The market gained some strength on December 8 after falling for three sessions in a row. The Nifty50 reclaimed the 18,600 mark amid yet another rangebound session. The climb was supported largely by banks, especially after pricing in the rate hike by the Reserve Bank a day before.

The BSE Sensex gained 160 points to 62,571, while the Nifty50 rose 49 points to 18,609 and formed a bullish candle on the daily charts, taking major support at the 18,500 mark.

"The rangebound action continued in the Nifty and the immediate support of 18,550-18,500 levels remains active," Nagaraj Shetti, Technical Research Analyst at HDFC Securities said.

"The overall chart pattern signal positive bias for the short term. Immediate resistance is at 18,650 levels," Shetti added.

The broader markets also closed in a positive terrain, with the Nifty Midcap 100 and Smallcap 100 indices rising six-tenth of a percent and a third of a percent, respectively, while the volatility index India VIX dropped 4.83 percent to 13.40 levels, lending more comfort to bulls.

We have collated 15 data points to help you spot profitable trades:

Note: The open interest (OI) and volume data of stocks in this article are the aggregates of three-month data, and not just of the current month.

Key support and resistance levels on the Nifty

As per the pivot charts, the key support level for the Nifty is placed at 18,557, followed by 18,536 & 18,502. If the index moves up, the key resistance levels to watch out for are 18,624 followed by 18,645 and 18,678.

The Nifty Bank performed better than broader markets, climbing nearly 500 points to end at a record closing high of 43,597 and formed a long bullish candle on the daily charts on December 8. The important pivot level, which will act as crucial support for the index, is placed at 43,236, followed by 43,107 and 42,899 levels. On the upside, key resistance levels are placed at 43,653 followed by 43,781 & 43,990 levels.

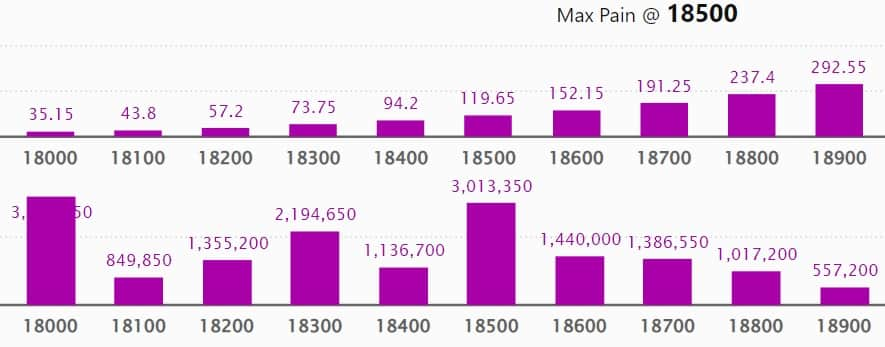

We have seen the maximum Call open interest at 19,000 strike, with 37.20 lakh contracts, which can act as a crucial resistance level in the December series.

This is followed by 20,000 strike, which holds 24.31 lakh contracts, and 19,500 strike, which have more than 18.72 lakh contracts.

Call writing was seen at 19,000 strike, which added 2.37 lakh contracts, followed by 19,100 strike, which added 1.55 lakh contracts, and 19,600 strike which added 62,450 contracts.

Call unwinding was seen at 18,600 strike, which shed 1.93 lakh contracts, followed by 18,900 strike which shed 71,900 contracts and 18,700 strike which shed 69,950 contracts.

We have seen a maximum Put open interest at 18,000 strike, with 32.12 lakh contracts which can act as a crucial support level in the December series.

This is followed by 18,500 strike, which holds 30.13 lakh contracts, and 17,000 strike, which has accumulated 26.05 lakh contracts.

Put writing was seen at 18,300 strike, which added 1.55 lakh contracts, followed by 17,400 strike, which added 1.28 lakh contracts and 17,700 strike which added 76,800 contracts.

Put unwinding was seen at 18,600 strike, which shed 1.23 lakh contracts, followed by 18,700 strike which shed 1.2 lakh contracts and 18,200 strike which shed 46,400 contracts.

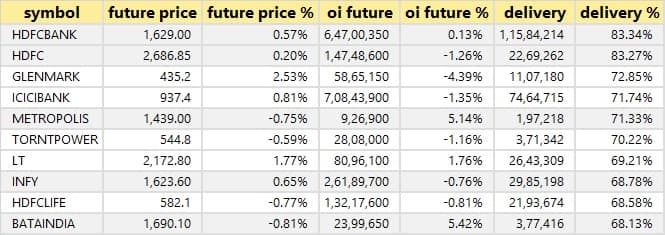

Stocks with a high delivery percentage

A high delivery percentage suggests that investors are showing interest in these stocks. We have seen the highest delivery in HDFC Bank, HDFC, Glenmark Pharma, ICICI Bank, and Metropolis Healthcare, among others.

An increase in open interest, along with an increase in price, mostly indicates a build-up of long positions. Based on the open interest future percentage, we have seen a long build-up in total of 58 stocks on Thursday, including Bank of Baroda, Bank Nifty, Coromandel International, Astral, and Axis Bank.

A decline in open interest, along with a decrease in price, mostly indicates a long unwinding. Based on the open interest future percentage, a total of 17 stocks have seen long unwinding on Thursday including Hindustan Unilever, HCL Technologies, Indiabulls Housing Finance, Torrent Power, and HDFC Life Insurance Company.

An increase in open interest, along with a decrease in price, mostly indicates a build-up of short positions. Based on the open interest future percentage, we have seen a short build-up in a total of 45 stocks on Thursday including Kotak Mahindra Bank, Dixon Technologies, LTIMindtree, Power Grid Corporation, and Bata India.

74 stocks witnessed short-covering

A decrease in open interest, along with an increase in price, mostly indicates a short-covering. Based on the open interest future percentage, we have a total of 74 stocks in the short-covering list on Thursday including Nifty Financial, Punjab National Bank, Polycab India, ICICI Lombard General Insurance, and Bosch.

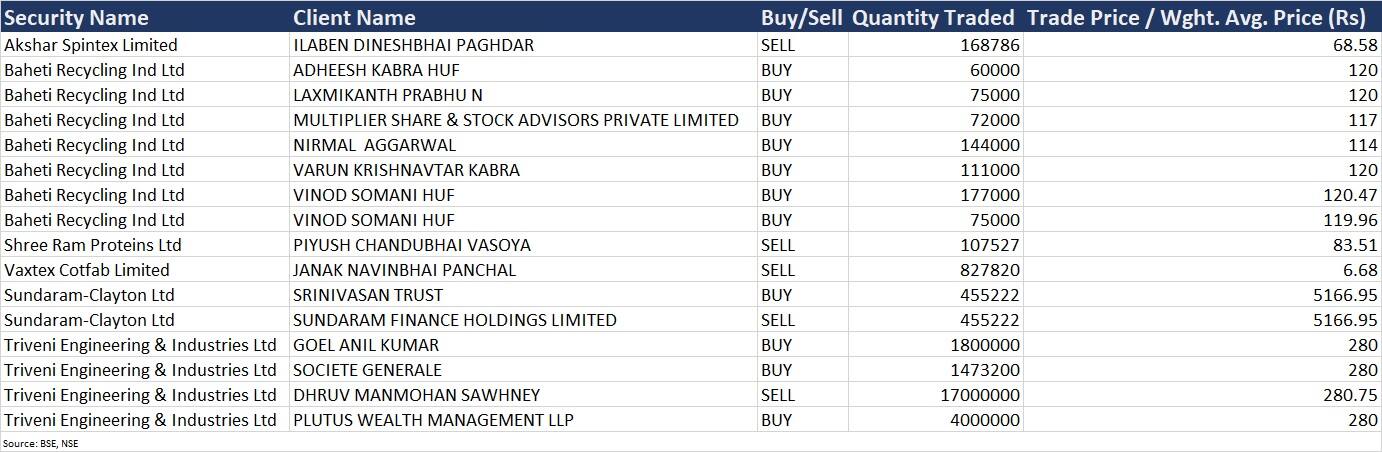

Triveni Engineering & Industries: Promoter Dhruv Manmohan Sawhney has offloaded 1.7 crore shares or 7% stake in Triveni Engineering via open market transactions, at an average price of Rs 280.75 per share. However, Goel Anil Kumar acquired additional 18 lakh shares in the company at an average price of Rs 280 per share. Societe Generale bought 14.73 lakh shares and Plutus Wealth Management LLP purchased 40 lakh shares at same price.

(For more bulk deals, click here)

Investors Meetings on December 9

Cipla: Officials of the company will interact with Nomura Financial Advisory & Securities (India).

Syngene International: Officials of the company will interact with Marshal Wace LLP.

Tata Chemicals: Officials of the company will interact with FSSA Investment Managers.

Clean Science and Technology: Officials of the company will interact with IDFC Mutual Fund.

Bharat Forge: Company has organized institutional investor meet.

Voltas: Officials of the company will interact with FSSA Investment Managers, ITI Long Short Equity Fund, and BOBCaps.

Punjab National Bank: Officials of the bank will interact with Prabhudas Lilladher, Marshall Wace, and DSP Mutual Fund.

Krsnaa Diagnostics: Officials of the company will interact with TATA AIA Life Insurance.

VIP Industries: Officials of the company will interact with InCred Capital.

Gati: Officials of the company will interact with Sundaram Mutual Fund.

Tata Power Company: Officials of the company will interact with Government of Singapore.

MedPlus Health Services: Officials of the company will interact with Investec.

Stocks in News

Hindustan Unilever: The company has entered into definitive documents to acquire 19.8 percent shareholding of Nutritionalab. This is a strategic investment by the company to enter the health & wellbeing category. The transaction cost is Rs 70 crore.

Adani Enterprises: The company has acquired 100 percent stake in Alluvial Mineral Resources, from Adani Infra (India). Alluvial Mineral Resources is engaged in mining of minerals & ores activities and other allied activities.

Lupin: The pharma major has appointed Spiro Gavaris as President of US generics business. He most recently served as President of specialty generics business at Mallinckrodt Pharmaceuticals and the president of US injectables at Hikma.

Max Financial Services: The company has completed acquisition of balance 5.17 percent stake in Max Life Insurance Company, from Mitsui Sumitomo Insurance Company, Japan. After this transaction, its shareholding in Max Life stands increased to 87 percent.

Jyoti: The company has secured order for Khalwa micro irrigation project from Navayuga Engineering Company. The order worth Rs 21.25 crore includes designing, engineering, manufacturing, testing & supply of large capacity vertical pumps and HT motors for Water Resource Department (WRD).

Sun Pharmaceutical Industries: The company in its clarification note after import alert for Halol facility says it is not revising the revenue guidance for current financial year and also there will be no impact on specialty revenues. US supplies from Halol contributed approximately 3 percent of consolidated revenues for FY22, including sales from exempted products, it added. The USFDA has excluded 14 products from this Import Alert subject to certain conditions.

Fund Flow

Foreign institutional investors (FIIs) have net sold shares worth Rs 1,131.67 crore, while domestic institutional investors (DIIs) net bought shares worth Rs 772.29 crore on December 8, as per provisional data available on the NSE.

Stocks under F&O ban on NSE

The National Stock Exchange has retained GNFC and Indiabulls Housing Finance, under its F&O ban list for December 9. Securities thus banned under the F&O segment include companies where derivative contracts have crossed 95 percent of the market-wide position limit.

Disclaimer: The views and investment tips expressed by investment experts on Moneycontrol.com are their own and not those of the website or its management. Moneycontrol.com advises users to check with certified experts before taking any investment decisions.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!