A new wave of Indian startup IPOs is finally putting cash back into venture investors’ hands.

After years of paper gains and markdowns, early backers in a clutch of consumer-tech and fintech unicorns are now cashing out shares worth around Rs 13,220 crore — nearly $1.5 billion — from secondary share sales across a string of public issues this year, marking the strongest liquidity cycle since 2021.

An analysis of filings with the Securities and Exchange Board of India (SEBI) shows that across eleven companies — including Groww, Lenskart, Pine Labs, Ather Energy, Bluestone, Urban Company, Meesho, Amagi Media Labs, Wakefit Innovations, Curefoods India, and Shadowfax Technologies — existing shareholders are offloading large tranches of equity through the offer-for-sale (OFS) route.

While the Rs 13,220-crore total includes both institutional investors and promoters, filings show that venture funds such as Peak XV Partners, Accel, and Elevation Capital account for the most significant share of realised gains, given their repeated presence across multiple IPOs and large exit blocks.

Priced IPOs lead the liquidity cycleThe sharpest exits this year have come from startups that have already listed or announced price bands — Pine Labs, Lenskart, Bluestone, Urban Company, Ather Energy, Shadowfax, and Groww.

Fintech major Pine Labs has set a price range of Rs 210–221 per share, with 14.78 crore shares being sold by existing investors. At the upper end, the OFS is worth Rs 3,266 crore.

Logistics platform Shadowfax Technologies has declared a Rs 1,000-crore OFS alongside an equal-sized fresh issue.

Among completed listings, Lenskart’s 13.23-crore-share offer at Rs 382-402 generated Rs 5,318 crore in investor proceeds. Bluestone’s 2.39 crore shares at Rs 492-517 added Rs 1,236 crore, while Urban Company saw a Rs 1,471-crore OFS.

Electric-vehicle maker Ather Energy sold 1.10 crore shares at Rs 304-321, worth Rs 355 crore, and investment platform Groww, priced at Rs 95–100 a share, contributed another Rs 574 crore through a 5.74-crore share OFS that includes sellers such as Peak XV Partners, Ribbit Capital, VY Capital, and Tiger Global.

Together, these seven IPOs account for Rs 13,220 crore in confirmed secondary exits — money flowing directly to existing shareholders rather than to the companies themselves.

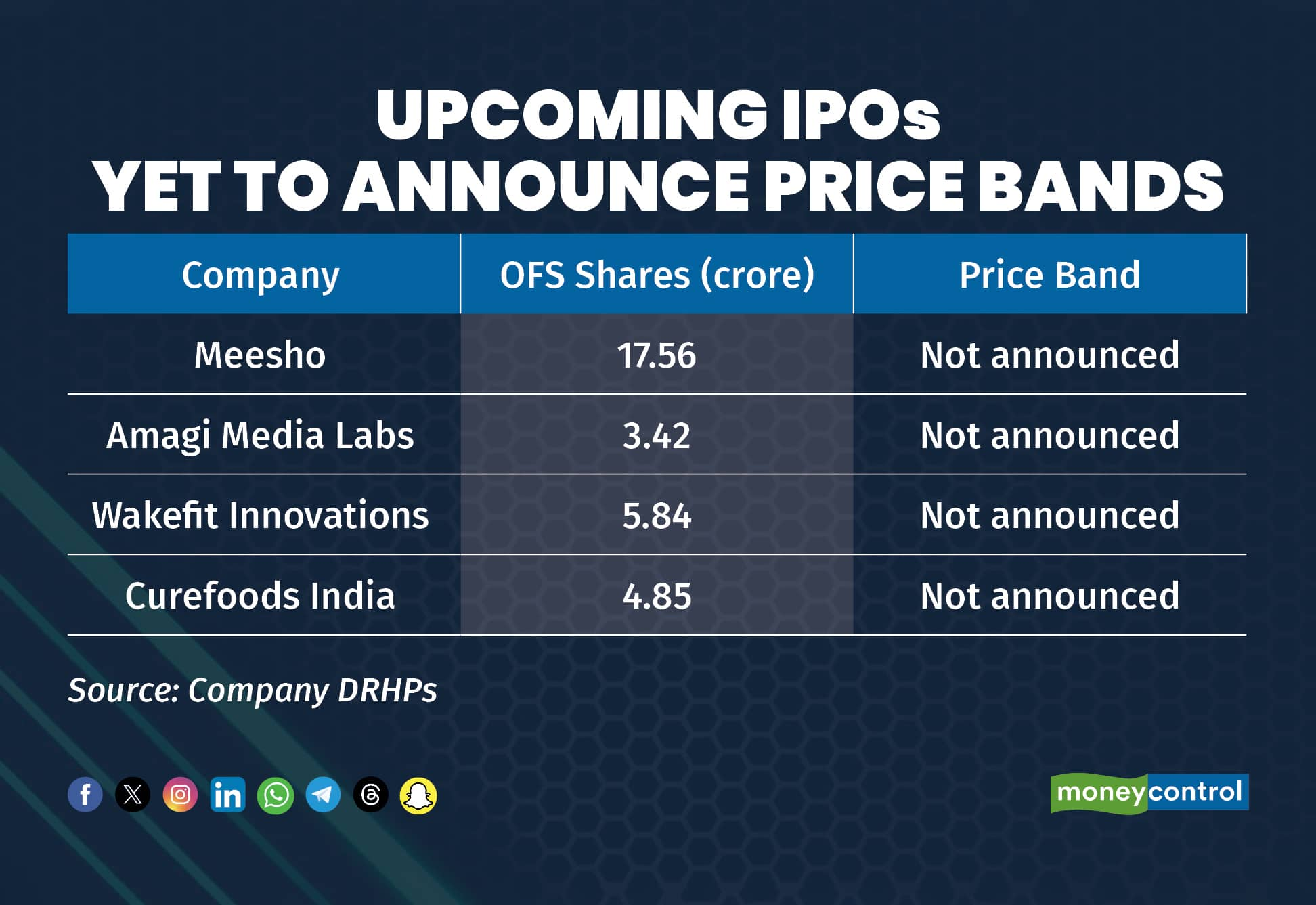

More IPOs in the pipelineFour other startups — Meesho, Amagi, Wakefit, and Curefoods — have filed draft prospectuses but are yet to announce price bands. Their filings detail the number of shares to be sold but not their rupee value. Once priced, these offerings are expected to lift total secondary proceeds well beyond Rs 15,000 crore, extending what has already become the largest liquidity event for Indian private capital in four years.

The latest listings have delivered robust gains for early investors.

In Urban Company, Accel India exited shares acquired at Rs 3.61 for Rs 103, an almost 29× return, while Elevation Capital earned 19× on its Rs 5.39 cost. In Bluestone, Accel’s Rs 57.9 cost turned into a 9× gain at Rs 517.

Lenskart’s issue at Rs 402 gave SoftBank Vision Fund about 5.4×, while Premji Invest booked a 17x return from its earlier entry at Rs 24.14. At Pine Labs, Peak XV Partners’ Rs 5.6 cost base implies a potential 39× return at the upper end of the band.

VC cashouts so farAmong priced IPOs, Peak XV Partners has stands to realise about Rs 2,444 crore from its share sales in Pine Labs and Groww combined — the largest venture cashout so far this year.

Accel India’s total proceeds from Urban Company and Bluestone amount to Rs 589 crore, while Elevation Capital, which sold a smaller portion in Urban Company, booked Rs 346 crore.

Among strategic investors, SoftBank Vision Fund stands to gain Rs 1,025 crore from Lenskart, while Premji Invest will gain Rs 350 crore from the same issue.

These gains reflect what venture and strategic investors have realised by selling a part of their holdings in these companies. They continue to hold significant stakes in several of these startups, which will further add to their returns as valuations rise. In addition, they stand to gain more as companies such as Meesho, Amagi, Wakefit, and Curefoods go public later this year.

Repeat sellers dominate this year’s exitsPeak XV Partners, Accel and Elevation Capital feature across several IPOs, underscoring how India’s venture ecosystem has matured into a steady pipeline of public-market opportunities.

Accel appears in Urban Company, Bluestone, Amagi and Curefoods, while Peak XV participates in Groww, Pine Labs, Wakefit and Meesho, giving it the broadest and highest-value exposure.

Elevation Capital and Iron Pillar have partial exits lined up, while late-stage funds such as SoftBank, Premji Invest, Verlinvest, Mirae Asset and Kedaara Capital are also trimming holdings.

A more disciplined IPO cycleUnlike the exuberant 2021 listings, this year’s IPOs are defined by measured valuations and healthier balance sheets. Many issuers — including Lenskart, Wakefit, Amagi, and Bluestone — are profitable or near break-even, making them attractive to domestic institutions.

The growing share of secondary sales within IPO structures also marks a shift in focus: India’s startup listings are now as much about returning capital to investors as about raising funds for growth.

With confirmed secondary proceeds of Rs 13,220 crore, 2025 is already the strongest year for investor liquidity since India’s first tech IPO wave. As larger issues such as Meesho and Amagi get priced, the total is likely to cross Rs 15,000 crore, cementing the public market’s return as a viable exit route for India’s venture ecosystem.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.