The year 2022 was one of struggles for the Indian fast-moving consumer goods (FMCG) companies which battled simultaneously on two very important fronts — soaring raw material costs and food inflation on one side, and dismal rural demand on the other.

This impacted not only volumes but also gross and operating margins for all the players in the segment. Apart from passing on the rising costs to end-consumers, companies had to resort to measures like grammage cuts and reduction in ad spends.

However, the early shoots of a trend reversal have begun to showing up and the sector may finally come out of the woods this year. While rural demand is expected to look up on better crop yields and realisations, volumes will recover on lower inflation, which in turn will help improve the margins.

Difficult 2022

Even though the impact of the pandemic waned and had minimal bearing on demand, rural demand was depressing due to the price hikes taken by the FMCG companies on the back of significant surge in raw material prices due to the Ukraine crisis and also high inflation impacting the consumers’ cost of living in a substantial way.

Demand in urban areas, on the other hand, was better off and witnessed an improvement with the opening up of the Indian economy and increased mobility.

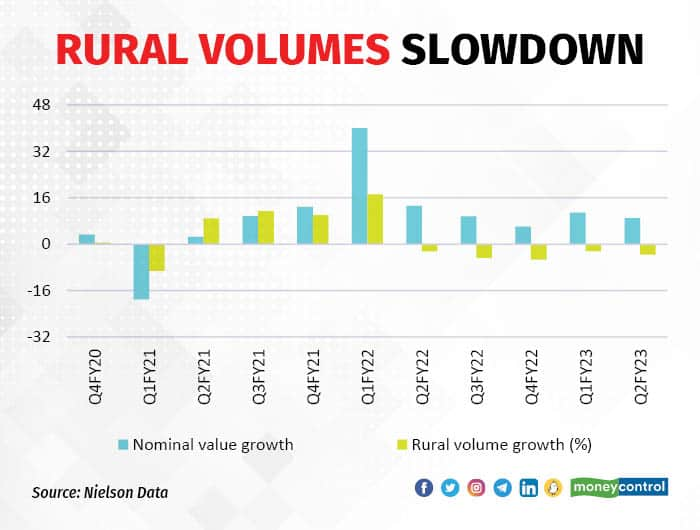

“Overall FMCG market volumes declined 8 percent/6 percent/6 percent YoY in Q1/Q2/Q3CY22 led by rural sector weakness, with some down-trading also being witnessed,” said a report from Nomura Global Markets Research. Down-trading involves consumers switching from expensive brands to cheaper alternatives.

That said, while two consecutive years of near double-digit product price hikes impacted volumes, it aided value growth to remain intact.

Category rebalancing picked up pace as health, hygiene and immunity-building saw moderation from elevated levels. Discretionary and lifestyle categories such as paints, jewellery, QSR and spirits demonstrated resilience in 2022 and grew despite a high base (pent-up demand in 2021) as normalcy in mobility returned.

The margins remained impacted despite the price hikes which were not able to completely match the raw material inflation. However, the silver lining was that the organised players were able to gain market share by going for price hikes that were lower than inflation.

2023 holds promise

Experts believe that as we move forward in 2023, rural demand will pick up strongly, urban demand will remain steady and move with a positive bias, volume growth will replace price-led growth, and more importantly, the sector will witness margin recovery.

Rural demand set for an up-move

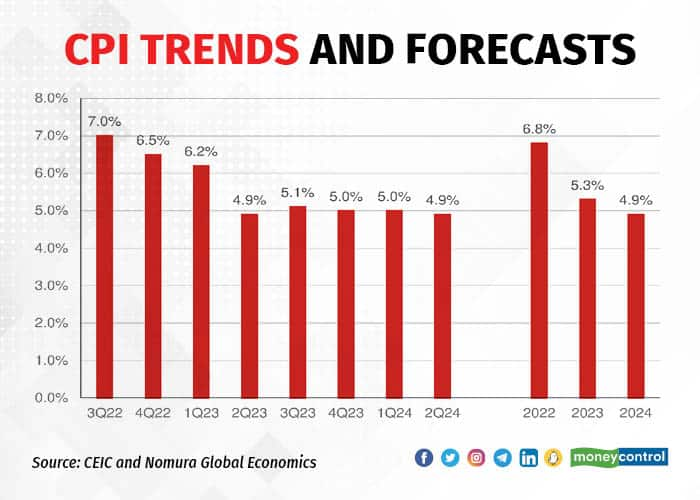

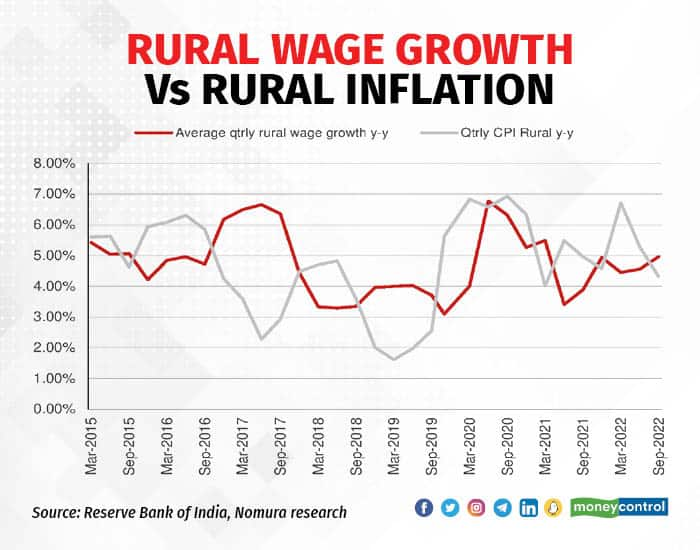

Rural demand, which is one of the most important factors for the health of the FMCG sector, is poised to recover, with food & overall inflation likely to trend between 5-5.5 percent compared to 6.8 percent in 2022. The lower inflation will support rural demand.

Improved environment for rural jobs and government expenditure will also aid rural demand growth. “Demand for MGNREGA jobs is going down and is only a tad above pre-pandemic levels, implying better-paying jobs are available. And with 2023 being the year before the general elections, we expect the government to ensure enough spending to revive the rural economy,” said a report from Nomura.

Better crop yields and higher realisations (strong show in Rabi sowing season) also auger well for rural demand.

The other factor that can lend support to rural demand is the expected increase in urban remittances. “Hospitality sectors were severely impacted in the past two years of Covid-19, which adversely impacted jobs,” said the analysts at Nuvama Institutional Equities. “Not all migrant labourers have returned to urban centres, and accordingly, urban remittances are still not back to peak levels, but that could change in 2023.”

Urban demand steady with positive bias

Experts see a steady improvement in urban demand in 2023, driven by increase in working population, increase in disposable in incomes, job creation, and premiumisation.

“The average per capita consumption of FMCG in India is also extremely low and at the cusp of an improvement, with India’s per capita income crossing $2,200,” the report from Nomura said.

The data shows that India’s average per capita consumption stands at $46 with rural consumption at $27. The rural consumption is just one-third of urban India which currently stands at $82. India’s per capita consumption is half of Indonesia ($103), one-third of China ($126), one-fifth of the Philippines ($255) and one-tenth of Thailand ($438). This leaves a lot of scope for overall growth in FMCG consumption.

Volume growth to return

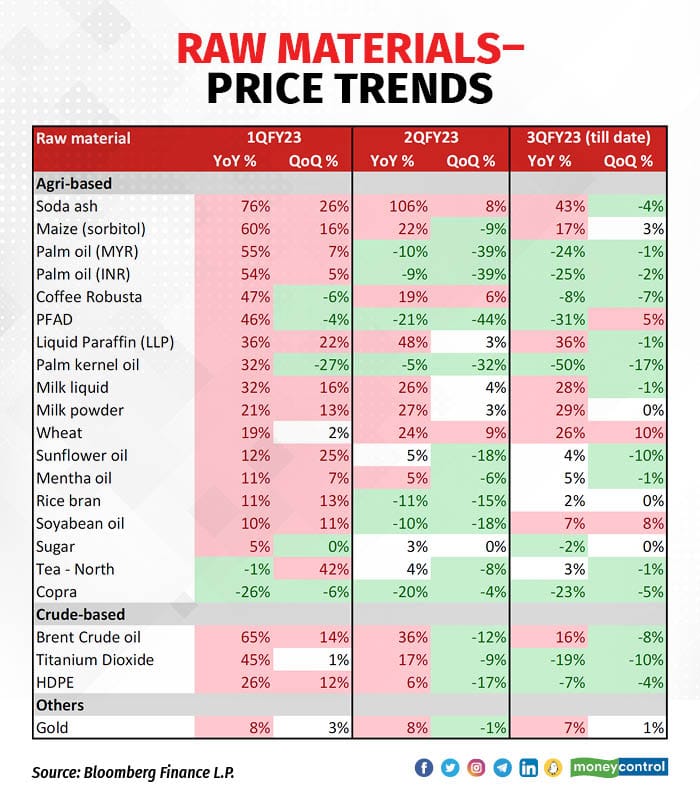

The year 2022 saw a surge in commodity and raw material prices which led the FMCG companies to go for sharp price hikes to pass on the rising input costs to the consumers. Apart from price hikes, grammage cuts also hurt the volume growth meaningfully.

“With softening and range-bound RM prices in the near term, we expect companies to focus on driving volume growth with no meaningful price increases that would negatively impact consumer demand,” the analysts at Nomura said in their report.

Experts expect organised companies to remain competitive and cut product prices as RM prices soften, but that would not result in any meaningful improvement in overall sales growth.

Mass discretionary in the staples category is likely to see volume growth with improvement in rural demand. The analysts at Nomura expect companies with mass skin care, deodorants, hair colour, malted food drinks and hair oils to see better volume growth vs others.

Modest growth is likely to continue for food companies while the revenues of paints companies will likely moderate on a yearly basis in the absence of any price-led growth. Though volumes are likely to be strong with the likely pick-up in rural demand, the inferior product mix is likely to continue which will keep the growth muted for paints companies.

Margins, finally set to come out of the woods

The softening of raw material prices auger well for the margins of businesses and with the prices of key raw materials likely to remain range-bound, at least in the first half of 2023, the gross margins are likely to see recovery across the board.

Experts expect the sharp price hikes taken by companies, soft raw material prices, and better portfolio mix to aid gross margin improvement in 2023.

Operating margins too are expected to respond positively, but according to the analysts at Nomura, “Operating margin expansion will be a function of (1) premiumisatiom of portfolios through innovative value-added launches commanding superior margins, (2) cost-efficiency programs, and (3) operating leverage benefits coming through an improvement in the scale of operations.”

The analysts at Nomura prefer companies that have invested in distribution, digital capability, new launches, have higher pricing power, the most margin tailwinds with softening input costs, and have made their business models leaner / improved efficiency in these challenging times.

The preferred stocks are Britannia (Target price Rs 5,200 at a P/E of 49x Mar-25F EPS), Hindustan Unilever (Target price Rs 3,175 at a P/E of 55x Mar-25F EPS), Godrej Consumer Products (Target price Rs 1,050 based on sum of total parts) and Dabur (Target price Rs 715 at a P/E of 49x Mar-25F EPS).

Disclaimer: The views and investment tips of investment experts on Moneycontrol.com are their own and not those of the website or its management. Moneycontrol.com advises users to check with certified experts before taking any investment decisions.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!