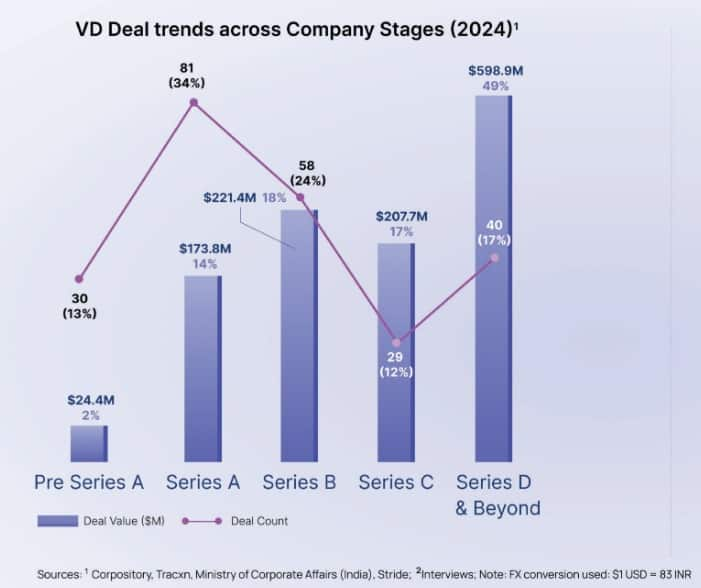

Venture debt (VD) investments remained flat in 2024, growing just 2.5 percent year-on-year (YoY) to $1.23 billion across 238 deals, compared to $1.2 billion raised across 185 deals in 2023.

This tepid growth stands in contrast to venture capital (VC) funding, which surged 20 percent YoY to $12 billion from 1,168 deals, recovering from the so-called funding winter, according to the Global Venture Debt Report 2025 by Stride Ventures and Kearney.

While VD investments slowed in 2024, the asset class has expanded significantly over the past seven years, increasing 15-fold from just $80 million in 2018. It gained traction during the funding winter as VC investors pulled back, leading to a 33% drop in VC funding to $25.7 billion in 2022 from the peak of $38.5 billion in 2021. Since then, VD investments have followed an upward trajectory, rising 150% in 2021, 60% in 2022, and 50% in 2023 before plateauing last year.

How venture debt has played out.

How venture debt has played out.

Why VD remains relevant

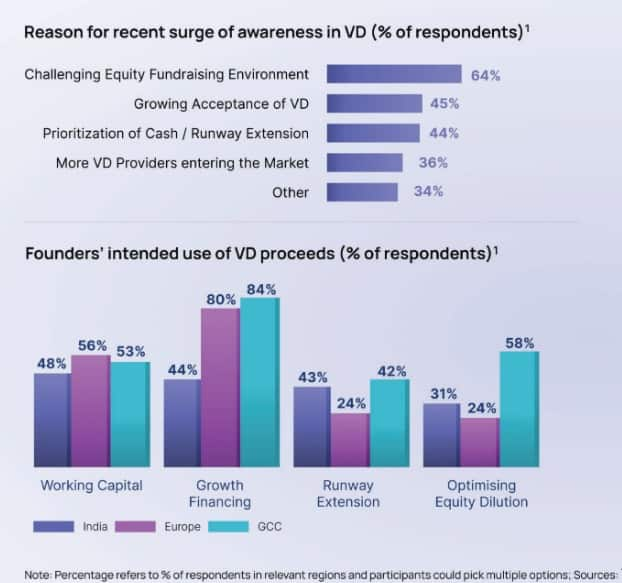

Despite the slowdown, venture debt continues to play a critical role in startup financing. A survey of 244 founders, investors, and limited partners across India, Europe, GCC, and Southeast Asia highlighted key drivers of VD adoption.

Around 64 percent of respondents pointed to a challenging equity fundraising environment, 44 percent cited the need for additional cash and runway extension, while 45 percent attributed the growth to increasing awareness and acceptance of VD as a funding tool.

“With delayed equity rounds, we see quite a momentum for venture debt in the last years…I have seen various use cases for VD, ranging from securing additional working capital in Series A to financing M&A activities in Series C and D,” said Amit Jhunjhunwala, CFO at Accel.

VD is increasingly seen as a bridge between venture capital and traditional banking. “The cost of VC capital was once the most expensive form of capital, and founders in their naivety would use it simply because venture debt options didn’t exist,” said Prashant Prakash, founding partner at Accel India, at the report launch.

“Now, whether it’s working capital or anything else, VD is filling that gap. We will see a very different startup ecosystem as a result, with VD earning its place alongside VC. This synergetic relationship will only strengthen.”

Sector-wise venture debt

Sector-wise venture debt

Rahul Taneja, Partner at Lightspeed, noted that “smarter founders” are leveraging VD more effectively. Commerce businesses, especially manufacturers and global service providers, are using VD for leverage, while digital product companies like Pocket FM are using it to fund expansion in international markets like the US. Startups in asset-heavy sectors, such as Solar Square, are also increasingly turning to venture debt.

Pre-IPO and sectoral trends

Venture debt is becoming a critical funding tool across all growth stages, particularly pre-IPO, where startups use it to fuel growth before listing. Companies such as Ola Electric, Ather Energy, Bluestone, and Infra.market have raised significant venture debt ahead of their IPOs. “These deals typically involve large ticket sizes, contributing to an expansion of the market size,” the report noted.

In 2024, 49 percent of VD funding went toward late-stage rounds, while 47 percent was deployed in pre-Series A and Series A deals. The sectoral concentration was also high, with 80 percent of total deal value flowing into just three sectors—fintech, consumer internet, and cleantech. Fintech alone attracted $447 million in VD, accounting for 37 percent of the total deal value, while the consumer internet sector led in deal count with 81 transactions. Cleantech emerged as another key beneficiary, securing 18 percent of total venture debt investments.

VD continues to be primarily used for working capital, which accounted for 52 percent of its deployment, followed by growth financing and runway extension, each contributing 44 percent.

Bridging the gap with banks

A major shift in venture debt’s evolution is its role in connecting startups with banks. “VD-backed companies are finding it easier to establish banking relationships, as banks gain confidence in lending to them,” said Prakash. It is also facilitating channel financing, particularly in areas like franchise expansion in the retail sector.

While venture capital and venture debt investors may have different perspectives, their investment philosophies are now aligning. “You create a governance structure when you invest in a company—both VC and VD. We are fairly in sync on how the investment is going to pan out. Governance is there to serve founders, not impede them,” said Taneja.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.