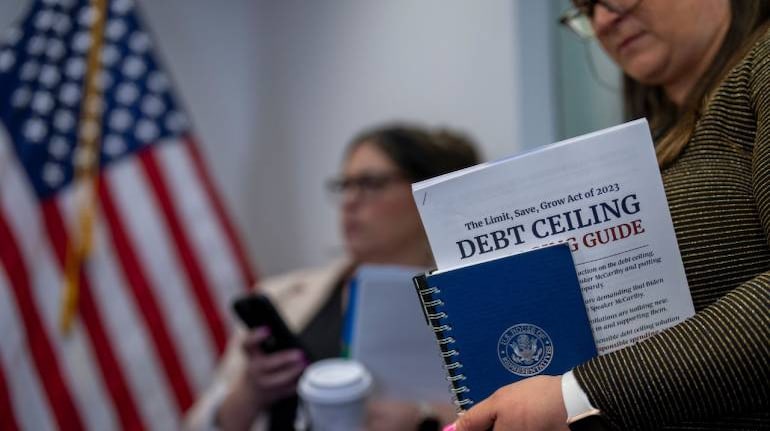

As the high drama over the debt ceiling is over, markets should react positively as the risk of the US government defaulting on its payments has subsided. The medium-term impact of this move will cause the US dollar and US bonds to rise once again, according to Ritesh Jain of Pine Tree Macros.

This is because the US government remains short on tax receipts. Since taxes are a function of higher markets and higher nominal GDP, and both US markets and GDP are flat this year, the US government will need to build its cash chest. “Janet Yellen is going to start restocking cash balances, from currency $50 billion to possibly $600-700 billion over the next three months,” Jain explained.

Also read: Debt deal adds brake on US economy already at risk of recession

The US government has not issued any new bonds on a net basis for the past five months after it hit its debt ceiling on January 17. On the contrary, it has spent almost $500 billion from the US treasury's cash balances outside the banking system.

“Thus, US treasury supply will accelerate sharply in short order, much larger than we have previously seen,” Jain said. “This will have to compete with lending to the Fed overnight facility which is at 5 percent as banks have the option of parking cash with the Fed on an overnight basis,” he added.

Also read: Banking is slowly getting narrower — and better

Jain believes this will also crowd out private-sector borrowing and lead to widening spreads for high-yield bonds and emerging market bonds. “As more borrowing starts hitting the market it should lead to higher USD and higher USD bonds,” he said.

The near-term, however, remains positive across asset classes, as the market is relieved about the fact that US default risk is behind.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.