Within three months of opening up for applications, CoinSwitch’s Web3 Discovery Fund is evaluating 150 Indian Web3 startups across use cases like infrastructure-related products and blockchain analytics, to name a few, even as the sentiment around crypto assets continues to remain low.

The fund, which is expecting to announce its first cohort of 10 start-ups soon, plans to invest in about 100 such startups by the end of 2024. The early-stage fund will be looking to write cheques of about $100,000-$200,000 and work as a bridge to introduce these start-ups and fund jointly in larger rounds along with its 20 VC (venture capital) partners, including Tiger Global, Ribbit Capital, Coinbase Ventures, Sequoia Capital, Woodstock Fund, Elevation Capital, and incubation partner Builders Tribe, a senior executive of the Discovery Fund told Moneycontrol.

The Discovery Fund has been sharing bi-weekly data with these VC partners on deal flows that they are evaluating.

Ashish Singhal, Co-Founder and CEO, CoinSwitch told Moneycontrol, “We already have about 150 start-ups that we are evaluating. In fact, our team has not been able keep pace with the kind of talent and innovations we are seeing coming in. Today, it is hard for retail users and businesses to search the Web3 ecosystem. So people have started building the Web3 equivalent of Web2 companies like Google, for crypto, etc.”

“We weren't expecting to see so much activity on the ground and meet so many founders and builders building specifically for Web3. The people who are building it come from different backgrounds. A lot of first-time builders are just coming out of college. Then there are seasoned professionals who have made exits in other projects, maybe like a Web2 project, and are now building something in Web3,” Parth Chaturvedi, Crypto Ecosystem Lead, CoinSwitch, who is heading the fund, added.

With the current regulatory uncertainty, high taxes, and most recently, the wide-spread distrust due to the FTX collapse, VCs have been wary of investing in futuristic technology-related projects and start-ups which are still at a nascent stage, several VCs told Moneycontrol during interactions.

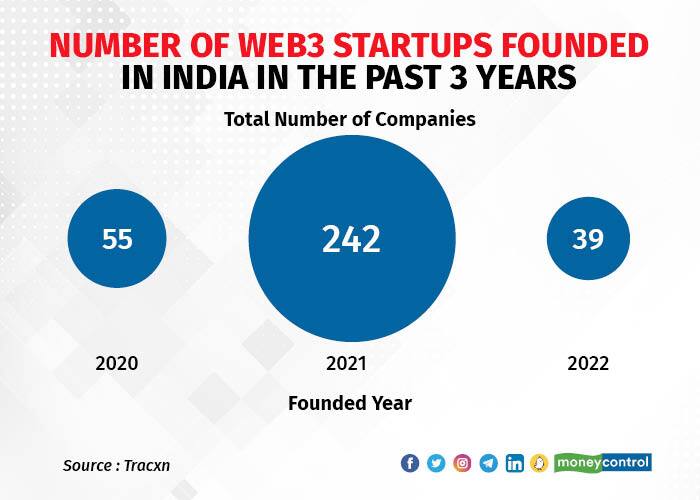

Chaturvedi said, “In 2020-21, we saw a lot of speculative projects — such as NFTs or those related to the metaverse — getting funded. Such projects are very far along down the line. In this bear market, we are seeing a lot of Web3 infrastructure products being developed.”

According to Chaturvedi, the applications for the fund included a lot of use-cases around blockchain analytics, self-custodial solutions for Web3 wallets, Web3 infrastructure-related products, etc. Self-custody wallets store `private keys’ that allow you to securely access your blockchain-based assets, such as cryptocurrency.

Similar to CoinSwitch's fund, its peers like CoinDCX have also forayed into venture capital with CoinDCX Ventures targeting early stage Web3 startups. This may be a boost for the Web3 ecosystem, but also sheds light on the ongoing pain in the pure-play crypto segment. In fact, CoinSwitch, a crypto exchanges aggregator, recently rebranded itself and plans to offer other asset classes like ETFs, mutual funds (MF), fixed deposits (FD), stocks, etc.

What’s driving the growth?

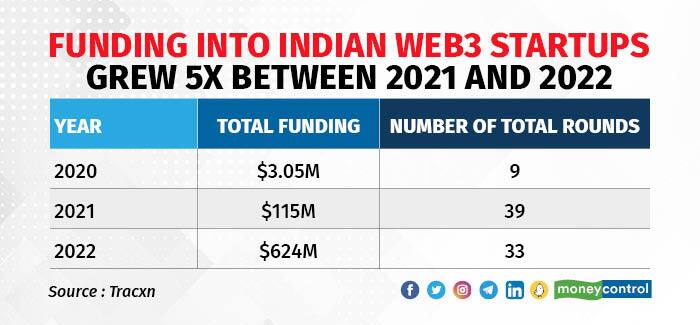

Despite a bear market, it turns out that Web3 startups in India raised about $624 million in funding across 33 rounds in 2022, compared to $115 million raised in 39 rounds in 2021 — a growth of over 5X year-on-year (YoY), according to data sourced from Tracxn.

“I look at it in three ways: blockchain is the underlying technology, which is changing everything. Crypto is the asset class, which tries to power this economy because you need incentives for these decentralised networks to run. And Web3 is the broader term where the way the internet is structured is getting changed at a very fundamental level, where owners of data also become participants in the new web that is being created,” Chaturvedi said.

He added, “In Web2, you might be creating content and posting it, but it all belongs to the platforms, it doesn't really belong to you. Whereas in Web3, because of the underlying blockchain technology, it is possible for the creators of the content to actually own it, and monetise it effectively. So, while interest in crypto and its prices have fallen, interest in building Web3 is on the rise.”

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.