After piling up shares of Zomato in July, mutual fund managers’ opinion was divided on the stock in August. Nonetheless, mutual funds bought over 11 crore shares of the company during the month.

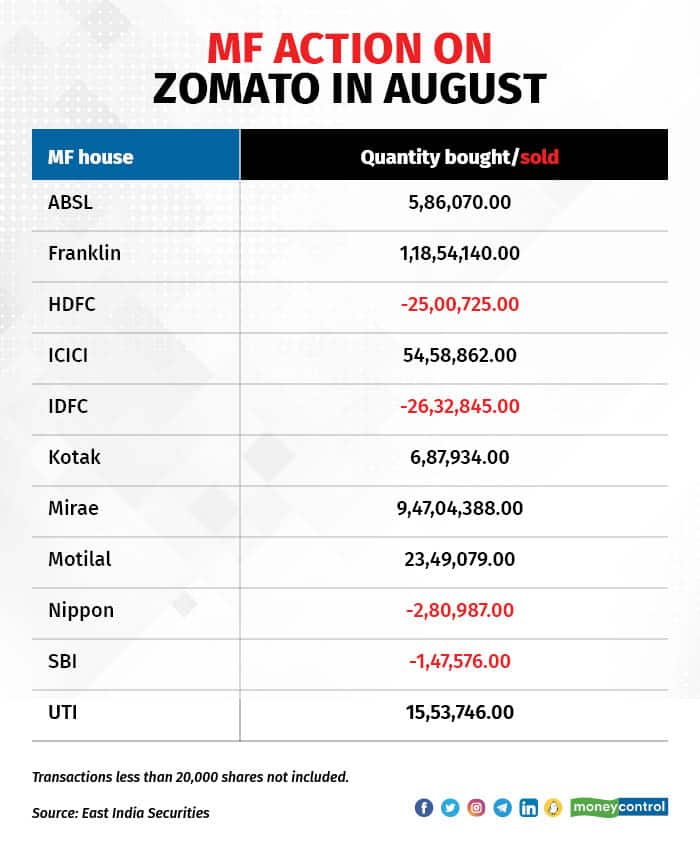

Out of 20 fund houses that transacted Zomato shares, 12 were net sellers while the rest were buyers. However, they net bought over 11 crore shares - thanks to the two mutual fund houses that bought the stock in bulk.

Mirae Asset was the biggest buyer gobbling up 9.47 crore shares of the company. Franklin Templeton followed by adding over 1.18 crore shares of Zomato to its portfolio. Among other big buyers were ICICI Prudential Mutual Fund, Motilal Oswal Mutual Fund and UTI Mutual Fund, data compiled by East India Securities showed.

The bullishness on the company shown by these fund houses is thanks to an improved outlook for its business as the company has seen a rise in revenue. Its food delivery business – Zomato’s mainstay – also turned break-even on Ebitda level.

Analysts have also shown their willingness to recommend the stock to their clients. Some – including Kotak Securities and Jefferies – have even upgraded the stock target price in recent months.

“We increase our average order value (AOV) assumptions for FY23-25 and beyond as we recognize that the impact of lower proportion of family orders post-Covid has been completely offset by food inflation and propensity to order from better quality restaurants by top cohorts,” said Garima Mishra of Kotak Securities.

Similar opinions have been expressed by other analysts.

Thanks to the prevailing bullish sentiment, the stock prices have also zoomed significantly. From the all time lows of Rs 41, the stock now trades at 66 – a jump of 66 percent since mid-July.

Dalal & Barocha has a target of Rs 79 on the stock. Jefferies sees the stock at Rs 100 and Kotak Securities at Rs 85.

However, as stated earlier, a majority of money managers have chosen to book profits – at least partially – rather than stay with their investments. HDFC Mutual Fund, IDFC Mutual Fund, Nippon Mutual Fund and SBI Mutual Fund were those that sold more than a lakh shares each.

It shows not everyone on the Street agrees with the bullishness. Moreover, one should not forget, the stock is still much lower than its all time high price of Rs 169 - meaning many investors including those at mutual fund houses are still sitting on losses. So, such a sharp recovery in stock prices presents them an opportunity to cut down their losses.

Please note that some of the mutual fund buying or selling could be due to adjustment of weightage, especially in passive funds.

Disclaimer: The views and investment tips expressed by investment experts on Moneycontrol.com are their own and not those of the website or its management. Moneycontrol.com advises users to check with certified experts before taking any investment decisions.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.