International payments made using your credit cards overseas will not attract 20 percent tax collected at source (TCS) for now, the finance ministry has said in a recent notification, rescinding its May circular that brought credit cards under the liberalised remittance scheme (LRS).

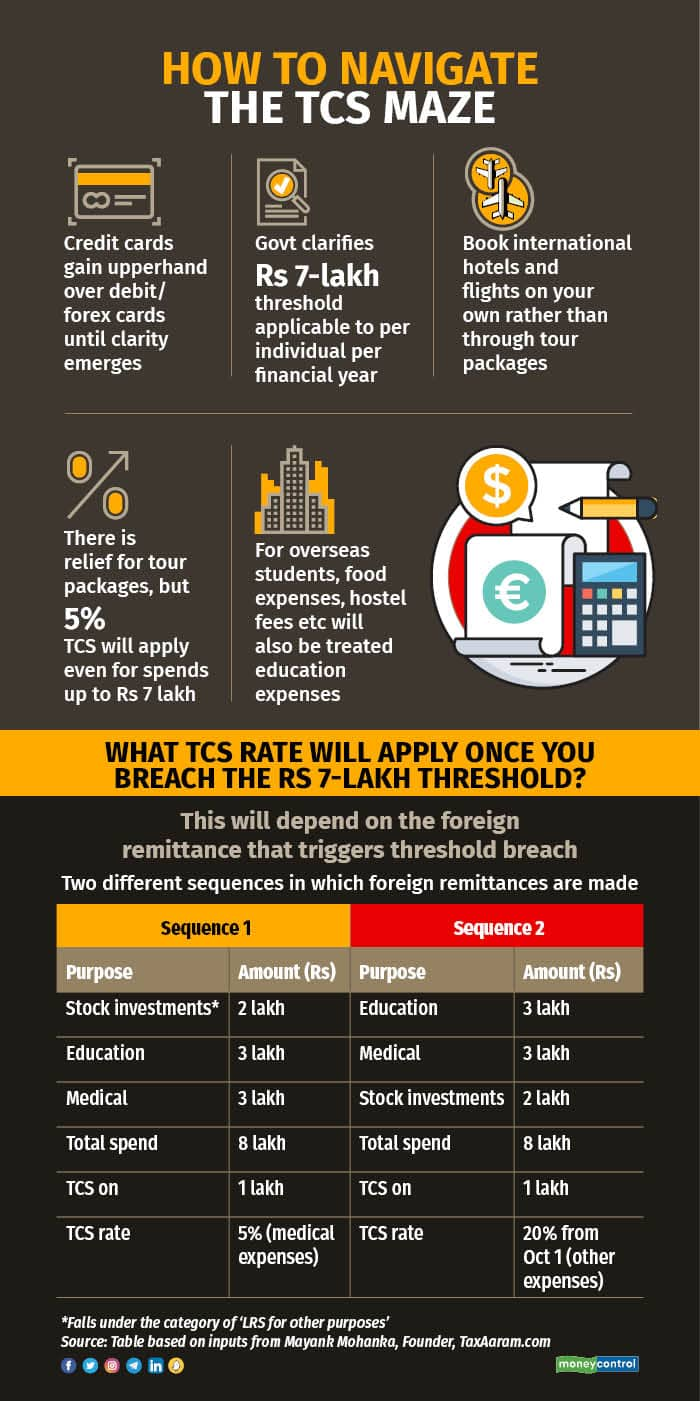

The government notification also clarifies that international remittances or payments (all put together) of up to Rs 7 lakh per financial year per individual will not attract any TCS ― up until September 30 and even afterwards. Bookings of overseas tour packages have a separate Rs 7 lakh threshold ― 5 percent TCS for spends up to Rs 7 lakh and 20 percent thereafter from October 1. This is irrespective of the mode of payment used.

Earlier, a higher TCS rate of 20 percent, up from the current 5 percent, was to come into effect from July 1, 2023. This was introduced in Budget 2023. This will now be implemented from October 1. (see table for details)

The government has also provided some relief to those using foreign currency and forex cards on their foreign trips by bringing all modes of payment under the TCS exemption threshold of Rs 7 lakh.

Ankur Mittal, Co-Founder, Cardinsider, a credit card comparison website, says, In the case of credit cards, it is clear that they will not be subject to TCS until the banks are ready with the necessary infrastructure. So, October 1, 2023, is not relevant for credit cards at the moment."

Multiple credit cards

There has been much confusion and uproar since the government brought international credit card payments when outside India under TCS from May 16. First to start with, all such international credit card transactions were brought under the TCS net. Then, on May 19, the government introduced a per year threshold of Rs 7 lakh – TCS would apply only beyond this limit. Now, this has been postponed till the requisite infrastructure is in place to keep a tab on such spends.

Since the threshold was introduced, speculation has been rife that people might use their credit cards with different banks to get around this limit. Banking and taxation experts that Moneycontrol had spoken with then had evinced mixed views on whether this limit would apply at the level of each bank or permanent account number (PAN). This has now been put to rest.

"The government press release has clarified that the exemption threshold limit of Rs 7 lakh is applicable per individual remitter and not per authorised dealer or per usage or per mode of remittance," says Mayank Mohanka, Founder, TaxAaram.com and Managing Partner, S M Mohanka & Associates. TaxAaram.com is an e-interface solution for all income tax planning and compliance.

Clarity on TCS exemption threshold

Commenting on the June 28 announcement, Mohanka says, "The restoration of the exemption threshold limit of Rs 7 lakh for TCS on all categories of LRS payments, through all modes of payment, regardless of their purpose, is a very positive move. It removes the undesirable differential treatment for different purposes and modes of payment of LRS remittances."

According to Mohanka, the limit of Rs 7 lakh per individual per annum will apply on a collective basis for all LRS remittances of an individual taken together in a year and not separately for each purpose.

Note that, the TCS rate applicable on remittances for education abroad, medical treatment, and other purposes beyond the Rs 7 lakh exemption threshold are not the same. So, what TCS rate will apply once this threshold is crossed? Mohanka says, "The purpose of the LRS remittance that results in the crossing of the Rs 7-lakh threshold will govern the applicable TCS rate on such remittance." (see table for an example)

He explains that the First In, First Out (FIFO) method will be applicable for determining the applicable TCS rate. So, if a person has to make LRS remittances for foreign education, medical treatment abroad, and investment in foreign stocks, then it is advised that he first spend towards investment in foreign stocks, and then towards medical treatment and education abroad, to avoid the higher TCS rate of 20 percent on investments in foreign stocks being levied.

Relief on overseas tour packages

Those buying overseas tour packages, especially budget travellers, also have reason to cheer. Currently, when you buy an overseas tour package, the tour operator collects 5 percent TCS, irrespective of the package amount. This was to be hiked to 20 percent from July 1.

Now, the Finance Ministry press release has offered relief to those going for overseas tour packages, especially budget travellers. One, the 20 percent TCS will kick in only on October 1 and, more importantly, only on spends exceeding Rs 7 lakh per year. For those spending up to Rs 7 lakh per year, the TCS rate will continue to be 5 percent.

What’s important to note is that overseas tour packages have a separate Rs 7-lakh threshold limit for lower TCS of 5 percent. "From the perspective of TCS applicability, the thresholds for overseas tour packages and other LRS transactions have to be seen separately. This has always been the case. Though, the Rs 7-lakh threshold for overseas tour packages is not relevant until October 1, the 5 percent TCS rate is applicable irrespective of the quantum spent," says Parizad Sirwalla, Partner and Head, Global Mobility Services, Tax, KPMG India.

Mohanka offers a similar view. He says, "It appears from the language of the government press release that the threshold limit of Rs 7 lakh will apply separately for availing the benefit of a reduced TCS rate of 5 percent in the case of overseas tour packages. This is not required to be clubbed together with LRS remittances."

Forex cards versus credit cards

If you have been planning to use a forex card instead of a credit card on your next foreign trip, then again, you have reason to be relieved.

On May 19, when the government announced the TCS exemption threshold of Rs 7 lakh for international debit and credit card transactions, it was silent on any such threshold for foreign currency and forex cards. This had put foreign currency and forex card users at a big disadvantage compared to those using debit and credit cards for international travel. Now, the June 28 notification makes it clear that the TCS exemption threshold of Rs 7 lakh applies to all transactions, irrespective of the mode of payment. That is, even the use of foreign currency and forex cards, or, for that matter, any other mode of payment, will fall under this overall limit.

Having said that, credit card users will still have the upper hand. As of now, international spends on credit cards when present outside India have been kept out of the LRS and, therefore, the TCS.

Thanks to the government’s recent notification, those travelling abroad can now continue to use their credit cards for international transactions. "For now, it is clear that you should use credit cards rather than other modes of payment for travel abroad. Also, instead of choosing an overseas tour package, you can book international hotels and flights using your credit card to avoid TCS. Even after September 30, 5 percent TCS will apply on overseas tour package purchases of up to Rs 7 lakh. Beyond this limit, TCS will be 20 percent," says Sumanta Mandal, founder of TechnoFino, a platform that reviews debit and credit cards.

Also read: TDS, TCS aren’t money lost forever, you can adjust or claim it back

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.