As crude prices slump to lows, falling under the key $75 mark, foreign brokerage Investec said domestic OMCs could see record profits, as a result of high marketing margins.

However, potential government intervention of lowering fuel prices ahead of the Maharashtra state election could potentially hinder these profits. This uncertainty heightens earnings volatility for OMCS.

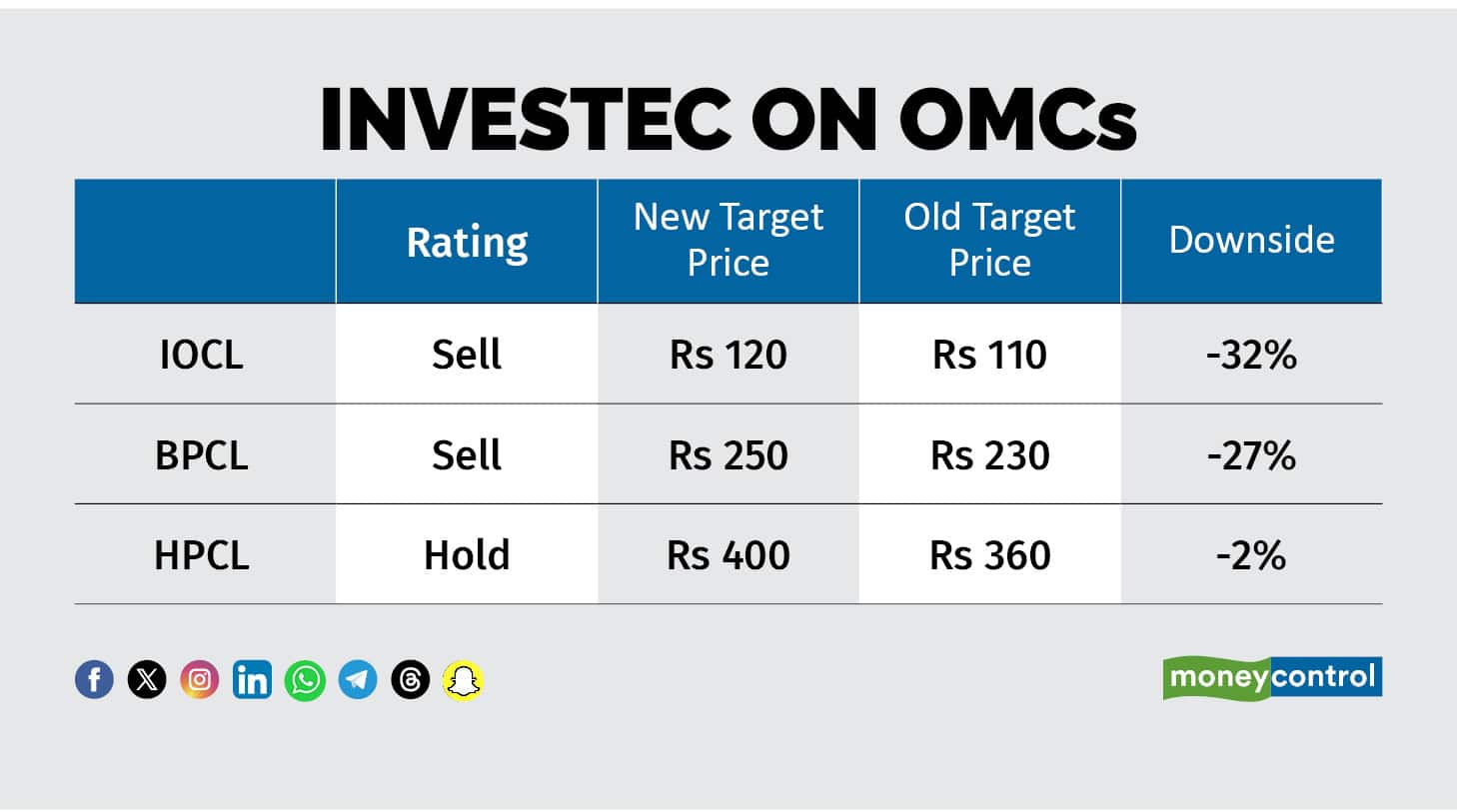

For IOCL and BPCL, Investec maintained its sell call, but bumped up their target prices to Rs 120 and Rs 250, up from Rs 110 and Rs 230 respectively. For HPCL, the brokerage reiterated its hold call, but hiked its fair value assumption on the share price to Rs 400 per share, from Rs 360 earlier.

Follow our live blog to catch all the market updates

A decline in crude prices benefits oil marketing companies (OMCs) as it reduces their input costs and gives them more leeway to generate higher margins. In addition to that, OMCs can also capitalise on inventory gains by restocking at reduced prices.

However, on the flipside, the fall in crude prices will have a negative bearing on oil drilling stocks like ONGC and Oil India as it squeezes their profit margins. This is because the price of refined products may not drop as quickly or proportionately and hence, refineries holding inventories bought at higher prices may face inventory losses as the value of their stock decreases.

Brent crude prices fell to their lowest levels in almost nine months, slipping closer to $73 per barrel, marking a sharp fall from a high of over $81 per barrel last week. Pressure on Brent prices is stemming from concerns of a demand slowdown in China, the world's largest importer of the commodity, due to an increased adoption of electric vehicles.

Disclaimer: The views and investment tips expressed by investment experts on Moneycontrol.com are their own and not those of the website or its management. Moneycontrol.com advises users to check with certified experts before taking any investment decisions.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.