Highlights

The stock of Coforge (CMP: Rs 7469 Market Cap: Rs 49819 crore, Rating: Overweight) has outperformed significantly in the past five months and is now close to its life-time high. The organic performance has been robust. With its strength in BFSI, the company is ready to ride the demand revival. The second quarter (Q2) will be the first one of consolidated reporting after the recent large acquisition of Cigniti and the valuation is way beyond the zone of comfort. Is it therefore time to partially book the gains?

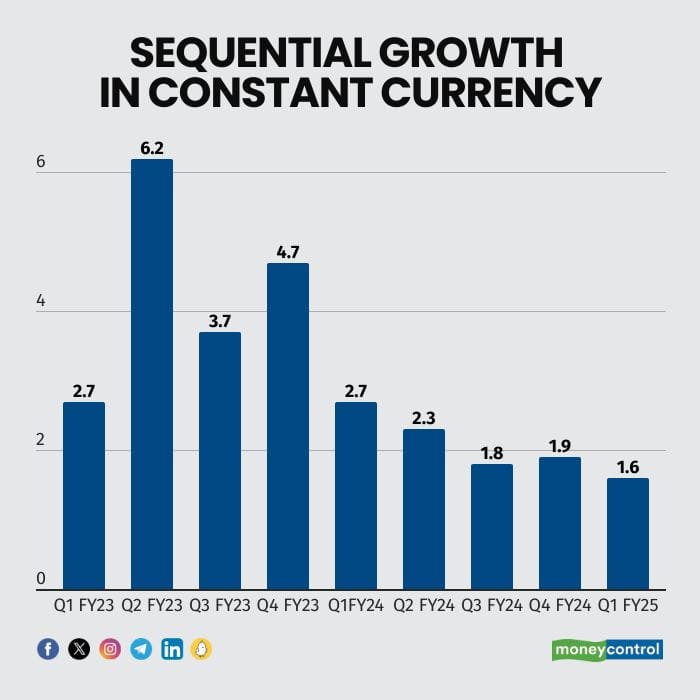

Revenue momentum strong so far

Coforge had ended FY24 on a strong note with an organic Constant Currency revenue growth of 13.3 percent. While Q1 FY25 started on a healthy note with a sequential revenue growth of 1.6 percent, the high base of FY24 and the Cigniti acquisition may lead to a slight subdued near-term growth. However, on the back of demand revival, FY26 could turn out to be a good year. Nevertheless, given that the company has now dropped the annual growth guidance, and the Cigniti integration (although Cigniti grew by a decent 2.4 percent sequentially in reported currency in Q1) may consume some bandwidth, we feel the rally partially captures the optimism.

Source: Company

Margin remains a key watch

In the last reported quarter, adjusted operating margin (excluding ESOP costs) declined by 110 basis points sequentially on account of visa costs even in the absence of a wage hike that got implemented from July 1. However, the management is still guiding to a margin improvement of 50 basis points in the first half of FY25 over the corresponding period thereby indicating 120 basis points sequential decline in margin in Q2. Coforge is hopeful of a full-year margin expansion of 50 basis points.

After FY25, margin improvement is expected, thanks to the peaking out of sales and marketing expenses (now over 15 percent of revenue), higher offshoring (now 52 percent and has headroom to improve), stable resource cost as attrition has fallen to a low of 11.4 percent now, and improving utilisation, which at 81.6 percent is lower than most peers.

However, the key near-term watch remains the margin gains in Cigniti (28 percent stake at the end of Q1 and likely to go up post the open offer) that reported a margin of 12.6 percent in Q1. The management is guiding to a strong margin uptick to the tune of 16 percent for Cigniti.

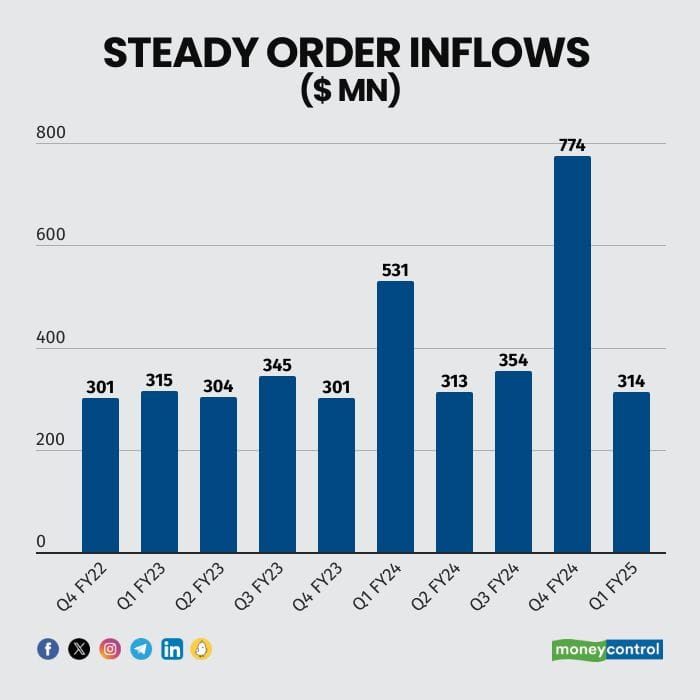

Order inflows extremely strong

Despite the challenging market environment, the company maintained traction in deal wins, thanks to its aggressive sales and marketing efforts. In Q1 FY25, the company won two large deals, one in BFS (banking financial services) and the other in aviation and clocked more than $300 million in order inflows for the 10th consecutive quarter.

Source: Company

Source: Company

The executable order book is solid with a YoY growth in excess of 19 percent, providing revenue visibility for the organic business.

Source: Company

Cigniti acquisition – Is the Street pricing in a success?

After the initial hiccup with the Cigniti acquisition, the Street appears to be turning optimistic on the same. While the net margin of Cigniti is similar to Coforge (as Coforge had a few exceptional items impacting margins in recent times), the operating margin of Cigniti is much inferior. In fact, the offerings of Cigniti, which are mainly digital assurance and digital engineering service, are inherently low-margin compared to Coforge.

Coforge’s rationale for the acquisition was primarily to have three additional industry verticals — retail, hi-tech, and healthcare — through Cigniti. In addition, Cigniti has a good footprint in south-west, mid-west, and western part of the US while Coforge is concentrated in the east coast. Coforge has a relatively smaller presence (48 percent of sales) in the US and this acquisition should aid in fortifying presence in a key market. Finally, Coforge believes that testing, which is the principal offering of Cigniti, isn’t going to get eliminated with the adoption of the AI. It believes that the need for testing should increase as new complexities and opportunities arise. This remains a key watch.

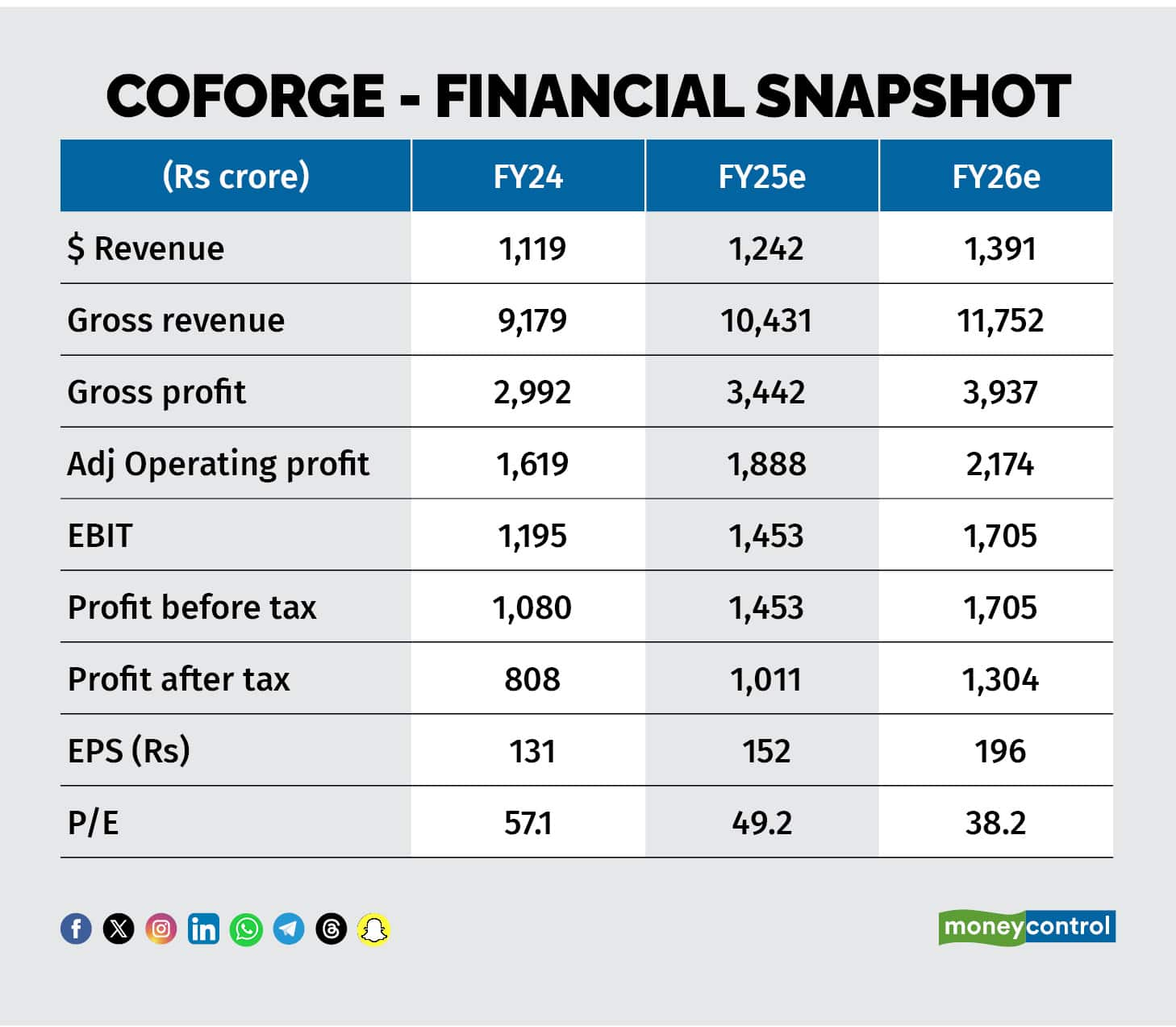

The combined entity of Coforge plus Cigniti of $1.3 billon at the end of FY24 is targeting to achieve $2 billion revenue, implying a revenue CAGR of 15 percent. Coforge is also expecting 150-250 basis points margin gains over this period.

While we have not tweaked our estimates factoring in this acquisition, we feel the recent rally captures the near-term optimism of a better-than-expected acquisition. Given the strong rally, we recommend investors should partially book profits and re-enter on any weakness as Coforge with its BFSI-heavy portfolio is in a vantage position to capture the demand revival.

Source: Company, Moneycontrol Research

Source: Company, Moneycontrol Research

Key risks: Severe demand slowdown and/or heightened competitive intensity

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.