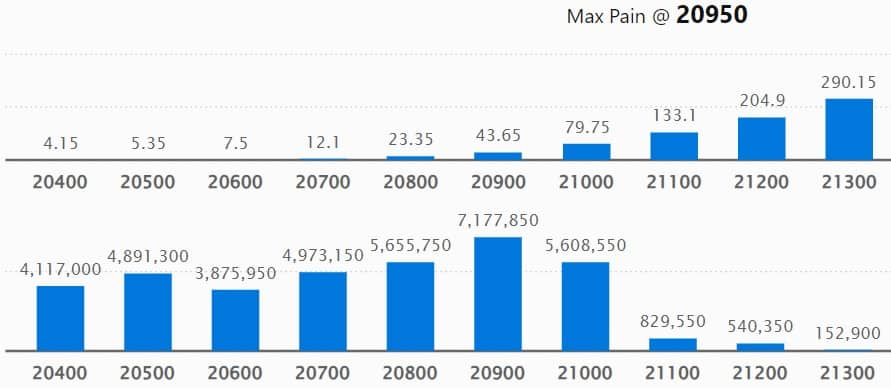

On the Put front, the 20,900 strike has the maximum open interest, which can act as a key support area for the Nifty, with 71.77 lakh contracts. It was followed by 20,000 strike comprising 59.74 lakh contracts and 20,800 strike with 56.55 lakh contracts.

Meaningful Put writing was at 20,400 strike, which added 18.41 lakh contracts followed by 21,000 strike and 20,700 strike, which added 16.05 lakh contracts and 15.33 lakh contracts.

Put unwinding was at 20,300 strike, which shed 6.79 lakh contracts followed by 20,200 strike, which shed 2.08 lakh contracts and 20,100 strike which shed 1.07 lakh contracts.

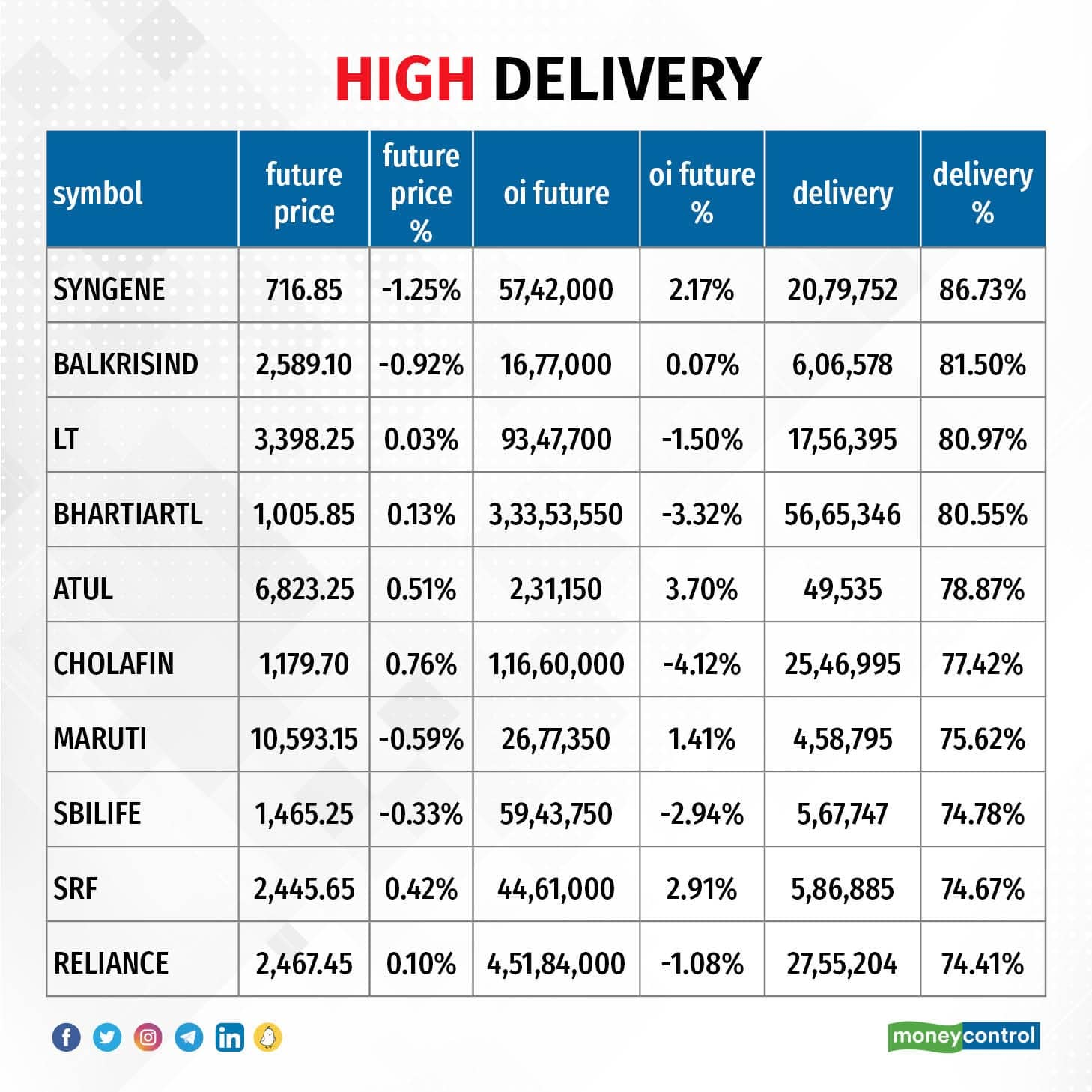

Stocks with high delivery percentage

A high delivery percentage suggests that investors are showing interest in the stock. Syngene International, Balkrishna Industries, Larsen & Toubro, Bharti Airtel, and Atul saw the highest delivery among the F&O stocks.

A long build-up was seen in 61 stocks, which included UltraTech Cement, Cummins India, Samvardhana Motherson International, Jindal Steel & Power, and Mahanagar Gas. An increase in open interest (OI) and price indicates a build-up of long positions.

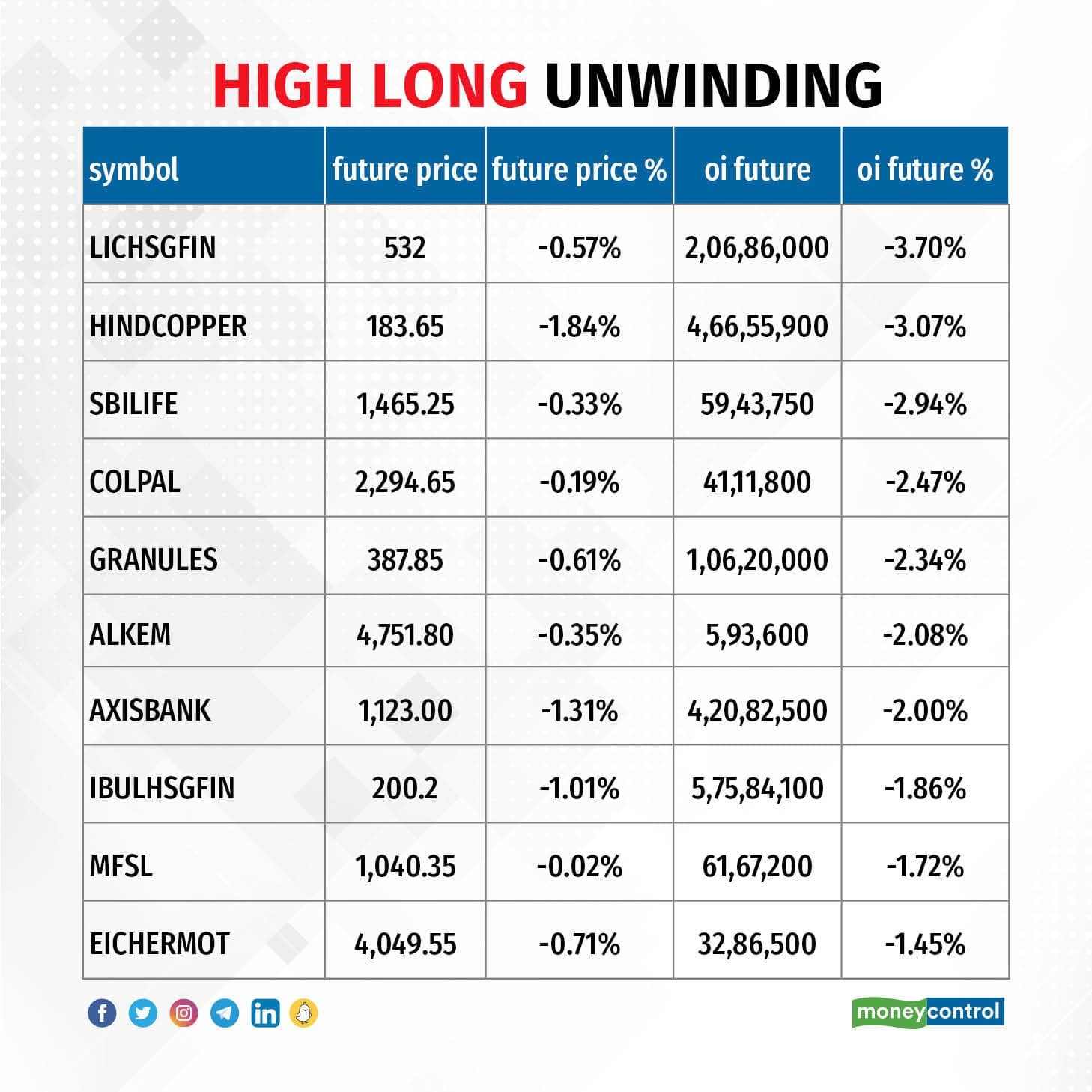

Based on the OI percentage, 17 stocks saw long unwinding, including LIC Housing Finance, Hindustan Copper, SBI Life Insurance Company, Colgate Palmolive, and Granules India. A decline in OI and price indicates long unwinding.

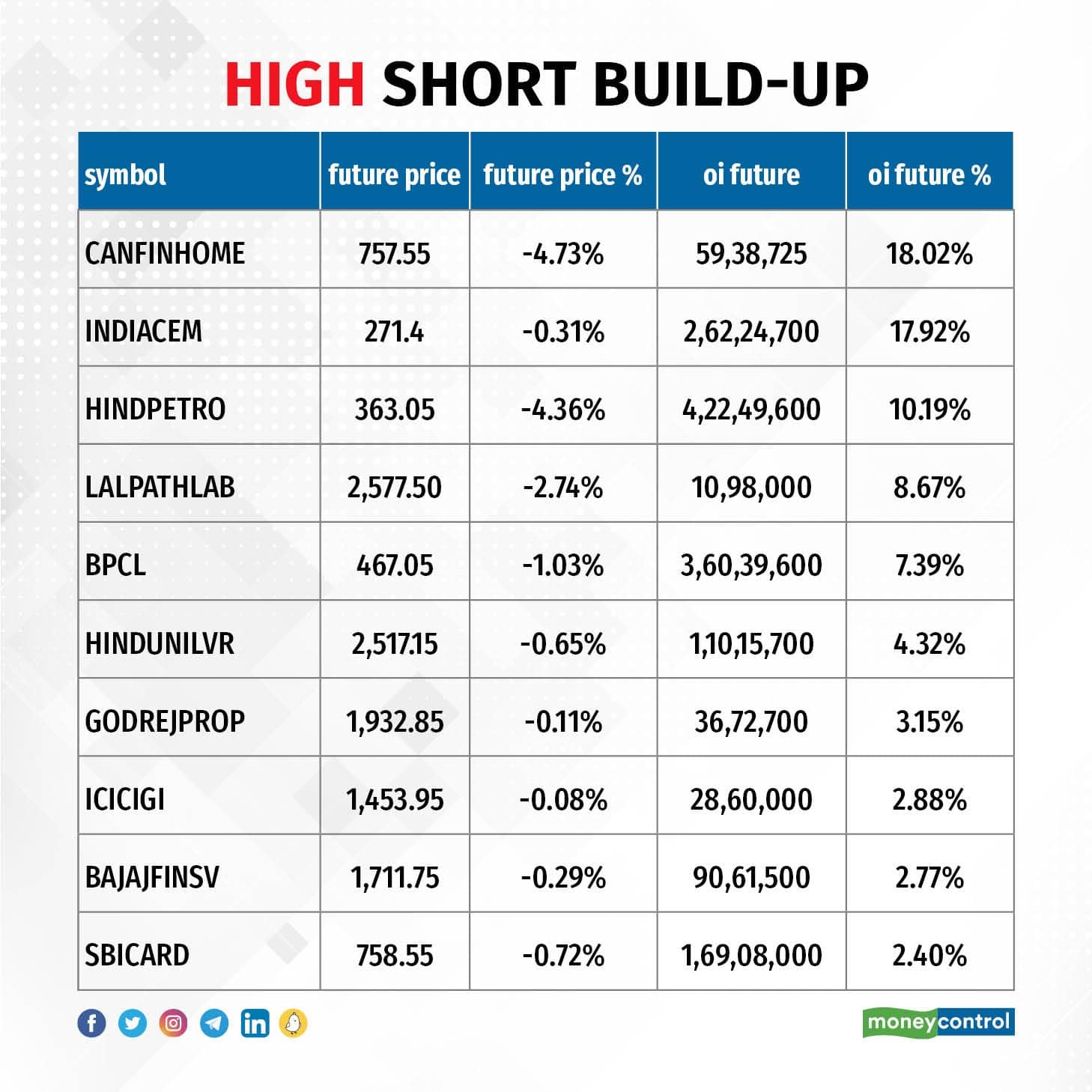

42 stocks see a short build-up

A short build-up was seen in 42 stocks, which were Can Fin Homes, India Cements, Hindustan Petroleum Corporation, Dr Lal PathLabs, and BPCL. An increase in OI along with a fall in price points to a build-up of short positions.

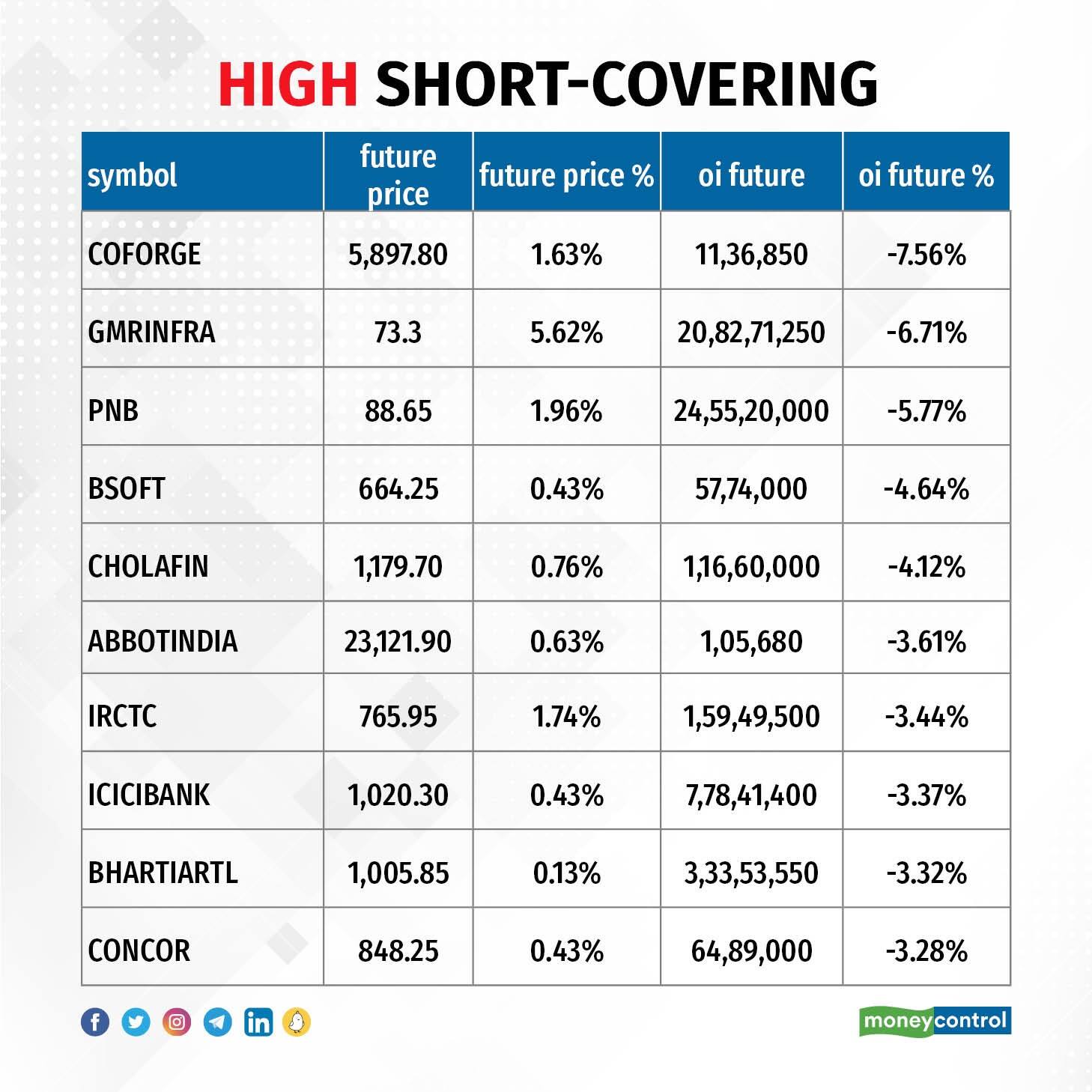

Based on the OI percentage, 67 stocks were on the short-covering list. These include Coforge, GMR Airports Infrastructure, Punjab National Bank, Birlasoft, and Cholamandalam Investment and Finance. A decrease in OI along with a price increase is an indication of short-covering.

The Nifty Put Call ratio (PCR), which indicates the mood of the equity market, declined further to 1.14 on December 11, from 1.20 levels in the previous session. An above 1 PCR indicates that the traders are buying more Put options than Calls, which generally indicates an increase in bearish sentiment.

For more bulk deals, click here

Stocks in the news

Infosys: The country's second-largest IT services company said the Board has appointed Jayesh Sanghrajka as the Chief Financial Officer and key managerial personnel of the company with effect from April 1, 2024. Nilanjan Roy has resigned as Chief Financial Officer and key managerial personnel of the company. Roy's last date with the company would be March 31, 2024.

Mankind Pharma: The company is likely to see a change of hands up to 7.9 percent equity via block deal, reports CNBC-TV18 quoting sources. The total block deal size is likely to be around Rs 5,649 crore, including the base size at Rs 4,935 crore. Beige Investment, Link Investment Trust, Cairnhill CIPEF, Cairnhill CGPE, and Hema CIPEF are likely sellers in the block deal.

Wipro: The IT services company said it has supported Marelli Electronic Systems, the mobility technology supplier to the automotive sector, in the development of its Cabin Digital Twin viable product. This product enables original equipment manufacturers (OEMs) to introduce connected vehicle services to the market quickly.

REC: The state-owned entity has entered into a 200-million-euro loan agreement with Germany’s KfW Development Bank. REC would use a Line of Credit to refinance investments in the distribution infrastructure of DISCOMs in the framework of and in alignment with the Revamped Distribution Sector Scheme (RDSS).

DLF: Vivek Anand has resigned as Group Chief Financial Officer of the country's largest real estate developer, to pursue other career avenues. Vivek Anand will continue in his role until February 29, 2024. Ashok Kumar Tyagi, who has the overall responsibility for all corporate functions, including finance, will now have oversight of the Group Finance, IT, and Secretarial functions. Currently, Tyagi is the Managing Director of DLF.

Rail Vikas Nigam: The joint venture of RVNL-URC emerged as the lowest bidder (L1) for part design and construction of an elevated viaduct, five elevated metro rail stations, and a ramp between chainages for the Indore metro rail project. The project is worth Rs 543 crore. RVNL holds a 51 percent share in the joint venture and the balance 49 percent by URC.

Funds Flow (Rs Crore)

Foreign institutional investors (FIIs) net bought shares worth Rs 1,261.13 crore, while domestic institutional investors (DIIs) sold Rs 1,032.92 crore worth of stocks on December 11, provisional data from the National Stock Exchange (NSE) showed.

Stock under F&O ban on NSE

The NSE has added India Cements to its F&O ban list for December 12, while retaining Balrampur Chini Mills, Delta Corp, Hindustan Copper, Indiabulls Housing Finance, National Aluminium Company, and SAIL to the said list. Zee Entertainment Enterprises was removed from the said list.

Securities banned under the F&O segment include companies where derivative contracts cross 95 percent of the market-wide position limit.

Disclaimer: The views and investment tips expressed by experts on Moneycontrol are their own and not those of the website or its management. Moneycontrol advises users to check with certified experts before taking any investment decisions.

Disclaimer: Moneycontrol is a part of the Network18 group. Network18 is controlled by Independent Media Trust, of which Reliance Industries is the sole beneficiary.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.