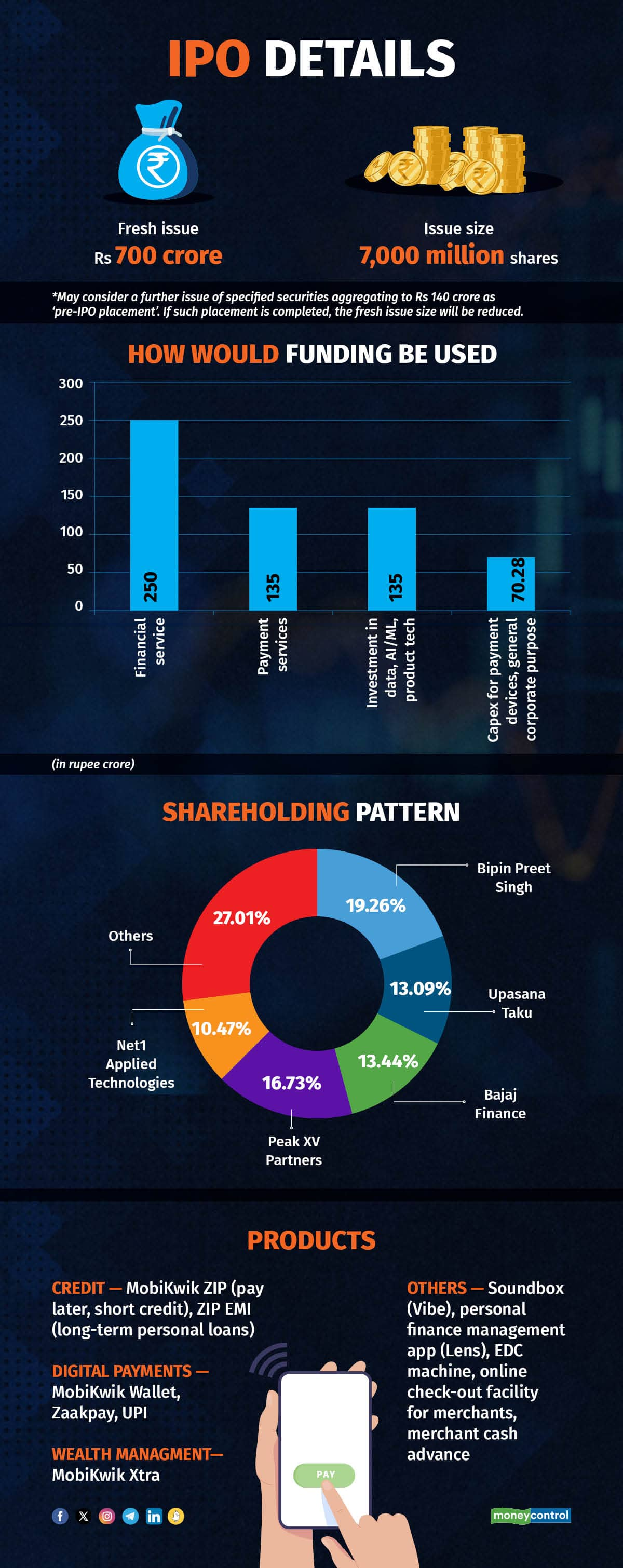

In its second attempt to go public, digital payments and financial services company Mobikwik filed a fresh draft red herring prospectus (DRHP) with SEBI on January 5 to raise Rs 700 crore through a fresh issue of shares.

This time around, the size of the proposed IPO is over 50% lower than the previous issue which was planned at Rs 1900 crore.

Over the last two years, Mobikwik claims to have focussed on profitability, expanding product suit to catch up with its peers.

While it did manage to hit two profitable quarters, it closed its FY23 with a loss of Rs 84 crore, and an almost flat operating revenue of Rs 540 crore. Even in the first half of FY24, its revenue from operations stood promising, but flat, at Rs 381 crore.

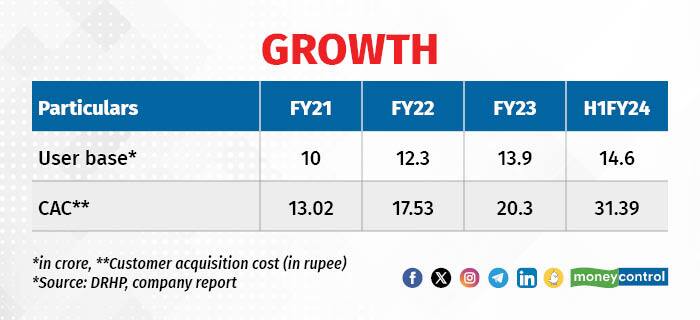

In terms of users, Mobikwik has over around over 14 crore registered, and is only behind PhonePe with 50 crore registered users, Paytm with 30 crore and Airtel’s payment bank with 15 crore users (in FY23).

Its customer acquisition cost, however, went up to Rs 31.29 in the first half of FY24, compared to Rs 20.30 in FY23.

User Base & CAC

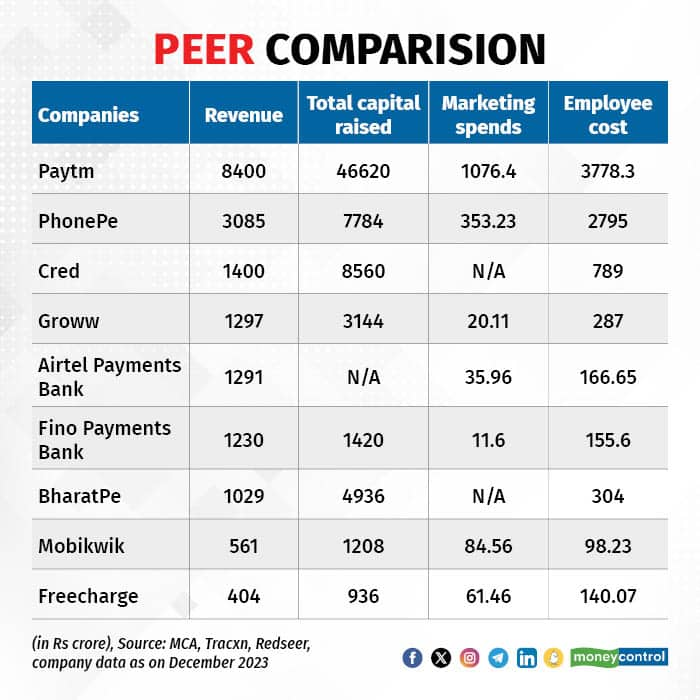

User Base & CACThe analysis further states that MobiKwik had one of the lowest employee cost per revenue among digital financial products and services platforms in FY23. Its revenue per employee metric stands around 0.18, where it is only behind Navi and Fino payment banks in the metric.

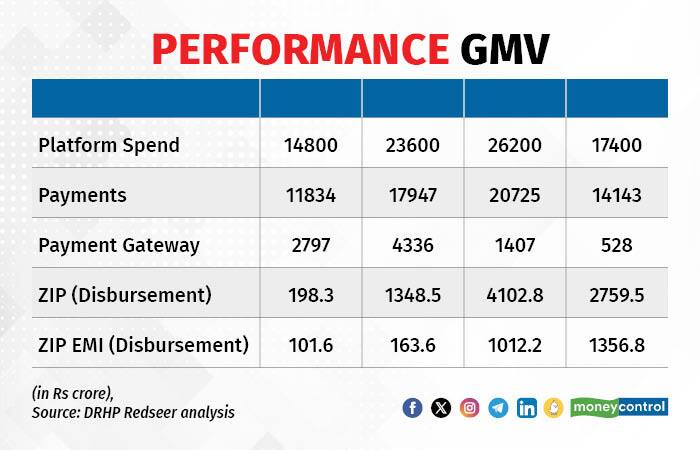

In FY23, MobiKwik disbursed Rs 4,102 crores worth of BNPL loans and has around 9-10% of the market share in the overall digital BNPL space, and Rs 1012.2 worth of long-term credit.

Though the numbers are small compared to its peers (Paytm at Rs 35,378 crore), the rise is significant compared to the previous fiscal. The company claims to be doubling down its effort to tap the credit space with almost 55% of its revenue now coming from the non-payments segment.

Being one of the oldest players in the space, Mobikwik has not been able to scale its businesses compared to its competitors.

On a side note, MobiKwik was rated as one of the most efficient digital financial product and services platforms in allocating marketing spending as of fiscal 2023 by Redseer.

For every Rs 1 spent on marketing, MobiKwik realised a revenue of Rs 6.64 as of Fiscal 2023. Other players like Fino Payments Bank, Groww, Phonepe and Paytm are ahead in this metric.

“MobiKwik stands out with its lowest negative EBITDA margin among payment service-focused players in Fiscal 2023. This showcased a relatively more resilient financial performance despite operating in a competitive landscape,” the report added.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.