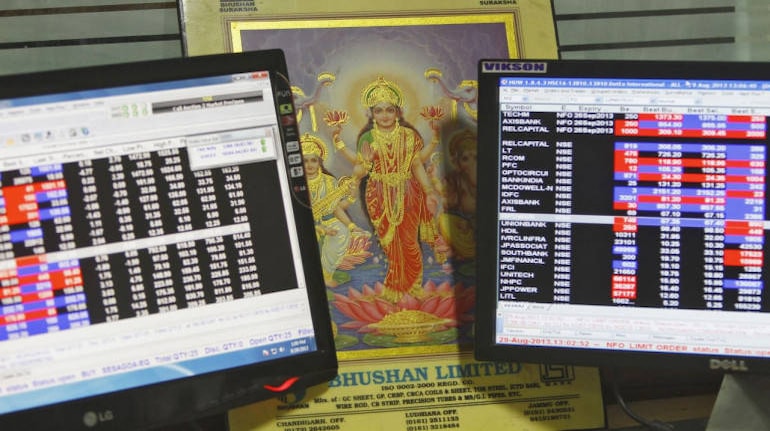

The Nifty broke below three crucial support levels of 5-days exponential moving average (DEMA), 10-DEMA, and 13-DEMA and is trading around its crucial resistance level of 9,200. But, there was plenty of stock specific action in the market.

The Nifty was trading around its crucial level of 9,200, but more than 100 stocks hit fresh 52-week highs on the NSE, which include names like Fag Bearings, Can Fin Homes, Dalmia Bharat, Yes Bank, Hitachi Home, BEML, Bajaj Finserv, Bajaj Finance, etc. among others.

The S&P BSE Sensex was trading with a negative bias but more than 200 stocks hit a fresh 52-week high on the BSE which include names like MRF, Polson, Bajaj Finserv, ABB India, BEML, InterGlobe Aviation, Century Textiles, Thermax, Jubilant Lifesciences, Polson etc. among others.

The S&P BSE Midcap index hit a yet another record high amid muted trend seen in benchmark indices. The S&P BSE Midcap index hit a fresh record high of 14,442.50, led by gains in MRPL which rose 6 percent, followed by Berger Paints (up 4.2 percent), Petronet LNG (up 4 percent), and Neyveli Lignite (up 3.4 percent).

The S&P BSE Smallcap index also hit a record high of 14,986.64 on Wednesday led by gains in Apcotex Industries which rose 15 percent, followed by ADF Foods (up 14 percent), Prime Focus (up 11 percent), Can Fin Homes (up 7 percent), Bombay Dyeing (up 5 percent) etc. among others.

Going by the buzz on D-Street we have collated a list of top five stocks from various analysts.

Analyst: Ashwani Gujral of ashwanigujral.com

Can Fin Homes has made a fairly strong move after moving in a narrow range for the last few days. We recommend a buy with a stop of Rs 2,480 and a target of Rs 2,600.

HDFC Bank in spite of Bank Nifty coming down didn’t correct and is making highs of the session that is a buy with a stop of Rs 1,430 target of Rs 1,465.

Dish TV has often been range bound between Rs 80 to about Rs 120. If you want to buy the stock, you have to buy closer to Rs 80. It is a utility stock and most utility stocks tend to move sideways, so nothing surprising about that.

Analyst: Mitessh Thakkar, miteshthacker.com

We have a buy call on Canara Bank as the entire public sector undertaking (PSU) banking space does look like enjoying some kind of a momentum. Canara Bank can be bought with a stop at Rs 309.50 for targets of Rs 330.

Traders can place a buy on IGL where we saw some kind of a strong intraday buy signals after days of consolidation. That is a buy with a stop at Rs 1,008 for targets of Rs 1,070.

Disclaimer: The views and investment tips expressed by investment experts on moneycontrol.com are their own, and not that of the website or its management. Moneycontrol.com advises users to check with certified experts before taking any investment decisions.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.