Jitendra Kumar GuptaMoneycontrol Research

Both pricing pressure and higher costs impacted the September quarter results of leading ferro chrome company IMFA, which reported 83 percent year-on-year decline in net profits. Earnings volatility is part of its business as a result of fluctuation in the ferro chrome prices. However, what is worth noting is that the company has never incurred losses in the past several years as a result of integrated operations, having its own captive power and ore mining thereby making it one of the lowest cost producers in the world.

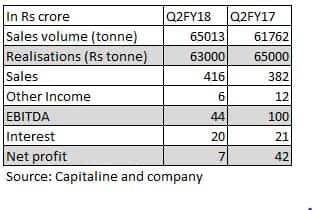

Turning to the results for the quarter gone by, despite 5 percent year-on-year growth in ferro chrome sales volumes to 65000 tonnes and revenue growth of 9 percent to Rs 416 crore, profits fell because of the lower margins and realisations. The company's realisations per tonne fell to about Rs 63000 per tonne as against Rs 65000 per tonne in the corresponding quarter last year and Rs 93000 per tonne in the June quarter. That apart, the overall cost increased because of higher coal prices, which is used both in power generation and converting ore into ferro chrome. During the quarter the company reported 18 percent year-on-year growth in raw material consumed.

The company perceives this to be a one-time blip and the company is expecting improvement on both cost and realisations front in the coming quarters.

Better outlook

In its recent analyst call, the management indicated that international ferro chrome prices are already trading at about 25 percent higher than the levels seen in Q2FY18. Moreover, the company has negotiated higher rates with the customers for the period Q3FY18.

The management is working on plans to expend its capacities. However, it also intends to establish back-end supply like raw material and power before committing on the expansion. It will first expand its mining capacity from 6 lakh tonnes to 12 lakh tonnes and aims at using the surplus power generated from its existing generation capacity.

The company has enough financial resources. The company will be sitting on cash equivalent of close to Rs 600 crore including estimated cash to be generated in the current fiscal.

Valuation

Stock prices have corrected by almost 24 percent from its 52-week high of Rs 823 and 8 percent post the announcement of results on October 24. The market is worrying about the volatility in earnings which is an inherent risk to this business.

However, with the demand-supply situation remaining favourable and the ferro chrome prices remaining relatively high there is higher possibility of better earnings in the coming quarters.

This year, the company is expected to report net profit of around Rs 200 crore and EPS of Rs 75 per share. At the current market capitalisation of Rs 1776 crore and market price of Rs 658, the stock is still reasonably valued at 8.8 times its FY18 estimated earnings.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.