Indian benchmark indices trades sideways amid volatility. The Nifty opened near the 22,600 level, followed by profit booking. It is holding above the 22,400 mark and according to experts, the rally in the Nifty is likely to continue.

It could test the next resistance level of 22,600 in the near term and potentially re-test the previous all-time high of 22,800. Supports for the Nifty are now seen at 22,400 and 22,250.

At 11:04 IST, the Sensex was up 58.13 points or 0.08 percent at 74,011.44, and the Nifty was up 7.60 points or 0.03 percent at 22,536.60. About 1,642 shares advanced, 1,559 shares declined, and 94 shares remained unchanged.

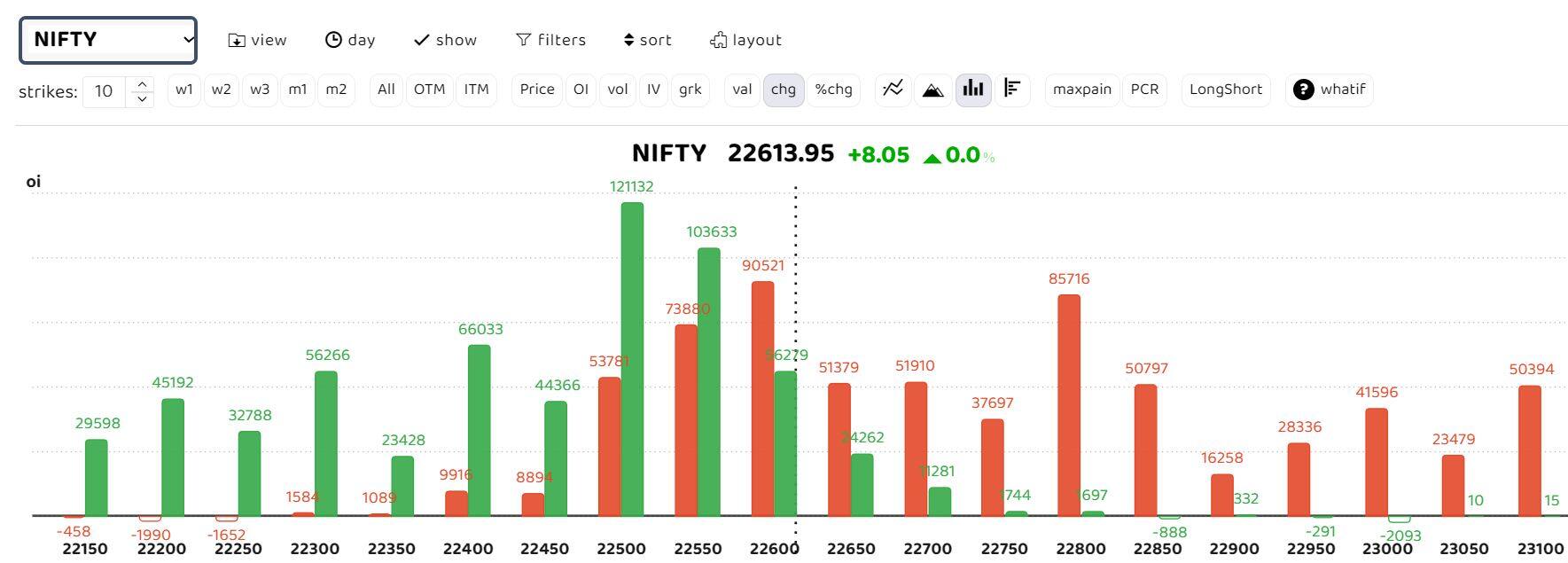

Options data suggests a tussle between call and put option writers at the 22,500 and 22,400 zones, forming key straddle positions. As per Tejas Shah, VP of Technical Research at JM Financial, "The Nifty is holding above the 22,200 mark. The rally in the Nifty is likely to continue and it can test the next resistance level of 22,600 immediately. Eventually, it can re-test the previous all-time high levels of 22,800. Supports for the Nifty are now seen at 22,400 and 22,250 levels. On the higher side, immediate resistance for the Nifty is at 22,600 levels, and the next crucial resistance zone is at 22,750-800 levels (the previous ATH)."

Angel One: In the upcoming session, while the undertone remains bullish, we may see consolidation in the major indices with sector rotation continuing. Traders are advised to focus on these areas for better opportunities. As the benchmark index nears the higher end of its recent consolidation, caution is advised, and dips should be considered as buying opportunities. Support is seen between the 20 and 50 EMA zones, ranging from 22,350 to 22,250, while the 22,600 to 22,800 range remains a significant barrier that has persisted for the past two months.

Bank Nifty

ICICI Securities: The Bank Nifty underperformed the Nifty due to selling pressure in the private banking space. For today’s weekly expiry, the 48,000 call and put both hold meaningful open interest, indicating consolidation around current levels.

Disclaimer: The views and investment tips expressed by investment experts on Moneycontrol.com are their own and not those of the website or its management. Moneycontrol.com advises users to check with certified experts before taking any investment decisions.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!