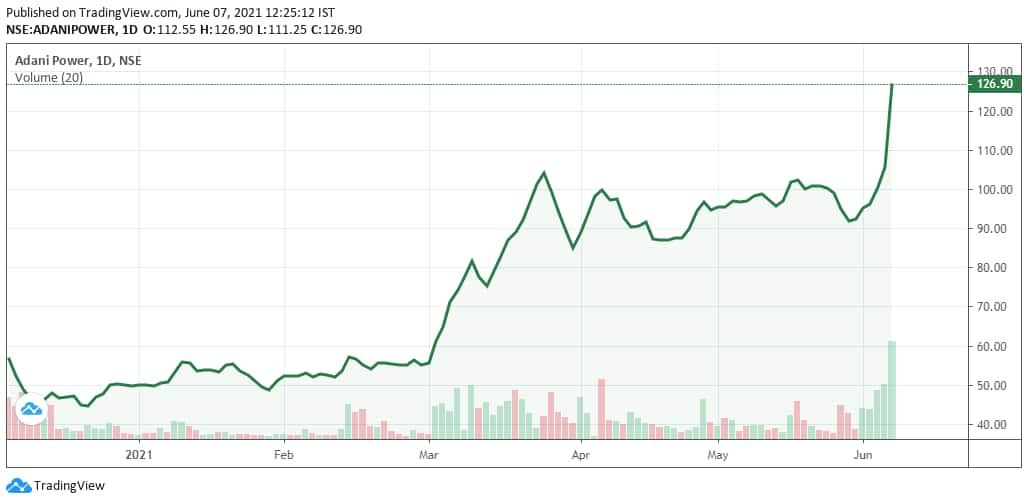

Adani Power share price surged 20 percent intraday on June 7 with high volumes as around 10,01,31,116 shares were being traded on NSE at 12:28 hours.

The stock price has jumped over 230 percent in the last 9 months and was trading at Rs 125.60, up Rs 19.80, or 18.71 percent. It has touched a 52-week high of Rs 126.50. It has touched an intraday high of Rs 126.50 and an intraday low of Rs 111.50.

According to BSE data, the stock traded at a price-to-earnings multiple of 38.3 and a price-to-book ratio of -5.01.

A higher P/E ratio shows investors are willing to pay a higher price because of better future growth expectations. The price-to-book value indicates the inherent value of a company and is the measure of the price that investors are ready to pay even for no growth in the business.

Adani Power price movement since 1 year

Adani Power price movement since 1 year

The company reported quarterly net profit at Rs 13.13 crore in March 2021 up 101 percent from Rs 1,312.90 crore in March 2020. Net sales came in at Rs 6,373.60 crore in March 2021, up 3.26 percent from Rs 6,172.43 crore in March 2020.

Recent results of the company point towards growth in operating profit with an increase in operating margins (YoY). The scrip is also showing strong momentum with price above short, medium and long term moving averages.

According to MC Technicals, the moving averages, technical indicator and moving averages crossovers are all bullish with the technical rating being bullish.

Disclaimer: The views and investment tips expressed by investment experts on moneycontrol.com are their own, and not that of the website or its management. Moneycontrol.com advises users to check with certified experts before taking any investment decisions.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.