Due to higher tax provision under the government's ‘Vivad Se Vishwas' scheme, power major NTPC, on June 27, reported over 70 percent year-on-year decline in its consolidated net profit at Rs 1,523.77 crore for the

March quarter of the financial year 2020.

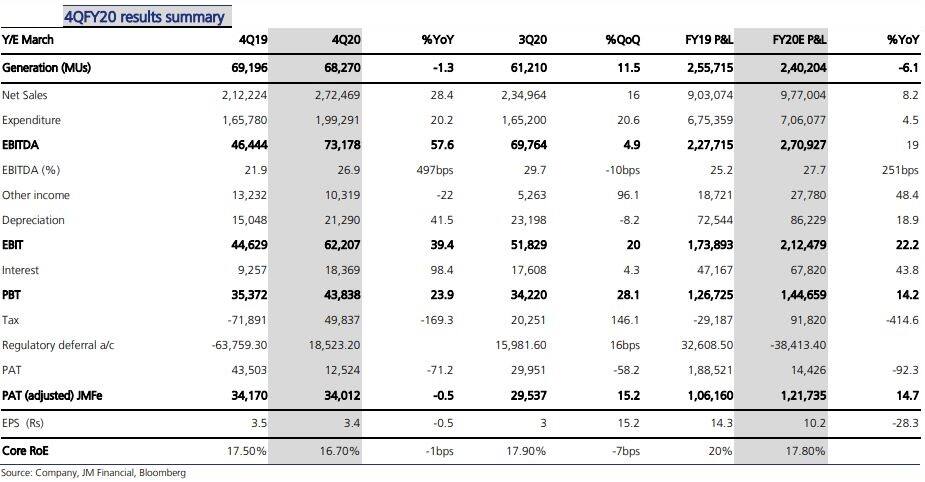

Total income stood at Rs 31,315.32 crore in Q4 FY20, compared to Rs 26,116.15 crore in the year-ago period.

Consolidated net profit for 2019-20 stood at Rs 11,901.96 crore, compared to Rs 14,034.4 crore in 2018-19 while the total income of the company in 2019-20 was Rs 1,12,372.58 crore as against Rs 1,02,533.05 crore in 2018-19.

Brokerages see up to 65% upside

Despite a weak show in FY20 and feeble prospects for FY21, NTPC's earnings growth has strong visibility over the next two years as 11 GW of under-construction coal-based capacities will likely be commissioned, say experts.

As per brokerage firm JM Financial, NTPC targets nearly 5-6 GW of additions at group level in FY21-22 whereas commercialisation targets remain at about 5.95-5.67 GW in FY21-22.

"We find NTPC to be immune to COVID-19 demand impact given regulated RoEs. While the discoms rebate (per MoP directive) will result in flattish FY21 earnings, we find capacity addition led growth to result in 13-14 percent EPS CAGR in FY20-22 period," said JM Financial.

"With power coal stocks at a high (29 days), future PAF losses for NTPC are not expected. We find the stock attractive given its potential for steady growth and inexpensive valuations at about 0.7 times FY22 BV and 6 times P/E."

The brokerage has a buy call on the stock with a 12-month target price of Rs 160, which is a 65 percent upside from the last session's closing of the stock (June 26).

So far in the calendar year 2020, the stock has fallen nearly 19 percent against a 15 percent fall in the benchmark index Nifty.

As per the brokerage, the recurrence of coal issues, delayed capacity addition and any adverse impact from CERC regulations on new PAF norms from FY21 are the key risks for the stock.

Motilal Oswal Financial Services also has a 'buy' call with a target price of Rs 145 on the stock.

"While extended lockdown at the country level could impact upcoming commercialisation plans, we note that even if we assume no incremental commercialisation, the full benefit of recent additions should aid FY21 PAT by Rs 900–1,000 crore (6–7 percent of FY20 adjusted PAT). With the pickup in capitalisation, which was partly hampered due to coal availability issues, we expect a regulated equity CAGR of nearly 12 percent over FY20–23," said Motilal Oswal.

The brokerage believes earnings could witness a drop in FY21 due to the announcement of a Rs 1,590 crore rebate. However, this is a one-off in nature, attributed to the disruption caused by COVID-19. The company would offer the rebate in its bills for Q1FY21, Motilal said.

Kotak Institutional Equities also has maintained a 'buy' rating on NTPC with a target price of Rs 140, citing inexpensive valuation of the stock of 0.7 times P/B and 6 times P/E on March 2022E earnings.

The government of India has already addressed the liquidity constraints of state-owned distribution utilities that will likely help NTPC monetize its receivables, even as the company looks to meet a 4 GW commercialization target for FY2021E, Kotak said.

Kotak believes the focus of FY2021E will now shift to the liquidation of the receivable build-up with outstanding debtors rising to Rs 15,600 crore as of March 2020 compared to Rs 8,400 crore in FY2019 and well above Rs 18,000 crore currently.

Disclaimer: The views and investment tips expressed by investment experts on Moneycontrol.com are their own and not that of the website or its management. Moneycontrol.com advises users to check with certified experts before taking any investment decisions.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.