The benchmark indices finished the session 0.08 percent down on September 29, with market breadth slightly favouring bears. About 1,459 shares declined compared to 1,335 shares that gained on the NSE. The market is expected to see some consolidation in the upcoming sessions after the recent sharp downmove. Below are some short-term trading ideas to consider:

Jigar S Patel, Senior Manager - Equity Research at Anand Rathi

BSE | CMP: Rs 2,097.4

BSE has experienced a significant correction of around 33 percent from its peak, translating to roughly Rs 1,000. Currently, the stock is trading between the 50% and 61.8% retracement levels of its prior upward move, which coincides with its previous breakout zone, providing a potential support area.

On the daily chart, the RSI has formed a bullish divergence, indicating a possible slowdown in selling pressure and hinting at a potential bounce. This combination of technical support and momentum signals suggests that BSE may stabilize or witness a short-term recovery in the coming sessions. Traders may consider entering long positions in the Rs 2,100–2,050 zone.

Strategy: Buy

Target: Rs 2,345

Stop-Loss: Rs 1,940

Bank of Baroda | CMP: Rs 254

Bank of Baroda has established a strong base near its 50-period EMA on the weekly chart, providing a solid support foundation. Recently, it broke out from this consolidation, supported by decent trading volumes, indicating healthy buying interest. On the momentum front, the weekly RSI has broken above its falling trendline and is comfortably trading above 50, signaling strengthening bullish momentum.

Additionally, the MACD has generated a bullish crossover above the zero line, further confirming the positive trend. Together, these technical signals suggest that the stock is likely to continue its upside trajectory in the medium term. Traders may consider entering long positions in the Rs 254–248 zone.

Strategy: Buy

Target: Rs 275

Stop-Loss: Rs 237

MRPL | CMP: Rs 134.11

After a consolidation range between Rs 125 and Rs 132, Mangalore Refinery and Petrochemicals (MRPL) has broken out and is currently trading near the Rs 134 level on strong volumes, indicating robust buying interest. During the consolidation, the daily RSI remained around the 50 mark, reflecting equilibrium between buyers and sellers and preventing any significant weakness. This steady momentum, combined with the breakout on volume, reinforces the bullish case for the stock.

These technical signals suggest that MRPL is well-positioned for further upside movement in the coming sessions. Traders may consider entering long positions in the Rs 135–133 zone.

Strategy: Buy

Target: Rs 150

Stop-Loss: Rs 126

Jay Thakkar, Vice President & Head of Derivatives and Quant Research at ICICI Securities

Axis Bank | CMP: Rs 1,132.2

Axis Bank has outperformed the Nifty Private Sector Bank index in the short term. It bounced back sharply on the back of short covering; however, it didn’t surpass its previous swing high of Rs 1,256+ levels, and until that happens, the overall bias remains negative for the stock. The open interest in futures fell when the price recovered, indicating short covering.

The options data suggests that the Rs 1,200 strike has the highest Call base, and it looks unlikely that the stock will surpass this level in the short term. The stock has also fallen below its maximum pain level, which is negative in the near term. Sell Axis Bank October Futures in the range of Rs 1,150–1,130.

Strategy: Sell

Target: Rs 1,090, Rs 1,050

Stop-Loss: Rs 1,190

Larsen & Toubro | CMP: Rs 3,688.4

Larsen & Toubro (L&T) seems to be breaking out of a consolidating range with an increase in open interest in the futures segment, which indicates long build-up. Hence, the short-term outlook is positive. There is a significant Call base in the Rs 3,700–3,800 range, which may act as a hurdle; however, the Rs 3,600 and Rs 3,700 strikes have witnessed strong Put additions, which will act as support.

Hence, a continuation on the upside is likely, and traders can adopt a bullish strategy for the October series in L&T. Buy L&T October Futures in the range of Rs 3,700–3,740.

Strategy: Buy

Target: Rs 3,850, Rs 3,920

Stop-Loss: Rs 3,630

Tech Mahindra | CMP: Rs 1,410.7

Tech Mahindra has again witnessed a short build-up, as with the fall in price there has been an increase in open interest in futures, which is negative for the stock in the near term. The Nifty IT index overall looks bearish in the short to medium term; hence, it is unlikely that this stock will make a lifetime high or outperform the Nifty going forward.

The stock has a huge Call base at the Rs 1,500 strike, and until it closes above this level, the overall trend is likely to remain sideways to negative. The stock is also trading below its maximum pain level, which is also negative in the near term. Sell Tech Mahindra October Futures in the range of Rs 1,400–1,430.

Strategy: Sell

Target: Rs 1,330, Rs 1,280

Stop-Loss: Rs 1,465

Vidnyan S Sawant, Head of Research at GEPL Capital

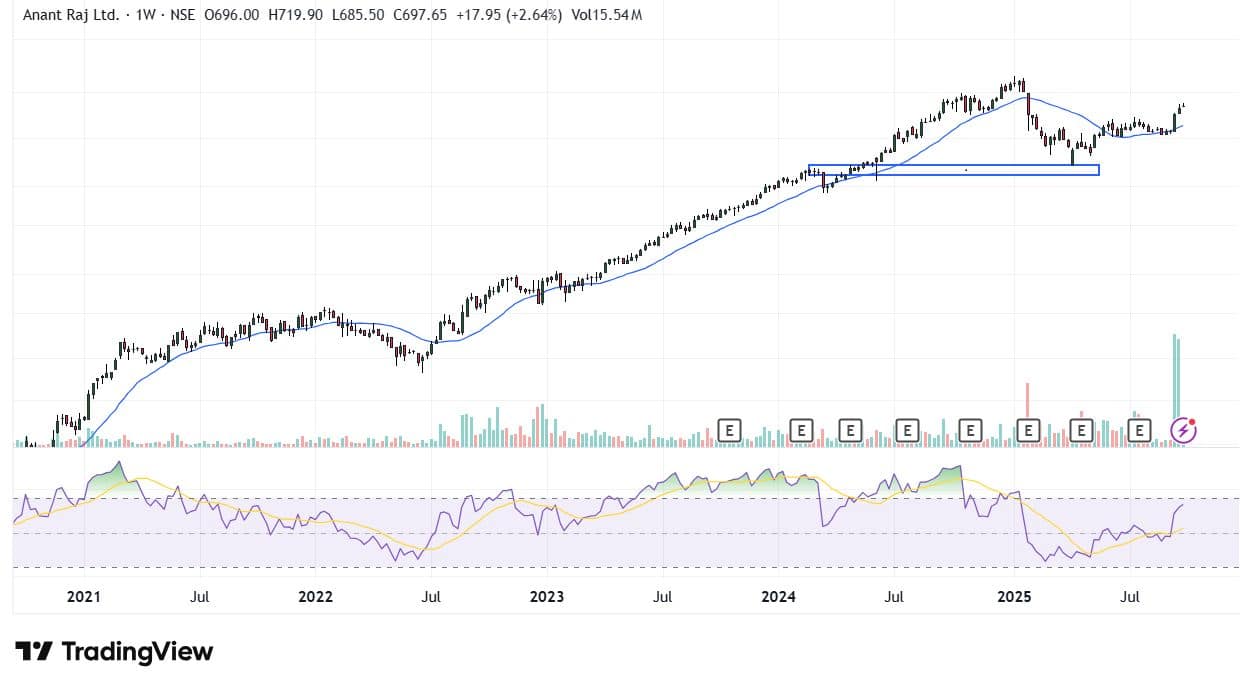

Anant Raj | CMP: Rs 699.15

Anant Raj hit a lifetime high of Rs 947 in January 2025 before correcting to Rs 376, where it formed a Change in Polarity (CIP) and resumed its bullish structure with higher highs and higher lows on the monthly chart. On the weekly scale, it has broken out of an Ascending Triangle, with a strong bullish candle engulfing eight weeks of action.

The stock has taken support at the 100-week EMA, reinforcing strength, while the RSI sustains above 60 with a bullish crossover, confirming positive momentum.

Strategy: Buy

Target: Rs 787

Stop-Loss: Rs 660

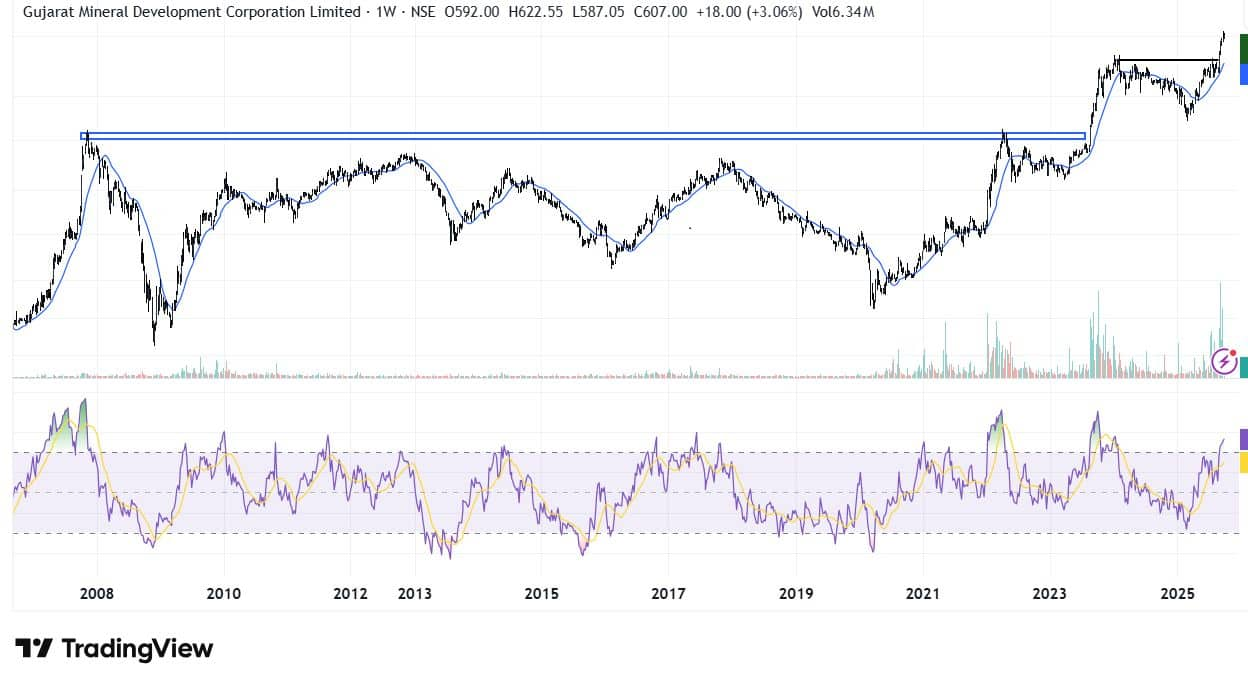

GMDC | CMP: Rs 602.9

Gujarat Mineral Development Corporation (GMDC) has been displaying a strong price structure since 2020, marked by consistent higher top and higher bottom formations. The stock has also surpassed its prolonged underperformance phase, which began in 2008, indicating readiness for an upward trajectory.

Momentum remains strong, with the RSI above 70, signaling acceleration. On the daily scale, the stock continues to trade firmly above its 20-DEMA, reflecting trend strength.

Strategy: Buy

Target: Rs 667

Stop-Loss: Rs 570

Usha Martin | CMP: Rs 476.5

Usha Martin has been in a broad rising trend and recently broke out of a 24-month consolidation phase, suggesting the stock is poised for an upward trajectory. The momentum indicator RSI is placed above 70, highlighting strengthening bullish momentum. On the daily scale, the stock continues to trade firmly above its 20- and 50-DEMA levels, confirming that it remains structurally well-positioned.

Strategy: Buy

Target: Rs 535

Stop-Loss: Rs 440

Hindustan Copper | CMP: Rs 319.45

In the prior week, Hindustan Copper broke above the June 2025 swing top, supported by a notable surge in volumes above its 20-week average, indicating robust structural development. The RSI has also gained momentum and is trending higher, confirming a sustained bullish undertone.

Strategy: Buy

Target: Rs 345

Stop-Loss: Rs 306

Disclaimer: The views and investment tips expressed by experts on Moneycontrol are their own and not those of the website or its management. Moneycontrol advises users to check with certified experts before taking any investment decisions.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.