Highlights:-

- Trent reported good numbers in Q1 FY20

- Healthy same-store sales growth is a key strength

- Store additions are underway in Westside and Zudio

- Consumption slowdown is a key risk - The stock may be bought on corrections

--------------------------------------------------

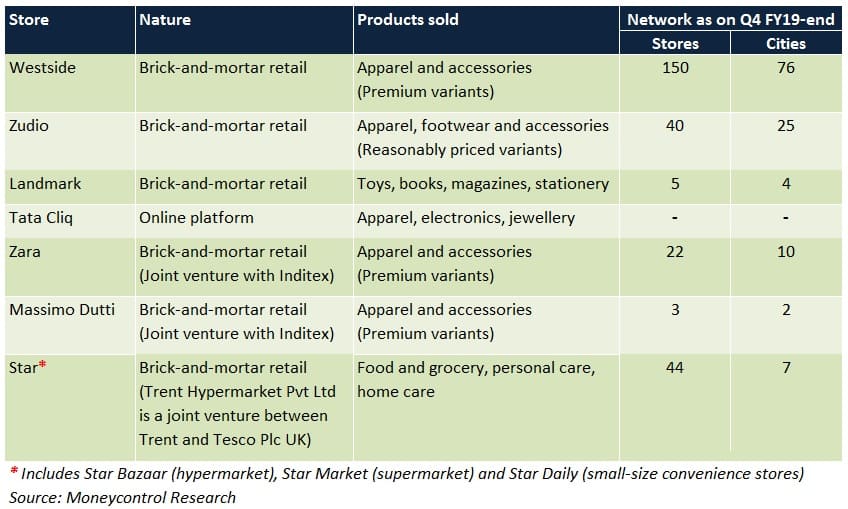

Trent, the retail vertical of the Tata conglomerate, is one of India’s leading multi-category retailers. Though the company’s earnings visibility remains on track, its elevated valuations restrict upside.

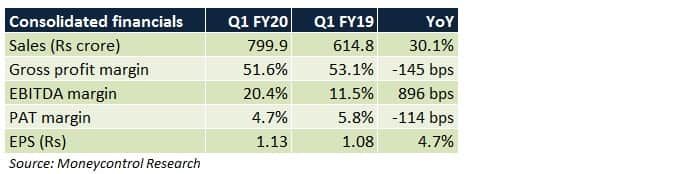

Q1 FY20 review

Trent reported a decent revenue traction on the back of store additions (under Westside and Zudio) and same-store sales growth of 12 percent year-on-year (YoY).

The nominal decline in gross margins was due to discounting and higher share of revenue from Zudio outlets, which have a lower margin profile compared to Westside.

EBITDA and PAT margins are not strictly comparable due to the implementation of Ind-AS 116. As per the accounting standard, lease rentals would not be a part of operating expenses. Instead, it will be bifurcated between depreciation and interest, consequently resulting in both line items increasing sharply YoY.

Why consider the company?

Same-store sales growth (SSSG)

SSSG represents the rate at which sales have grown from the stores that existed during the same quarter in the previous financial year. Westside stores, the flagship format of Trent, have been able to deliver SSSG of 5-10 percent every quarter.

In the context of retail, SSSG becomes particularly important because it indicates the following:-

- Conversion-to-footfall ratios are good

- The brand's recall is robust

- Even if a few new stores are added in a fiscal year, the company can still deliver healthy sales growth

- The company is capable of sweating/utilising its existing fixed assets effectively. The higher asset turns (calculated as sales divided by fixed assets) help derive better margins.

Value fashion

Given that India's population is predominantly price-sensitive, Trent is foraying actively in this space through its Zudio outlets. Since products will be competitively priced, sales growth from this vertical would be largely volume driven.

Store additions

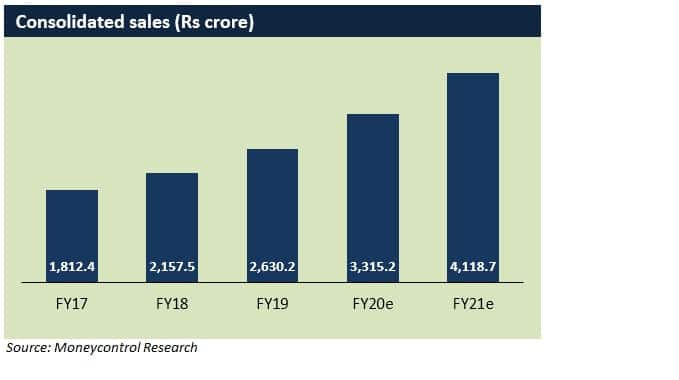

In every financial year, on an average, the management plans to open around 30-40/80-100 new stores under its Westside/Zudio formats, respectively. While Westside stores remain Trent's forte, Zudio is a space that the management is particularly bullish on. Capital infusion of Rs 950 crore by the promoters will play a crucial role in funding capex requirements for the new outlets.

While Westside stores cater to the premium category, Zudio, being an aspirational customer-centric brand, will appeal to a much larger target audience in smaller towns.

Private labels

Private labels make up for nearly 90-95 percent of Westside sales. For most part of a fiscal year, Westside products are not discounted. These two factors, coupled with Westside’s SSSG trajectory, should continue to give the company’s margins a fillip.

Zara

Being a well-recognised brand with a strong appeal, Zara garners a good response all year round. Since apparel is priced at a premium and conversions (the possibility of a customer shopping) are on an uptick with every passing year, this format is capable of yielding high operating leverage in due course. However, it is pertinent to note that Trent’s role in this joint venture with Inditex is limited to investment only and not policy decisions.

Landmark

After becoming profitable in FY19, the management is focusing on fine-tuning its product portfolio and emphasising on small to medium size stores. Unlike apparel, where the degree of seasonality is high, in this segment, sales remain more or less steady throughout the year.

Star

To cut costs, in connection with most of its new stores (20-25 to be opened in FY20), Trent is adopting the supermarket format (Star Market) instead of the hypermarket one (Star Bazaar). The company is also phasing out its convenience stores (Star Daily) in a gradual manner owing to its lack of profitability. These measures are likely to reduce losses from this format further.

To boost margins, attempts to achieve economies of scale (through bulk sourcing from suppliers at better terms) and promote the company’s own food/grocery brands (currently 35 percent of the segment’s sales) are under way.

What are the key risks to this business?

- Indian retail is subject to a high degree of competition. Though the industry is predominantly unorganised, brands of other retail majors are also upping the ante.

- Star remains in a restructuring phase as of now. Though losses are coming off steadily, reaching the break-even point may take some more time.

- Higher promotional spends may not necessarily yield the desired degree of revenue traction. This is because the consumption sentiment pan-India remains pretty muted as of now.

- Trent's valuations are largely influenced by the same-store sales performance of its Westside outlets. If there is any performance miss at this end, it would cause the stock to de-rate.

Is this a good time to invest?

Even in an environment clouded with uncertainty, Trent seems to be unfazed. The stock commands a superlative valuation multiple of 75 times its FY21 projected earnings.

From September 12, 2017, to April 10, 2019, more often than not, Trent traded between 300-350 levels. After going through a rather long bout of time correction spanning close to 2 years, there was a price rally in the past 3-4 months. Moreover, the stock's proximity (price as on August 27, 2019, at Rs 475.25) to its 52-week high (Rs 488.95) cannot be ignored.

At a time when the financial markets are already pretty volatile, the probability of the stock witnessing a sharp re-rating in the foreseeable future is bleak. Keeping the above-mentioned factors in mind, we advise investors to build positions in the stock on major market downturns.

For more research articles, visit our Moneycontrol Research page.

Disclaimer: Moneycontrol Research analysts do not hold positions in the companies discussed here.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.