PayU’s $4.7 billion buyout of payment gateway BillDesk, which makes it the biggest online payments company in India, gives it the economies of scale required for financial technology firms, or fintechs, to stay in the game for the long haul.

In an interview with Moneycontrol, PayU India’s chief executive officer (CEO) Anirban Mukherjee said the acquisition by the company, backed by Dutch investment firm Prosus NV, fits right into its strategy for India.

“PayU is trying to do three things in India. We are trying to become one of the leaders in digital payments, BillDesk’s acquisition is part of that. The second pillar is digital credit, we were one of the first companies to launch Buy Now, Pay Later. And third, we are trying to build a fintech ecosystem through partnerships, so we are trying to partner with entrepreneurs for that,” he said.

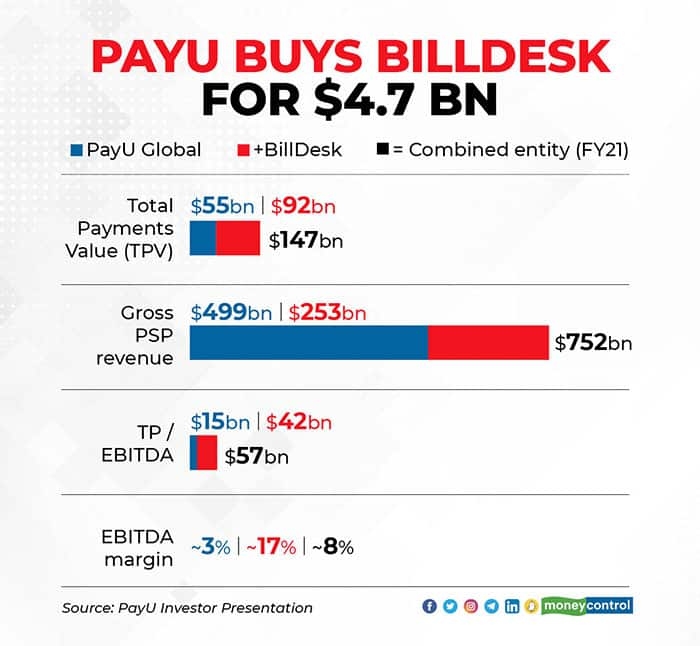

In the financial year 2021 , the combined Total Payments Value (TPV) of PayU and BillDesk was $147 billion, contributed largely by the latter. Prosus, an arm of South Africa’s Naspers Ltd, has described the acquisition as “transformative.”

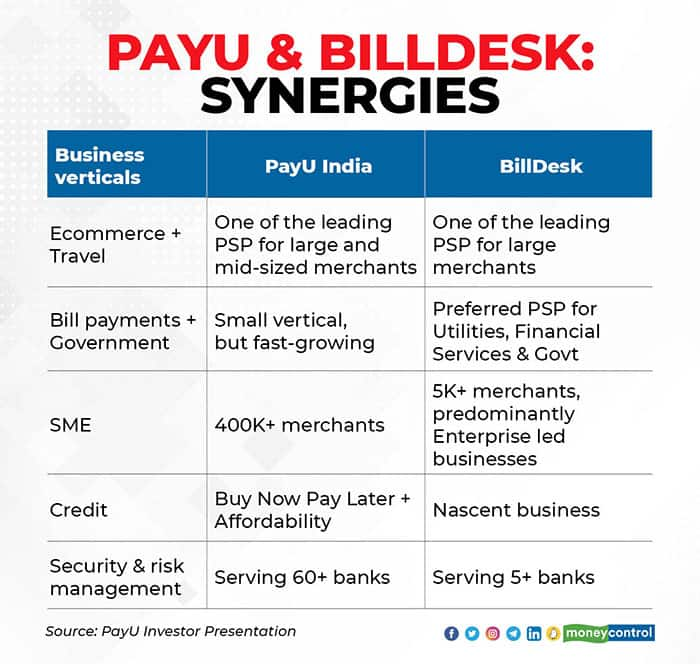

With PayU and BillDesk operating complementing businesses in India, the acquisition will help PayU address the gaps in its portfolio. BillDesk’s strength is its hold over utilities, government departments, and the Banking, Financial Services and Insurance (BFSI) segments. PayU is the go-to payments gateway for an array of internet companies.

“Combining BillDesk and PayU could create one of the leading digital payments companies that will be equal to the opportunity that presents itself. It is very important to understand the context,” Mukhejee said.

“Payments has grown massively in the last five years and the Reserve Bank of India (RBI) thinks we can achieve 10X more growth. So, building something strong is very important,” he said.

Mukherjee explained that it was premature to discuss how both companies can go about leveraging each other’s strengths as the closure of the deal is still some months away, pending approval from the Competition Commission of India (CCI).

“As of now, we have mostly talked about what product synergies exist between our two organisations. For the foreseeable future, things will work fairly independently of each other, except the places where we decide to synergize in terms of how we go to market,” he said, referring to the on-boarding of merchants.

The deal marks PayU’s fourth Indian acquisition, after Citrus Pay in 2016, Wibmo in 2019 and PaySense in 2020. Are there more acquisitions on the anvil?

Mukherjee said: “We always follow a mix of organic and inorganic strategies. Payments for now, we are happy with what we have done with BillDesk. In credit, we bought PaySense, built Lazypay and combined the two under PayU Finance. In broader financial services, you will see us take more partnership and investment-led route.”

India’s second largest internet deal after Walmart Inc’s acquisition of e-commerce company Flipkart in 2018 takes investments by Prosus in India to over $10 billion. PayU India and BillDesk will handle four billion transactions a year combined- four times PayU’s current size in India, according to Prosus.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.