Call it a case of bad timing for Indian stock bulls. Donald Trump has dealt two fresh blows to investor sentiment just as the market was showing signs of a turnaround.

The MSCI India Index has fallen in all five sessions since the US President signed an order to overhaul the H-1B visa program — a move that risks disrupting India’s $280 billion software services industry. His plan to impose a 100% duty on branded or patented pharmaceuticals saw Indian drugmakers join an Asia-wide selloff on Friday.

Prior to these shocks, the MSCI India gauge had risen for three straight weeks, adding more than 4% in what was its longest run since May.

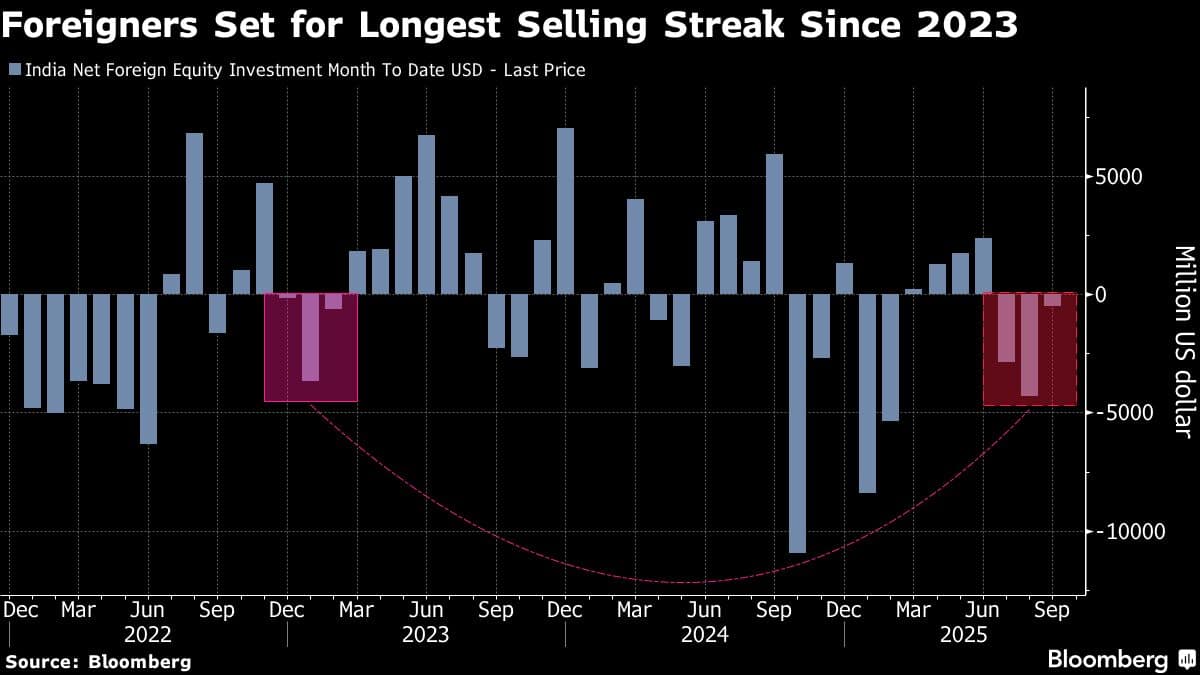

Trump’s latest salvos have also shaken foreign investors, who seemed to be finally putting in their stride the punishing 50% US tariffs on India that have soured relations between the two nations. Global funds turned sellers of Indian shares in recent sessions following two weeks of purchases.

“Escalating US–India tensions add another layer of pressure,” said Jian Shi Cortesi, a fund manager at GAM Investment Management in Zurich. “The related headlines provide investors with an additional nudge to reallocate away from India toward markets displaying stronger momentum, such as China and South Korea.”

Constrained by a slowdown in economic growth as well as the pace of corporate earnings expansion, Indian stocks have struggled to keep their momentum in 2025 after rallying for six straight years. The MSCI India gauge has risen around 2% this year, trailing a broader gauge of Asian equities by over 19 percentage points after outperforming it over 2021-2024.

Expectations Reset

Investors were pinning hopes on a year-end rally in stocks, buoyed by Prime Minister Narendra Modi’s move earlier to lower nationwide consumption tax — which took effect on Sept. 22, the central bank’s continued focus on growth, and bets that the resumption of trade negotiations with the US will lead to a positive outcome.

Those expectations are being reviewed following Trump’s latest actions.

The MSCI India gauge’s about 3% decline this week was its biggest since February. A measure of IT stocks lost 7.9% over five sessions, the most since April. The tech sector commands a near-10% weighting on the MSCI gauge — the third-highest.

Indians have made up more than 70% of the H-1B visas in the past. Economists have warned that the visa changes risk cutting remittance inflows, and could weaken the local currency, already among Asia’s worst performers. The rupee slid to a record low on Tuesday amid worries that India’s services exports could suffer alongside its tariff-hit merchandise exports.

An index of drugmakers lost over 2% on Friday to register its worst daily performance since early August following Trump’s latest tariff salvo.

“The underperformance of Indian asset prices looks set to continue,” Gavekal Research’s analysts Udith Sikand and Tom Miller wrote in a note. “The longer the 50% tariffs remain in place, the more likely it is that India’s economic growth disappoints.”

Foreign funds have sold Indian stocks worth around $16 billion on a net basis in 2025. That’s on track to be the second-biggest ever outflow following a record $17 billion withdrawal in 2022. The market’s performance would have been much worse this year, if not for the strong equity purchases by local institutions.

‘Quiet Corner’

Some market watchers, such as strategists at HSBC Holdings Plc, are more optimistic. A team led by Herald van der Linde this week upgraded their stance on Indian stocks to overweight from neutral.

“In stark contrast to the crowded trades in Korea and Taiwan, India is Asia’s quiet corner,” they wrote. “While earnings growth expectations can fall a little further, valuations are no longer a concern, government policy is becoming a positive factor for equities, and most foreign funds are lightly positioned.”

The MSCI India gauge is trading at 21.8 times its 12-month forward earnings, down from a multiple of 24.5 a year ago, according to data compiled by Bloomberg.

Overall, investors agree that the near-term outlook for Indian equities, particularly in terms of foreign flows, will continue to be determined by geopolitics. Allspring Global Investments is among those adding exposure to domestically driven sectors such as consumer and financials, which are less vulnerable to Trump’s America First agenda.

Hedging costs for Indian equities also climbed this week for the first time in a month. A gauge of 30-day ahead volatility on the National Stock Exchange of India Ltd. closed above its 50-day moving average Friday, suggesting traders are bracing for heightened market volatility.

Gary Dugan, chief executive officer of the Global CIO Office, said he would shift portfolios toward China and potentially to Latin America if geopolitical tensions with the US spiral.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.