Krishna KarwaMoneycontrol Research

In 2018, India's financial markets have been characterised by a high degree of volatility that has led to severe correction in certain pockets. On the upside, this has opened up interesting investment opportunities.

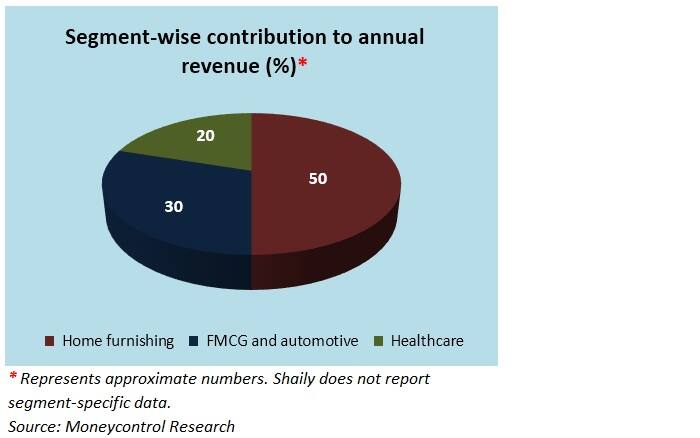

One such stock that is worth keeping on the radar is Shaily Engineering Plastics, a high-precision injection moulded plastic component manufacturer. The company's clientele includes some of the world's most well-known original equipment manufacturers (OEMs). It derives about 70-75 percent of its annual turnover from exports.

Why consider Shaily?

Home furnishing

Shaily's 14-year long relationship with a Swedish home furnishing major (SHFM) will come in handy at a time when the latter is scaling up its operations in India. So the company's revenue visibility for the coming fiscal years seems robust.

After opening its first store in Hyderabad in August 2018, the SHFM is planning to open its second centre in Mumbai in FY20 and a third one in Bengaluru by FY21-end. It also plans to invest Rs 10,000-11,000 crore to open 25 multi-channel stores (large format, small format, online) across India by FY25.

To meet the increased demand from the SHFM's end, Shaily will ramp up its manufacturing capacity.

In Q1 FY19, Shaily received an order from the SHFM to supply 6 new 'carbon steel furniture' products such as cabinets, shoe racks and tables. Realisations per unit for 'carbon steel furniture' are expected to be better compared to regular plastic furniture units. So the company should be able to derive higher asset turns (of up to 2 times) from its capital expenditure of Rs 40-50 crore for a dedicated facility, which will be commercialised in the second half of FY20.

Healthcare

This segment is divided into 2 sub-segments -- medical devices (insulin pens, dermatological pens) and primary packaging (child-resistant closures and bottles). Competitive intensity is low in both cases because of high entry barriers, steep compliance costs and clients' intolerance towards errors. As a result, Shaily gets some leeway on the pricing front to maintain its margins.

Some of India's leading export-focused pharma names procure packages, which have to be US FDA-compliant, from Shaily. Going forward, the company's target is to scale up utilisation levels at these facilities in tandem with the growth in its order book, while simultaneously introducing new products for different applications from time to time.

After seeking approvals from a US-based medical company, Shaily aims to earn revenue of around Rs 20 crore from sale of medical packaging goods by the end of this fiscal year.

Automotive

The size of the global automotive plastics market is likely to be over 18 million tonne by 2022, growing at an estimated rate of over 10 percent CAGR (compounded annual growth rate). Plastics provide considerable weight reduction for automobiles, thereby resulting in low fuel consumption and emissions.

Internationally-renowned automakers have been shifting their manufacturing bases to India, Thailand, China and Indonesia. This is largely on the back of government initiatives and the availability of affordable manpower in these countries. Shaily, by virtue of its business associations with some of India's and the world's best auto brands, has been able to manufacture specialised plastic components over the years and will continue to do so.

FMCG and wellness

India's beauty industry is among the fastest growing ones across the globe. This provides a good opportunity for Shaily to bag packaging orders from the top brands in the country. The company has the capability to meet varied demands for packaging products across categories such as cosmetics, wellness and consumables.

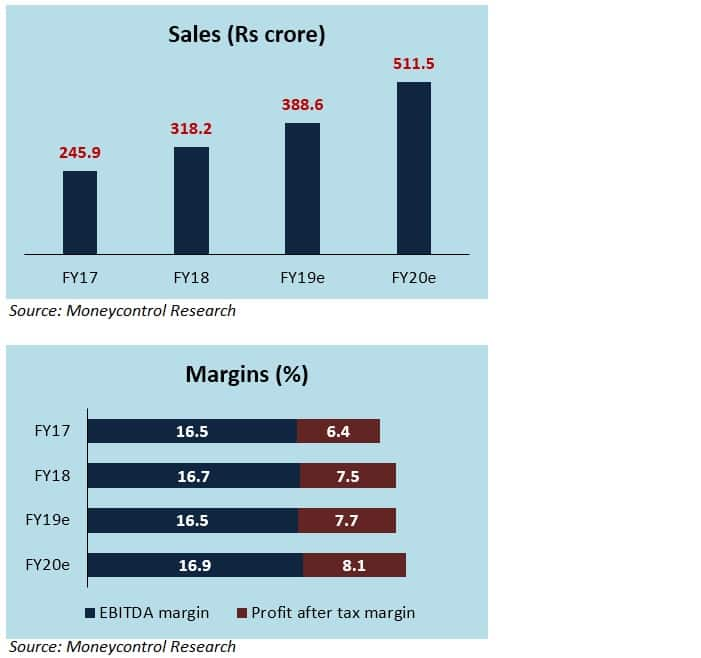

Cost normalisation

Labour and electricity costs, which rose in Q1 FY19, will normalise as the fiscal year progresses. This should aid margins.

Outlook

At a time when crude prices have been rising, revenue visibility in the home furnishing vertical, favourable growth prospects in the FMCG and automobile sectors, and a technological edge in medical packaging should offer Shaily some respite. This is because it is able to pass on any rise in raw material cost to its customers, albeit with a one-month lag.

However, margin accretion will largely depend on the utilisation at the company's healthcare facility, which has remained fairly low due to slower-than-anticipated demand from Indian pharma companies. Considering the SHFM's ambitious plans in India, Shaily may have to incur capital expenditure at regular intervals, especially if there is a new SKU to be added. An inability to derive the requisite asset turns will also dent margins.

After a sharp dip of 44 percent from its 52-week high, Shaily's stock is currenly trading at 17 times its estimated earnings for FY20. We advise investors to take advantage of the attractive valuation.

For more research articles, visit our Moneycontrol Research page

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!