Ever since it listed on the bourses in April 2006, Kewal Kiran Clothing has gained over 520 percent. What's more, brokerage Anand Rathi thinks the stock will rise more.

The brokerage has initiated coverage on the stock with a 'hold' rating and a price target of Rs 1,716, implying an upside of 13 percent from its previous closing price of Rs 1,520.

Anand Rathi believes that a strong distribution network and operations in different segments have helped the clothes manufacturer establish a pan-India presence in branded apparel.

Moreover, its range of products under home-grown fashion brands Killer, Integriti, Lawman, Pg3 and Easies, are seen attracting customers, it said.

"Its products are competitively priced and easily available, rendering them the preferred choice of customers," the brokerage said in its report.

On the financial front, Anand Rathi expects Kewal Kiran's revenue to grow at a compounded annual growth rate of 4 percent between FY18 and FY20, on the back of the company's distribution network and growth in the overall industry.

"Despite its lower-than-peers revenue growth, it has significantly outshone in profitability and cash-flow-generating ability and will continue to do so," the brokerage added.

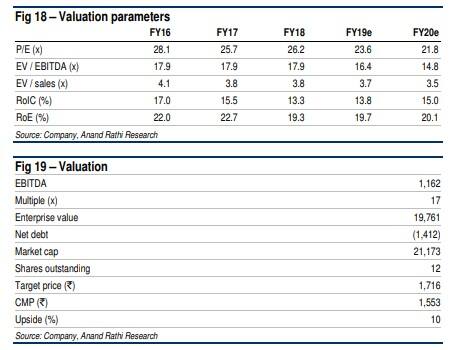

Speaking on the company's valuation, Anand Rathi believes it is justified, given the company's zero-debt status, high cash-generating ability and better return ratios.

"Its comparatively low revenue growth, though, and increasing working-capital days are concerns," it said in the report. The brokerage sees the impact of keener competition on volume and realisation growth as a key risk.

The stock has fallen around 15 percent in the past one year. It closed at Rs 1,520.00, down 1.94 percent, on Monday, and touched an intraday high and low of Rs 1,610.95 and Rs 1,508.00, respectively.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!