India’s peak electricity demand is expected to soar to 230 gigawatts (GW) this April, and while the government goes hell-for-leather to ensure that demand is met and blackouts avoided, there is a missed opportunity in the role solar power could have played in helping meet this requirement.

Solar energy is the biggest contributor from the renewable energy (RE) portfolio. But while the country has made big strides in adding solar power capacity in the last decade, it has fallen short of the targets.

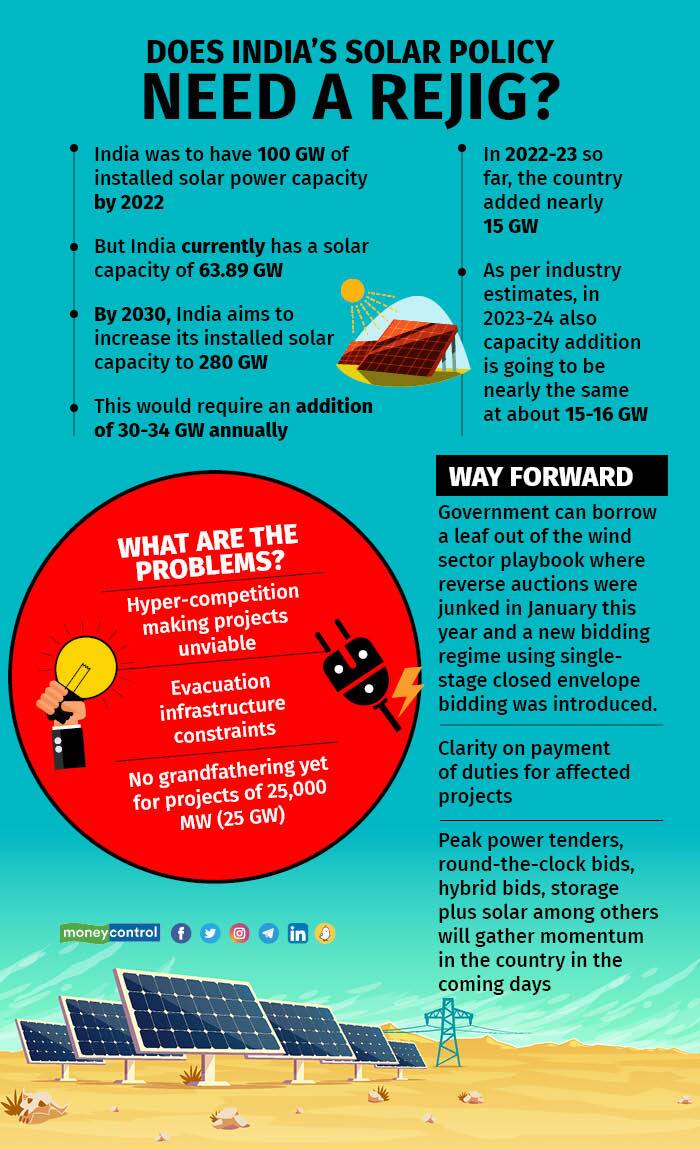

India missed its ambitious target of installing 100 GW of solar power capacity by 2022; it has managed only 64.38 GW so far.

Now it aims to increase the total installed solar capacity to at least 270 GW by 2030. For this to happen, the country needs to add 34 GW capacity every year. But in 2022-23 so far, the country has added only 15 GW.

Capacity addition in 2023-24 may also remain at the same lukewarm level, at about 15-16 GW, unless the government tweaks policies, industry players caution.

Missed opportunity

In April last year, when demand shot up to about 215 GW, solar power comprised as much as 18 percent of the electricity generated during the day. Had the country achieved its target of 100 GW of solar power by 2022, the contribution of solar power would have been substantially higher.

The steep increase in power demand last summer amid dwindling coal supplies forced the government to mandate generators to step up coal imports, pushing up the cost of electricity. Solar power would have been a cleaner way to fill the gap, at lower rates.

So why is the sunshine sector lagging behind targets?

Price wars making projects unviable

The most common factor cited by stakeholders is hyper-competition in the industry.

Pratik Agarwal, Director, Serentica Renewables, said competition is good, but hyper-competition in any sector can be counterproductive. “New entrants in the industry may sometimes take on projects at unviable costs, which later turn into NPAs (non-performing asset). This trend is visible in the solar industry, where the number of auctions has reduced visibly, leading to hyper competition, and the concluded auctions are still waiting for power purchase agreements (PPA),” he added.

Due to the extremely low margins, these projects are further delayed as developers are not able to manage the uncertainties around module prices. He said the government should ensure that projects are economically feasible at the costs they are being bid at.

“The government could consider setting a floor price for some of these bids and award projects based on technical parameters rather than purely financial ones,” Agarwal said.

To be sure, in a solar industry like India which boasts of a large number of solar power developers, competitive bidding is the only method that provides transparency in the appointment of competent and eligible power developers at the lowest tariffs.

According to Vish Iyer, Global Chief Commercial Officer, Jakson Green Private Limited, India has been witnessing an obsession with getting the auction prices to a level where the entire value chain struggles to remain afloat and suffers, especially in the balance-of-system (BOS) photo-voltaic (PV) set-up, which is 100 percent indigenous.

Leaving aside the PV modules, BOS includes inverters, switches, support racks, wiring, batteries / energy storage systems, insurance, labour, etc., and their costs.

“As a leading developer with EPC (engineering, procurement, and construction) contracts of over 1 GW in the country, we are witnessing this across the space. For instance, we see that though only a few quality EPCs service the utility-scale solar market, margins are poor and even top-quality EPCs are barely able to survive,” he added.

Checks and balances

Solar developers say it is how the competitive bidding process is conducted that poses a challenge, and that it is time for the government to introduce more nuanced systems to accelerate the pace of growth.

Arun Kumar, Partner, Energy and Infrastructure, Induslaw, said there has been consistent failure on the part of the bidding authorities to take into consideration the ground realities before setting the terms and conditions for submitting bids.

Pranav Master, Director, CRISIL Market Intelligence and Analytics, and several industry stakeholders, have urged the government to borrow a leaf out of the wind sector playbook, where reverse auctions were junked in January this year and a new bidding regime using single-stage closed-envelope bidding was introduced.

“Moreover, a long-term monthly calendar of potential tenders could also be implemented. This would provide adequate visibility to developers who can avoid outbidding each other to scale the portfolio,” he said.

Sharad Pungalia, Managing Director and CEO, Amplus Solar, said solar projects with aggressive futuristic bets on module prices, financing costs, and so on are highly vulnerable as even a little deviation makes them financially unviable, which in turn, delays project implementation. He said the government should take stringent action against defaulting bidders as “it could bring some sanity in the overall bidding climate.”

While the Ministry of New and Renewable Energy (MNRE) did not comment on the matter, a senior MNRE official pointed at the “one-of-a-kind order” issued by the ministry last month, per which the government will blacklist companies that delay the completion of renewable projects.

Kumar said that in a market like India, where there are a large number of solar power developers and a massive demand for the development and consumption of power, competitive bidding processes work the best.

“However, a major overhaul is required to align the competitive bidding process with new technologies which are available in the market. Widespread consultation between regulators, bidding authorities, power developers, and other stakeholders is required so that practical issues in the bidding process are highlighted and addressed,” he said.

Evacuation infrastructure

A leading Gurgaon-based company that works on renewable projects said evacuation constraints are turning out to be a major bottleneck in the addition of more solar projects.

Power evacuation is the system of transmitting generated power immediately from a generating plant to the grid for further transmission or distribution.

“Developers face evacuation constraints due to the mismatch of transmission infrastructure readiness vis-a-vis timelines given for RE projects. Also, states such as Rajasthan and Madhya Pradesh levy additional charges for the export of electricity from their states to others. Further, RE projects require vast land, which is difficult to acquire. Different states have different policies related to land acquisition, which makes it difficult for developers, and this also affects the setting up of evacuation infrastructure,” said a senior company official requesting anonymity.

Subrahmanyam Pulipaka, CEO, National Solar Energy Federation of India (NSEFI) said that over the next couple of years, accelerating the pace of solar projects implementation will depend on two things — availability of evacuation infrastructure, and relief for projects stuck due to the imposition of the basic customs duty (BCD).

No grandfathering

Pulipaka said that as on date nearly 60 GW of solar projects are in the pipeline, of which 25 GW (41 percent) are still stuck due to the absence of grandfathering. This is despite the government extending the completion deadline for the affected projects.

On March 9, 2021, the Centre announced that from April 1, 2022, any import of solar PV modules would attract a basic customs duty (BCD) of 40 percent and import of solar PV cells would attract a BCD of 25 percent.

Several projects for which bids were finalised before march 9, 2021, which would normally have been completed before the imposition of the duty, got delayed because of Covid and the resultant supply chain disruptions. In January this year, the government gave them an extension for completion by March 2024.

“But, there is still no word on grandfathering of these projects. As a result, these projects will have to pay this additional custom duty if the imports fall under this period, and the project cost will increase,” Pulipaka explained.

“They cannot pay BCD because it will make their tariff unviable, and in any case, they had bid for the projects before the BCD was imposed. Discoms are not agreeing to pay higher tariffs, which is why the developers cannot install the projects, and they become unviable,” he said.

Besides, in October last year, the finance ministry shut the project import route used by solar project developers to circumvent the BCD on solar modules and cells and pay lower duties.

The project imports scheme was meant to facilitate the import of equipment for setting up or expanding a unit. A concessional duty of 7.5 percent was applicable on such imports.

Iyer from Jakson Green said: “The solar sector is already finding it tough to meet the 2030 targets as it faces headwinds from policy paralysis on the solar module side. Besides, a plethora of grid norms being introduced by the Central Electricity Authority (CEA) and other interested parties are also increasing project costs for developers.”

New form of bids

Industry experts say that going forward the intensity of vanilla bids will decrease and instead there will be more tenders for green power sources that ensure round-the-clock electricity.

Tenders for peak power, round-the-clock power, hybrid power, storage-plus-solar power, among others, will gather momentum in the coming days.

“States and discoms have now understood the value of firm, dispatchable power. They have also understood that renewables with storage, or hybrid models, are the way out. For the first time, Maharashtra State Electricity Distribution Co. Ltd (MSEDCL) floated a peak power tender. This, in all likelihood, is going to be the future of bids,” said Pulipaka.

He added that the March 10 order exempting ongoing solar projects from the mandatory rule of procuring PV modules from the Approved List of Models and Manufacturers (ALMM) will benefit the commercial and industrial (C&I) sector the most, as the maximum number new solar projects are going to come up in this sector.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.