Think rich tycoon, a damsel in distress, fake marriages, misunderstandings galore—and love that conquers all. No, it’s not Pretty Woman or Judaai. It’s The CEO’s Secret Wife, served in 45 bite-sized episodes—perfect for a tea break binge.

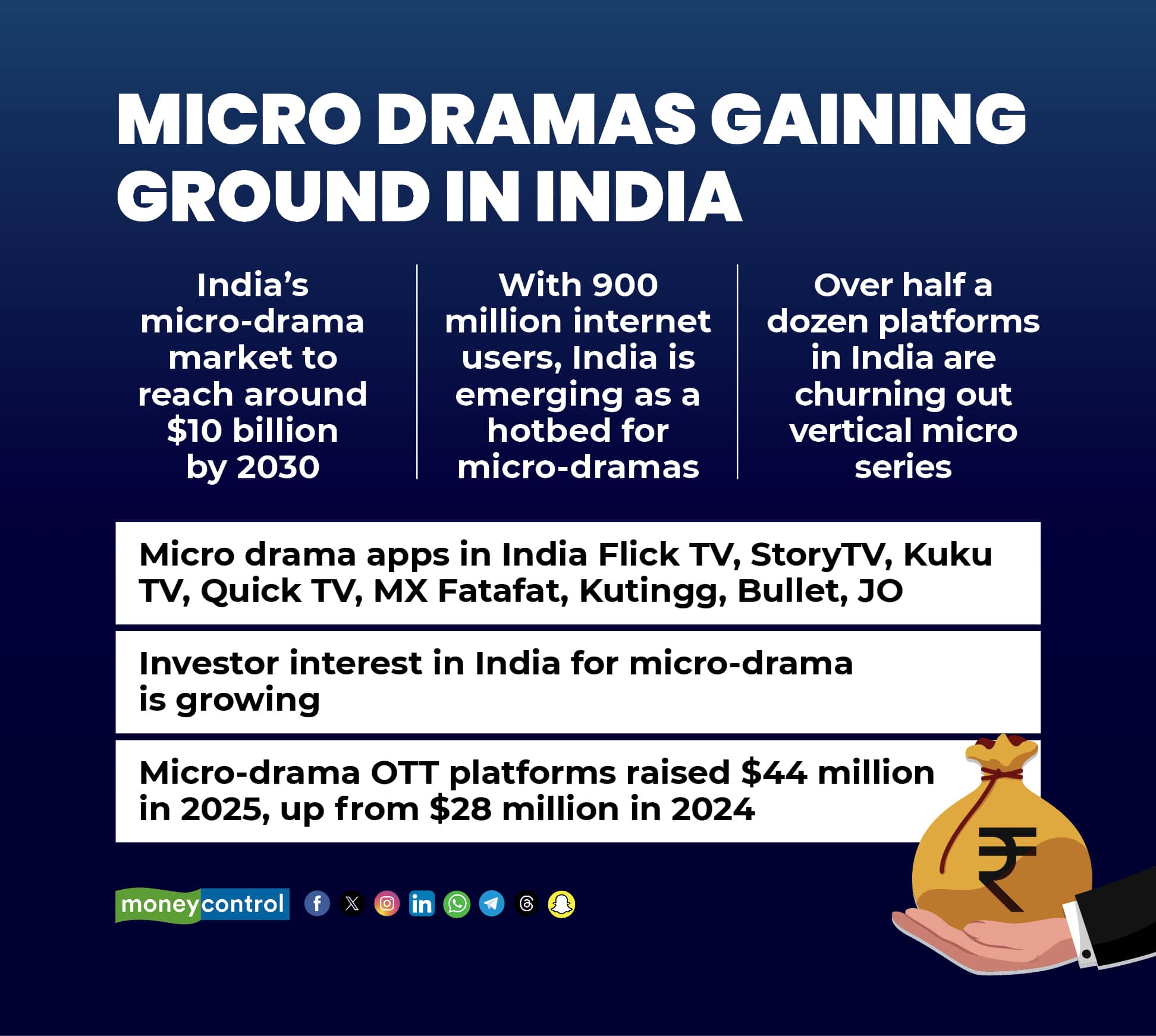

Swipe up, and you’re deep into another cliffhanger-cum-love story, a fast-paced thriller or murder mystery. At the heart of this content revolution are over half a dozen platforms churning out vertical micro series—the newest gold rush in India’s streaming ecosystem.

Chhota packet, bada dhamaka

With 900 million internet connections and a mobile-first user base, India is emerging as a hotbed for micro-dramas. “We expect the micro-drama segment to reach around $10 billion by 2030,” said Nitin Burman, chief revenue officer at Balaji Telefilms, which recently launched its own platform for such storytelling, Kutingg.

Kushal Singhal, co-founder of Flick TV, is more conservative but equally bullish. “China’s micro-drama market has scaled to $7 billion, and we believe India is not far behind with a projected $5-billion opportunity in the next five years," he said. He added that Indian consumers are showing “growing willingness to pay for premium short-form content across audio OTTs, live streaming and vertical content platforms.”

India’s own micro-drama ecosystem is fast filling up with standalone apps like Flick TV and platform-led ventures such as Eloelo’s StoryTV, Kuku FM’s Kuku TV, ShareChat’s Quick TV, Amazon MX Player’s MX Fatafat, Balaji’s Kutingg, Zee’s Bullet and JO from Gujarati platform JOJO.

Rewriting the script: Balaji embraces AI and snackable shows for future growth

Micro dramas gaining ground in India

Micro dramas gaining ground in India

Dialling up the drama

These bite-sized shows take just a few days to produce, cost less than a music video, and are fast turning into serious business. Some platforms now host over 200 titles. Kutingg, for instance, launched a month ago on the ALTT app, already has over 400 episodes and releases a new show each week. “Our downloads have increased by 20 percent since the launch. The highest consumption comes from males aged 18 to 30. We are a Hindi-first app with maximum reach in the top Hindi-speaking markets,” said Burman.

ReelSaga currently has 100 micro dramas. "We will add 100 more in next 1 year," said the platform's co-founder Shubh Bansal. The company recently raised $2.1 million in a Seed round led by Picus Capital.

Eloelo, which recently raised $14 million, is allocating capital specifically for this category. “We have the demarcated capital for new emerging businesses but what we are really focusing on right now is micro-dramas,” said founder Saurabh Pandey.

Flick TV is ramping up production with over 100 original micro-drama titles planned this year, spanning romance, thrillers and slice-of-life stories. The platform, which has already crossed 50,000 downloads, raised $2.3 million in seed funding from Stellaris Venture Partners.

Singhal shared that the idea for Flick TV came from an unexpected source: “I saw my mother binge-watching creator-led snackable dramas on Facebook, not on any mainstream OTT app. That moment revealed a clear gap: while Indian audiences are craving snackable, mobile-first entertainment, traditional platforms haven’t kept up with this shift in behaviour.”

JOJO’s founder Dhruvin Shah had a similar insight after seeing his grandmother rewatch a reel with spiritual themes on Instagram.

For Amazon MX Player’s Amogh Dusad, the format’s appeal lies in its ability to fit into fleeting moments: “Micro-dramas—bite-sized, serialised storytelling—will be an important part of our content offering, designed to meet the evolving consumption habits of our audience,” said the platform's director and head of content.

Micro dramas sit at the intersection of two unstoppable trends: short-form video consumption and serialized storytelling, noted Bansal. "India’s mobile-first audience has grown up on reels, but they’re craving emotionally richer content. Investors are seeing this as the next format shift—much like what happened in China, where microdramas now generate more revenue than traditional box office."

Rising investor interest

Investor interest in the micro-drama space has steadily grown over the past few years, with capital now flowing in more confidently as early signs of traction and monetisation emerge. Startups in this space are being seen as the next frontier in digital entertainment—combining short-form convenience with the storytelling depth of OTT offerings.

According to data from market research firm Venture Intelligence, micro-drama OTT platforms raised $44 million across six rounds in 2025 so far—a significant jump from the $28 million raised across five deals in all of 2024. The same amount was raised in 2021, but across more deals, indicating growing ticket sizes.

Stellaris Venture Partners, which backed Flick TV, believes micro-dramas fill a crucial gap. “It’s the best of both worlds—short video combined with emotionally engaging drama, suited for a mobile-native audience,” said Mayank Jain, investor at Stellaris. He noted that with the rise of AI, production has become cheaper and faster, especially for genres like mythology, horror and sci-fi. But he cautioned that success in this space will hinge on “content velocity, as well as content freshness”, which he termed as critical.

Monetisation models are still evolving, Jain added. “For the micro-drama category, given it’s a sunrise segment, monetisation hasn’t been proven. Our hypothesis is that a bulk of the monetisation over the long term will be consumer-led.”

Kitty Agarwal, partner at Info Edge Ventures, noted the convergence of multiple trends: shorter attention spans, growing demand for entertainment and rapid advancements in generative AI. “This is a combination of a couple of trends,” she said. “At the same time, it’s very easy to get a pretty deep library of shows… And with AI, you can now produce very realistic videos at scale and lower cost.”

She also pointed to rising comfort with micro-payments among Indian users. “Very few people in India still want to pay for long-term subscriptions. But people are okay... You show them five episodes free, and then ask them to make a small payment to unlock the next 25. People are becoming more and more comfortable with that.”

But Agarwal also flagged the challenges ahead. “It still remains to be seen what kind of content will get retention. A lot of clickbait-y stuff is happening... This is a capital-intensive game. I don’t think too many players are going to be able to survive.”

Who pays? And how much?

As platforms compete to grab viewer attention, monetisation models vary. Some are experimenting with subscriptions, while others are testing freemium models or ad-supported formats.

Eloelo is currently offering some free episodes while testing multiple models. “We will do multiple experiments on how many episodes we should keep free, should we make the cliffhanger monetisable, etc.,” said Pandey. The platform reported Rs 250 crore in annual revenue run rate last year, all through micro-transactions by users from tier 2 and 3 towns.

Flick TV is taking a hybrid approach—starting with micro-payments per episode and eventually moving to subscriptions. Kutingg is building a coin-based pay-as-you-watch model and plans to introduce ads that let users earn coins by viewing them.

Amazon MX Player, which runs MX Fatafat, is betting on its scale—250 million active users and over 1 billion downloads.

ShareChat is taking a two-pronged approach. It recently launched QuickTV, a subscription-based product, and has simultaneously started distributing free-to-watch micro-drama content on its short video app Moj.

“Until and unless you have a large user base of at least 5 to 10 million users spending at least 10 minutes a day, you don't have a meaningful proposition for the advertisers,” said Manohar Singh Charan, CFO of ShareChat and Moj.

Micro-dramas have already been adopted by 15 million Moj users and Charan expects this number to cross 30 million in a month. “Those users who consume micro-dramas are now consuming about 100 million episodes on a daily basis,” Charan said. He added that once brand marketers start adopting the micro-drama genre, this format has the potential to double ShareChat's advertising ARPU (average revenue per user) in 12-18 months.

But he thinks the ad-supported model will be much harder to pull off for most new entrants. “For a new player starting from scratch, it is at best a choice between pay-per-episode and subscription. Ad is not a choice for them because they will have to spend a substantial amount of capital to acquire a critical mass of users and equal amount of tech investments on building an ad stack before they can see the first dollar of ad revenue. The other challenge is the unit economics of subscription models... It may cost as high as over Rs 400 to acquire one paying user who pays Rs 350-500 per quarter, with 70-75 percent likely to churn after the first quarter itself.”

Backstage boom

Unlike TV and film, micro-dramas are fast and cheap to produce—and that’s opening up work for thousands of creators. Burman said most shows require two to three days of shooting. “We are focused on creating high-quality content at the lowest possible budgets,” he said.

Charan estimated costs at Rs 10,000 per minute, or Rs 6 lakh for an hour-long series. Pandey added that cities like Mumbai and Indore are seeing rising demand for independent artists thanks to this boom. “We are going to launch a new micro drama every day at 12 am... This will lead to massive employment for a lot of these actors.”

Singhal added that they’re building on-ground production studios and using AI heavily to scale. “Micro-dramas are produced in 20–25 days... We are also developing a next-gen content engine powered by generative AI and agentic workflows.”

The format also needs a different kind of writing—tight, twisty, emotionally high-stakes scripts. “Movie writers are not the ones who are writing micro-dramas,” said Pandey. “They are being written by two types of people—those who used to write ad films and those who have written TV serials.”

Big-screen dreams, small-screen format

Micro-dramas are also driving traffic to long-form content, said Dish TV’s CRO Sukhpreet Singh. On Watcho, its digital platform, shorter videos act as a hook. “Completion rates are higher. Videos less than 15 minutes do better.”

Watcho’s new creator-led OTT, Fliqs, already has 3,000 hours of uploaded content, with a growing share in the micro-drama format.

But the market may not support unlimited players. “A person who watches micro-dramas ends up spending 50 percent more time on a platform,” said Charan. “But there isn’t enough space for too many players. The market will have to consolidate.”

Shah of JOJO agreed: “There is already so much content going around... Micro-dramas will multiply that.”

But India has the population and the volume and micro-dramas will definitely amp up the average user watch time and retention, he said.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.