The market had a rangebound trade due to a lack of domestic and global cues on December 28, and finally closed lower for the first time in the last three consecutive sessions ahead of the expiry of December futures and options contracts on Thursday.

The BSE Sensex declined 17 points to 60,910, while the Nifty50 fell 10 points to 18,122 and formed a bullish candle on the daily charts as the closing was higher than the opening levels

"On the daily charts, the Nifty formed a bullish candle while maintaining a higher high, higher low. This points towards the rising positive undertone of the index," Vidnyan Sawant, AVP - Technical Research at GEPL Capital said.

The momentum indicator RSI is moving in sync with prices, which indicates the presence of positive momentum.

As per the overall price structure and inferences from indicators, the market expert expects the Nifty to move towards 18,200 followed by 18,350 levels. On the flip side, if the Nifty sustains below the 18,000 mark, then the bullish view will be negated, he said.

The broader markets had a mixed trend and the breadth was moderately in favour of bulls. The Nifty Midcap 100 index was up 0.13 percent, while the Nifty Smallcap 100 index fell 0.07 percent. About 1,153 shares advanced against 839 declining shares on the NSE.

We have collated 15 data points to help you spot profitable trades:

Note: The open interest (OI) and volume data of stocks in this article are the aggregates of three-month data, and not just of the current month.

Key support and resistance levels on the Nifty

As per the pivot charts, the key support level for the Nifty is placed at 18,081, followed by 18,056 & 18,016. If the index moves up, the key resistance levels to watch out for are 18,161 followed by 18,186 and 18,226.

The Nifty Bank snapped two-day gains, falling 32 points to 42,828 and formed a small-bodied bullish candlestick pattern on the daily charts as the closing was higher than opening levels.

The important pivot level, which will act as crucial support for the index, is placed at 42,723, followed by 42,642 and 42,512 levels. On the upside, key resistance levels are placed at 42,982 followed by 43,063 and 43,192 levels.

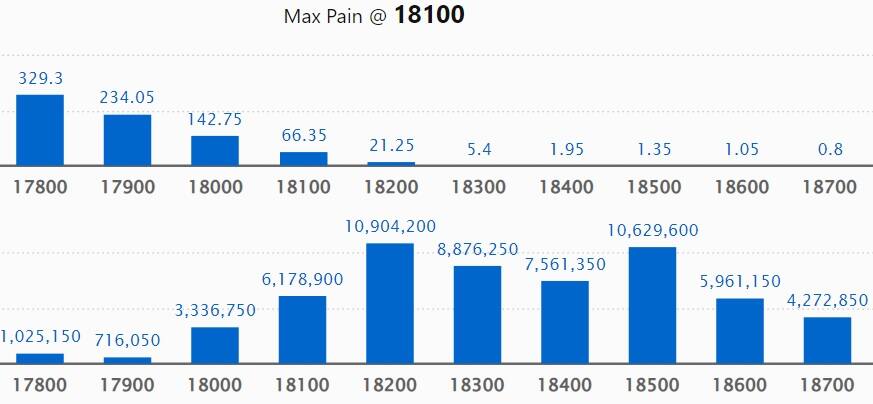

The maximum Call open interest was seen at 18,200 strike, with 1.09 crore contracts, which can act as a crucial resistance level on the monthly F&O contracts expiry day.

This is followed by 18,500 strike, which holds 1.06 crore contracts, and 18,300 strike, which have more than 88.76 lakh contracts.

Call writing was seen at 18,500 strike, which added 26.69 lakh contracts, followed by 18,300 strike, which added 22.48 lakh contracts, and 18,200 strike which added 21.95 lakh contracts.

Call unwinding was seen at 18,000 strike, which shed 11.39 lakh contracts, followed by 19,000 strike which shed 6.32 lakh contracts and 18,800 strike which shed 4.35 lakh contracts.

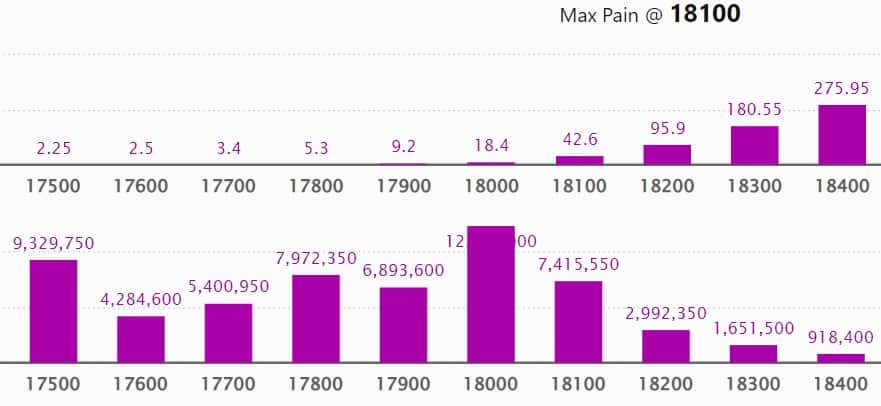

A maximum Put open interest was seen at 18,000 strike, with 1.23 crore contracts which can act as a crucial support level on the monthly F&O contracts expiry day.

This is followed by 17,500 strike, which holds 93.29 lakh contracts, and 17,800 strike, which has accumulated 79.72 lakh contracts.

Put writing was seen at 18,100 strike, which added 30.21 lakh contracts, followed by 17,500 strike, which added 25.41 lakh contracts and 18,000 strike which added 24.72 lakh contracts.

Put unwinding was seen at 17,100 strike, which shed 10.85 lakh contracts, followed by 17,400 strike which shed 8.3 lakh contracts, and 17,000 strike which shed 5.99 lakh contracts.

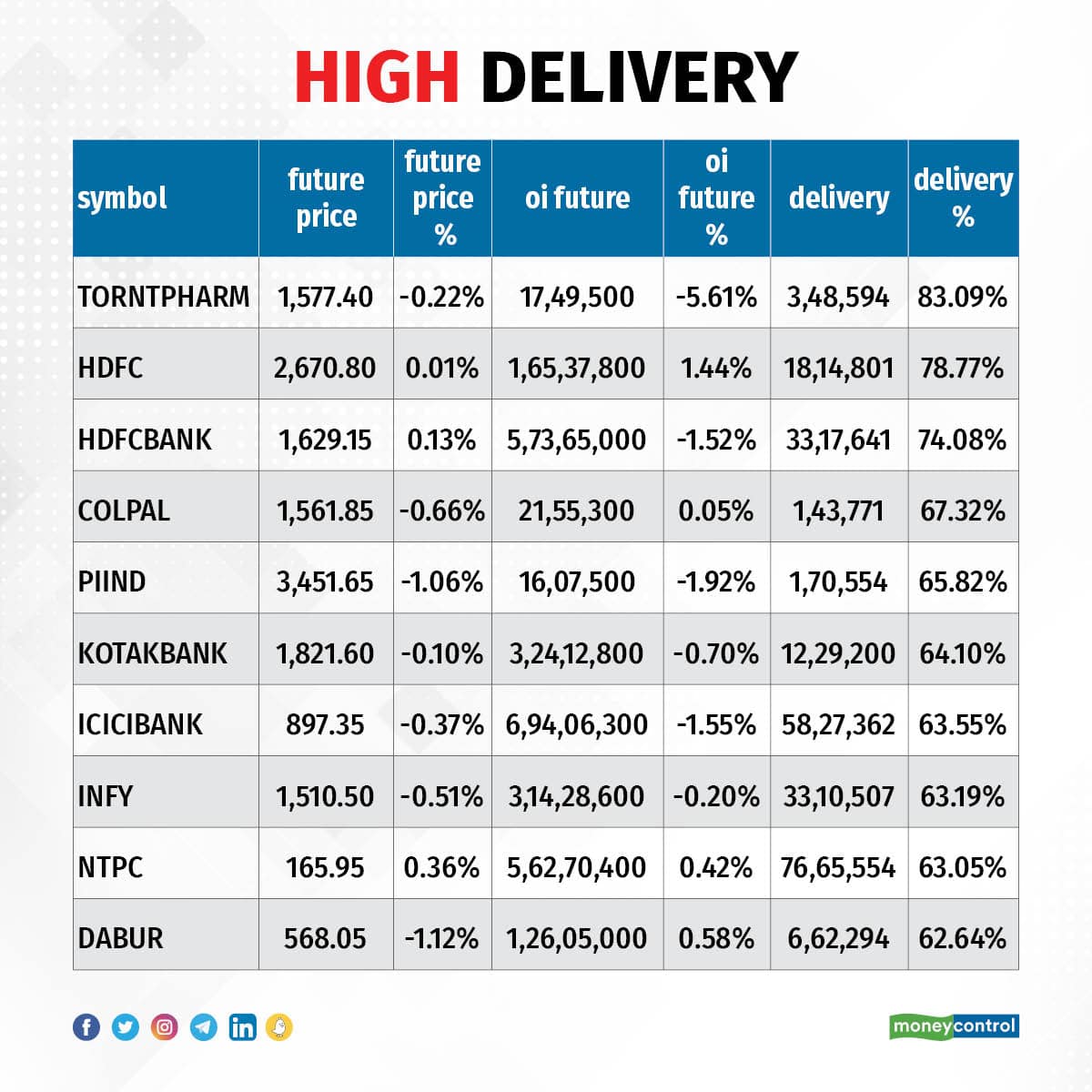

Stocks with a high delivery percentage

A high delivery percentage suggests that investors are showing interest in these stocks. We have seen the highest delivery in Torrent Pharma, HDFC, HDFC Bank, Colgate Palmolive, and PI Industries, among others.

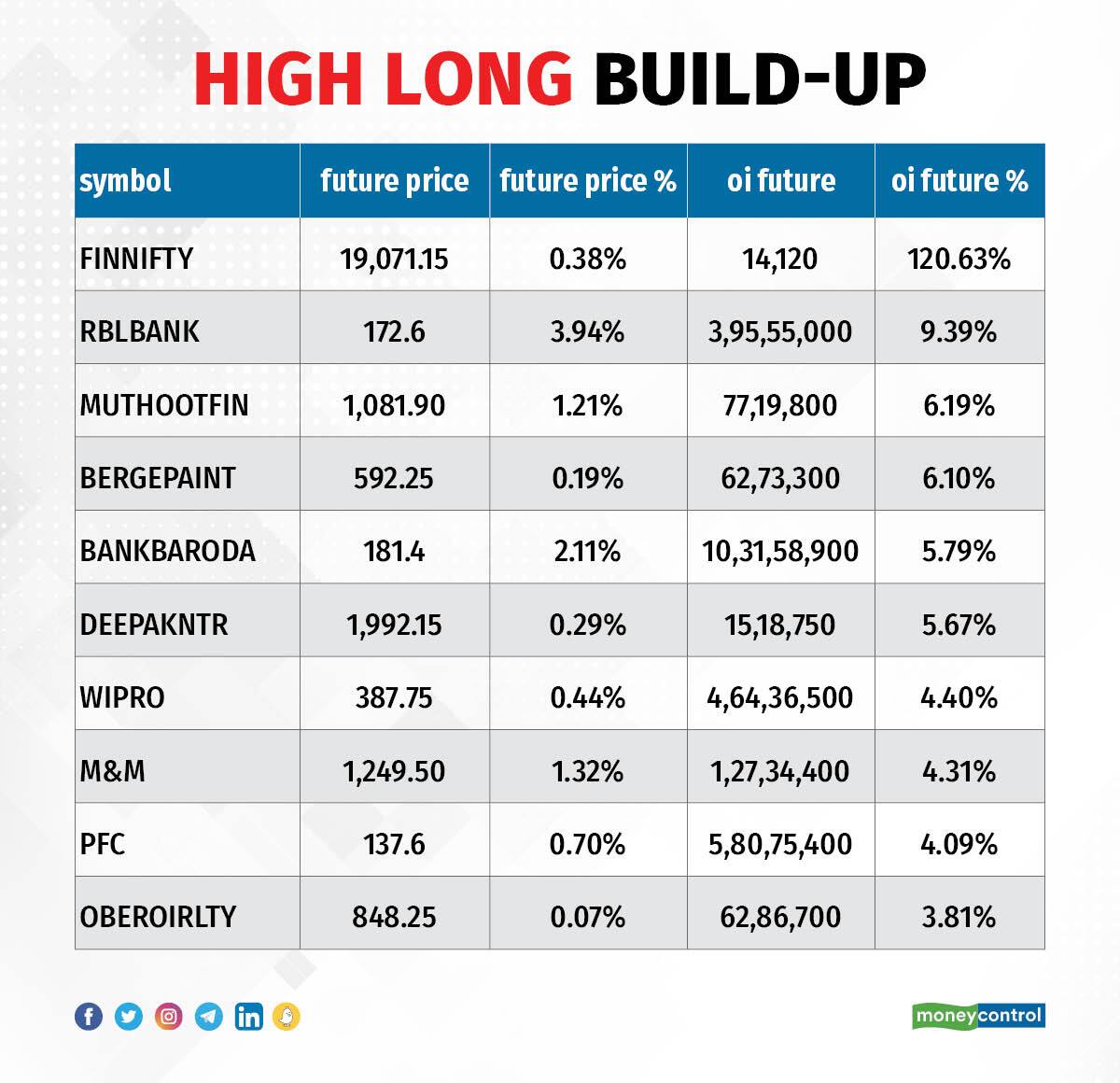

An increase in open interest, along with an increase in price, mostly indicates a build-up of long positions. Based on the open interest future percentage, a long build-up was seen in 27 stocks on Wednesday, including RBL Bank, Muthoot Finance, Berger Paints, Bank of Baroda, and Deepak Nitrite.

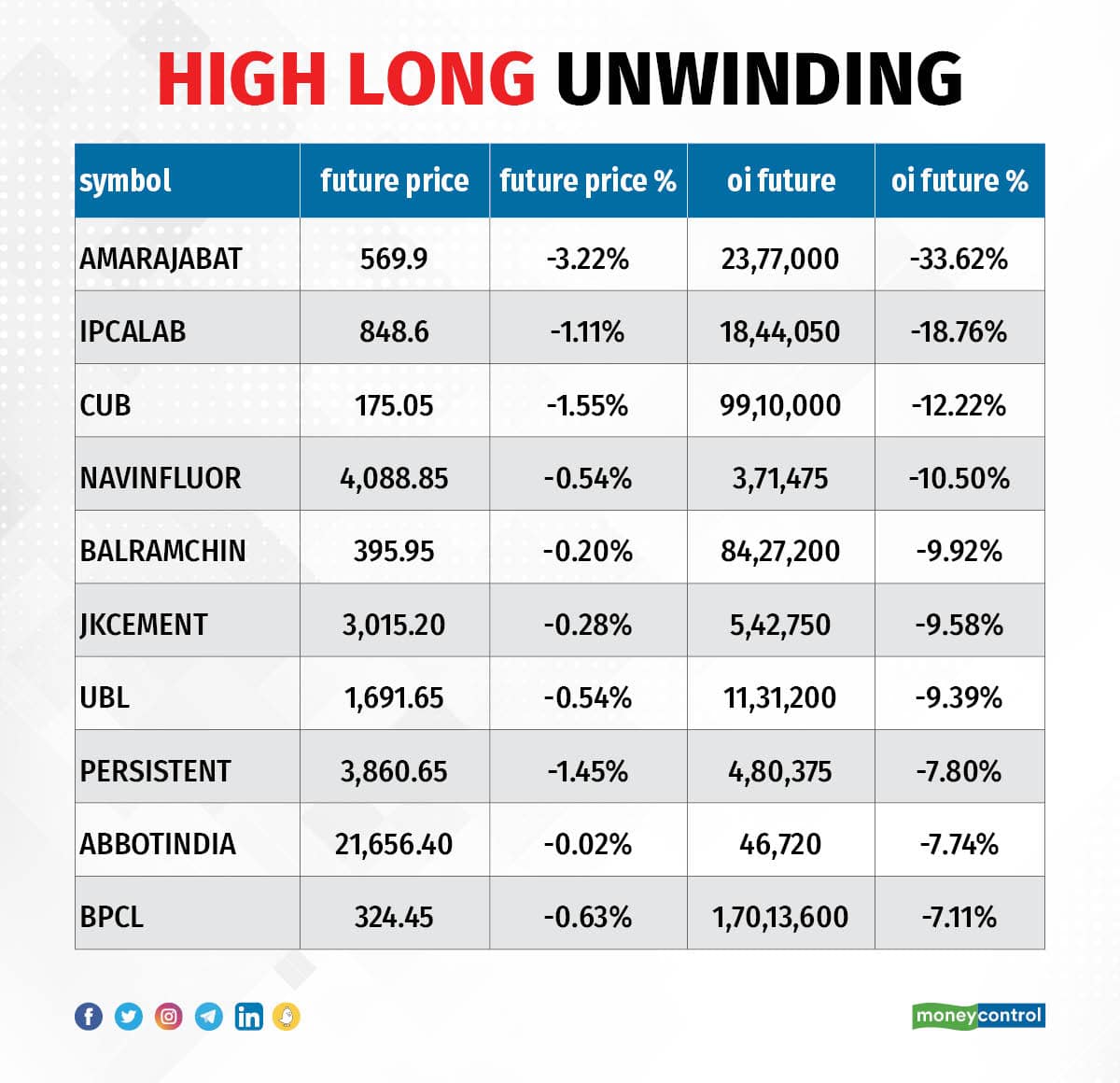

A decline in open interest, along with a decrease in price, mostly indicates a long unwinding. Based on the open interest future percentage, 81 stocks have seen long unwinding on Wednesday including Amara Raja Batteries, Ipca Laboratories, City Union Bank, Navin Fluorine International, and Balrampur Chini Mills.

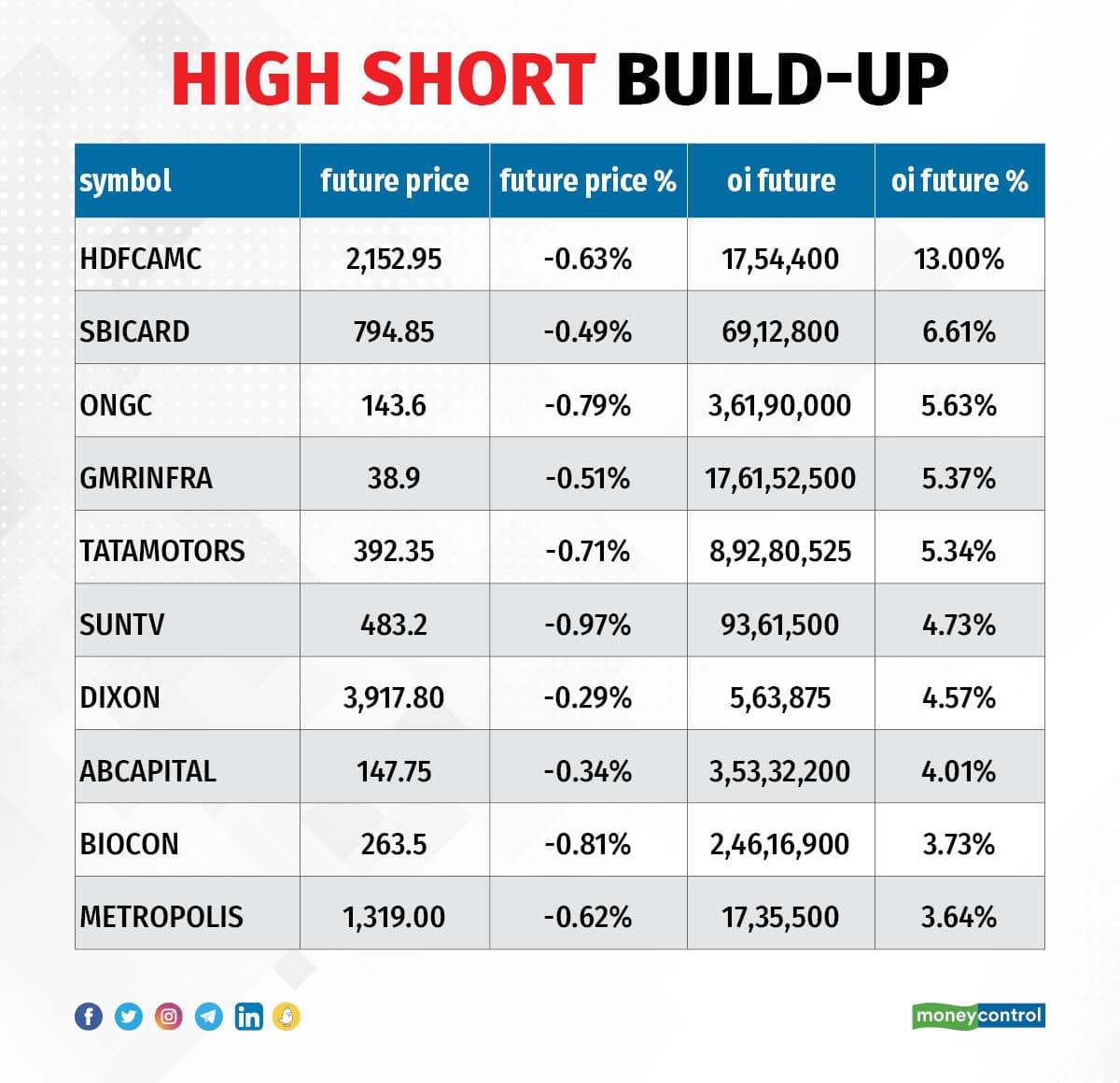

An increase in open interest, along with a decrease in price, mostly indicates a build-up of short positions. Based on the open interest future percentage, a short build-up was seen in 40 stocks on Wednesday including HDFC AMC, SBI Card, ONGC, GMR Infrastructure, and Tata Motors.

47 stocks witnessed short-covering

A decrease in open interest, along with an increase in price, mostly indicates a short-covering. Based on the open interest future percentage, we have 47 stocks on the short-covering list on Wednesday including Coforge, Punjab National Bank, Cummins India, GAIL India, and Dr Lal PathLabs.

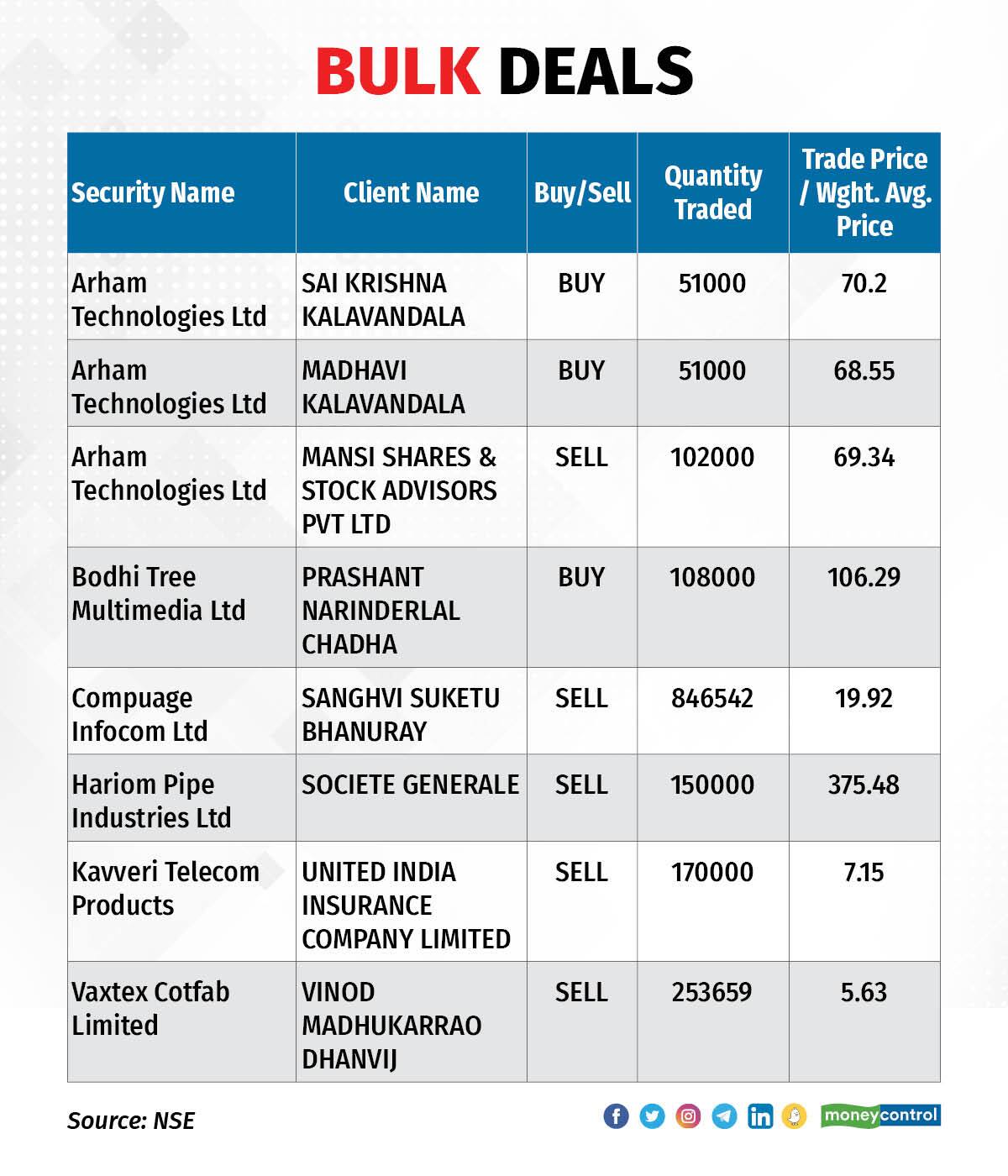

Hariom Pipe Industries: France-based financial services company Societe Generale sold 1.5 lakh shares or 0.58 percent stake in the company via open market transactions, at an average price of Rs 375.48 per share. Societe Generale had held 3.12 lakh shares or 1.23 percent stake in the company as of September 2022.

(For more bulk deals, click here)

Investors Meetings on December 29

Stocks in News

KFin Technologies: The financial services platform will make its debut on the BSE and NSE on December 29. The issue price has been fixed at Rs 366 per share.

Tata Power Company: Subsidiary Tata Power Renewable Energy has received a 'letter of award' to set up a 255MW hybrid power project (wind and solar) for Tata Power Delhi Distribution, in Karnataka. Tata Power Delhi Distribution is a joint venture of Tata Power and the Government of NCT of Delhi. The project will be commissioned within 24 months from the PPA execution date.

Ashoka Buildcon: The company has received three projects worth Rs 754.57 crore from Madhya Pradesh PoorvKshetra Vidyut Vitaran Company.

Garware Technical Fibres: The company closed its share buyback issue after buying 2.4 lakh shares at a price of Rs 3,750 per share through the tender offer process.

Bank of India: The public sector lender infused capital of Rs 1.13 crore in PSB Alliance as a part of strategic investment. With this, the bank raised its stake in PSB Alliance to 8.33 percent, from 7.14 percent earlier.

JSW Energy: The power company has completed the acquisition of Ind-Barath Energy (Utkal) via the corporate insolvency resolution process (CIRP) after the NCLT approved its resolution plan. Ind-Barath Energy (Utkal) is implementing a 700 MW (2 x 350 MW) thermal power plant at Jharsuguda, in Odisha.

Wipro: The IT services company has raised its stake in Encore Theme Technologies to 100 percent after completing the acquisition of the remaining 3.3 percent stake. Now Encore Theme has become a wholly-owned subsidiary of Wipro.

Spandana Sphoorty Financial: The company has approved the transfer of the stressed loan portfolio including written-off loans of Rs 323.08 crore outstanding as on September 2022 to an Asset Reconstruction Company pursuant to Swiss Challenge Method for Rs 95 crore.

Fund Flow

Foreign institutional investors (FIIs) have net-offloaded shares worth Rs 872.59 crore, while domestic institutional investors (DIIs) net-purchased shares worth Rs 372.87 crore on December 28, as per provisional data available on the NSE.

Stocks under F&O ban on NSE

The National Stock Exchange has retained Balrampur Chini Mills and Indiabulls Housing Finance under its F&O ban list for December 29, the monthly futures & options expiry day. Securities thus banned under the F&O segment include companies where derivative contracts have crossed 95 percent of the market-wide position limit.

Disclaimer: The views and investment tips expressed by investment experts on Moneycontrol.com are their own and not those of the website or its management. Moneycontrol.com advises users to check with certified experts before taking any investment decisions.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.