Who will be hit the hardest by the Reserve Bank of India’s (RBI) decision to withdraw the Rs 2,000 note from circulation? As Moneycontrol highlighted in an earlier piece, the move is unlikely to hurt the common public in a big way.

To start with, the Rs 2,000 note is not a big part of the currency in circulation — both by value and volume. According to RBI data, the value of Rs 2,000 notes in circulation came down to 10.8 percent of the total currency as on March 31, 2023 from around 37.3 percent around five years ago.

The value of the Rs 2,000 notes in circulation has declined from Rs 6.73 lakh crore at their peak on March 31, 2018 to Rs 3.62 lakh crore on March 31, 2023.

Even by volume, from around 274 crore, or 2.4 percent of the total currency in circulation, in March 2020, Rs 2,000 notes were now down to 214 crore, or 1.6 percent, at the end of March 2022, the latest data shows.

The RBI, too, said that the Rs 2,000 note, the highest currency denomination note in the country, was not being used much for transactions. So, it is unlikely that average customers will feel the heat beyond the need to visit to a bank branch to deposit or exchange the Rs 2,000 notes in their possession.

But not so for the tax cheats

The RBI move, however, is bad news for those hoarding crores worth of Rs 2,000 notes. Any high-value deposit in a bank will expose them to the tax department and probably punitive action as well. This could also be one of the reasons for the RBI’s note decision.

Both government and RBI have a good reason to pull out the Rs 2,000 note, a favourite of black-money holders since its launch on November 8, 2016. Since then, Rs 2,000 notes have constituted a major chunk of the black money seized by the income-tax (IT) department during searches and raids.

In November 2019, Finance Minister Nirmala Sitharaman told Parliament that 43.22 percent of unaccounted cash seized in the financial year 2020 was in the form of Rs 2,000 notes. In the financial year 2018, the Rs 2,000 note made up 67.91 percent of unaccounted cash, while the figure was 65.93 percent for FY19.

Why do tax cheats love Rs 2,000 note?

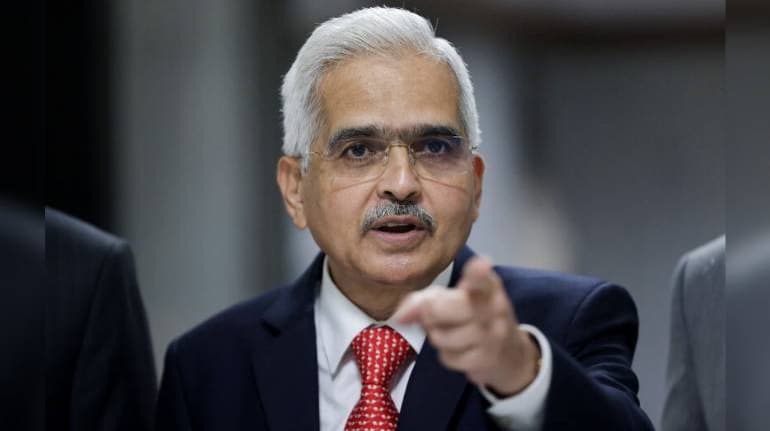

It is easy for black-money hoarders to stash Rs 2,000 notes, which make smaller bundles compared to lower denomination bills. Stocking requires less space, is convenient to handle and easy to move. For this reason, the Rs 2,000 note has been a big worry for the I-T authorities. With the latest move under governor Shaktikanta Das, Mint Street has addressed that problem to an extent.

Yet, the challenge to track down tax cheats remains. Those hoarding crores may do a repeat of 2016 when many used scores of bank accounts of friends and relatives to deposit unaccounted-for cash and managed to dodge tax officials looking at high-value deposits.

So, a demonetisation redux for tax cheats and tax officials? There is a possibility that unaccounted-for cash (money on which tax has not been paid) will find its way back into the system in small doses through bank accounts.

Even if that happens, the withdrawal of the Rs 2000 note will be a win-win for the government and the RBI. This should also significantly help the I-T department to curb the menace of black money.

With Rs 2,000 out of circulation, storing unaccounted cash will get tougher. To intensify the fight against black money, the government will have to focus on printing more lower denomination notes and limit the availability of high-value currency.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.