Bajaj Finance is expected to report an on-year growth of 30 percent in net interest income and 27 percent in net profit on the back of a 34 percent surge in new loan bookings, said analysts. The company will declares its June quarter results later today.

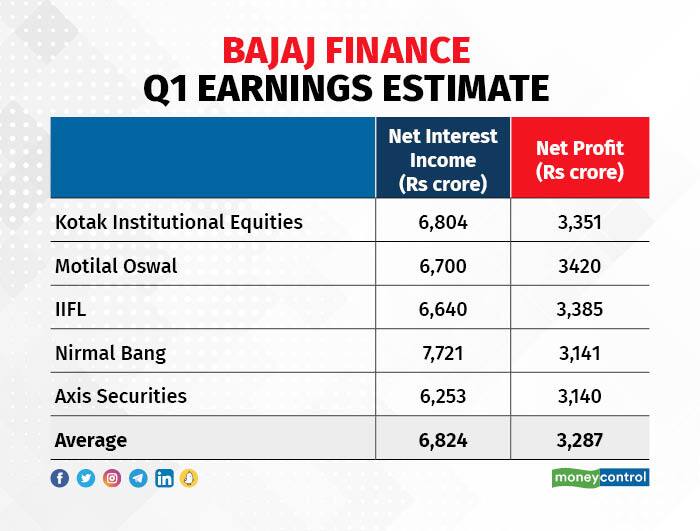

According to the average of estimate of five brokerages, the company's net interest income is set to reach Rs 6,824 crore from Rs 5,274 crore last year, while its net profit may come in at Rs 3,287 crore as against Rs 2,596 crore a year back.

Among the brokerages polled by Moneycontrol, Nirmal Bang Institutional Equities has the highest NII estimate for Bajaj Finance, while Motilal Oswal had the highest net profit estimate.

In its Q1 business update, Bajaj Finance had informed that new loans booked during the quarter grew by 34 percent to 9.94 million as against 7.42 million in the corresponding quarter of the previous year.

Its assets under management (AUM) jumped 32 percent on-year to Rs 2.7 lakh crore. This was the highest-ever quarterly increase. Meanwhile, its customer franchise stood at 72.98 million at the end of June 2023 as compared to 60.30 million as of June 2022.

The company's deposits book stood at Rs 49,900 crore as of June 2023, a growth of 46 percent over Rs 34,102 crore a year ago.

As cost of funds rise, analysts at Kotak Institutional Equities expect almost flat net interest margin, up 5 basis points sequentially. "Seasonal trends suggested marginally higher NIM for Q1 and Q3," they stated in a report. They expect cost-to-average AUM ratio to remain high at 4.5 percent.

When it comes to credit costs, most brokerages expect it to inch slightly downwards. Motilal Oswal Financial Services, for instance, sees credit costs declining ~10 basis points sequentially in Q1 FY24. Consequently, asset quality is expected to remain stable.

Bajaj Finance stock is trading about 5 percent below its 52-week high. On July 25, the stock closed flat on the NSE at Rs 7,605. Investors will remain watchful of management commentary on margin-growth trade-off and progress on the execution of Long Range strategy (LRS).

Disclaimer: The views and investment tips expressed by investment experts on Moneycontrol.com are their own and not those of the website or its management. Moneycontrol.com advises users to check with certified experts before taking any investment decisions.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.