Indian exports have so far braved the Red Sea crisis with outbound shipments registering a 3.1 percent rise in January, offering consolation that the country may escape the worst of the ongoing tensions at sea, but traders remain on the edge.

A survey by the Federation of Indian Export Organisations (FIEO), sourced by Moneycontrol, shows that Indian exports worth $64 billion could be impacted due to the Suez Canal crisis across a range of sectors, including plastic, rice and garments.

According to the FIEO analysis, around 14 percent of India’s total merchandise exports of $447.46 billion, as per FY23-levels, are suffering.

Since the outbreak of the Israel-Hamas war in October, the Red Sea has been in the news for periodic attacks by Houthi rebels of Yemen on commercial vessels passing through the Suez Canal, a crucial choke point for global maritime commerce.

For April 2023-January 2024, India’s goods exports stood at $353.92 billion, down nearly 5 percent from the first 10 months of 2022-23. The Red Sea strait is crucial for 30 percent of global container traffic and 12 percent of global trade.

Red flags

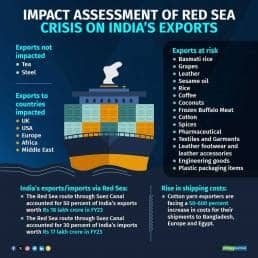

The FIEO survey of 170 exporters from across India reveals that the impact of the ongoing crisis is widespread. Some of the key merchandise exports that have been adversely affected include sesame oil, rice, coffee, coconuts, frozen buffalo meat, spices, pharmaceuticals, textiles and garments, leather footwear and accessories, engineering goods and plastic packaging items.

The survey showed that the maritime tensions have impacted the flow of Indian goods to countries and blocs such as the UK, the USA, Europe, the Middle East and Africa, among others.

India uses the Red Sea route through the Suez Canal to trade with Europe, North America, North Africa and parts of the Middle East. According to Crisil Ratings, these regions accounted for around 50 percent of the South Asian nation's exports worth Rs 18 lakh crore and about 30 percent of imports amounting to Rs 17 lakh crore last fiscal.

Given that about 30-35 percent of the production of agricultural commodities like Basmati rice is shipped to these regions, exporters are feeling the pressure as rising freight costs have curbed outbound shipments and a part of their inventory is now being sold in the domestic market, leading to a moderation in realisations, Crisil said in a note on January 25.

“The worst affected are certain food items or agricultural produce since it cannot survive the impact of being at sea for a longer duration,” an official from a trade advisory body told Moneycontrol.

This person added that the full impact of the Red Sea crisis is likely to be more visible in India’s export figures February onwards.

Uneven impact

However, some sectors are likely to remain unaffected by the delays and disruptions in the Red Sea.

While Basmati rice, grapes and leather exports are expected to be majorly impacted, India’s steel sector, wherein most of the demand is met through domestic supply, is likely to be unfazed.

“In the steel sector, which accounts for the largest pie in the metals sector, 95 percent of the demand is met through domestic supply. Hence, the Red Sea crisis will not have a major impact. Neither will there be much of an impact on the trade front since most imports are from East Asia," Crisil said in its February 2024 research note.

Unlike FIEO, Crisil sees minimal impact on India’s textiles industry in the near term with about three-fourths of the sector oriented towards the domestic market and the crucial festive season behind us.

Another trade body that primarily represents small and medium exporters expects a relatively moderate impact versus FIEO as it sees outbound shipments amounting to $25 billion getting affected due to the disruptions and delays with freight companies taking the longer route around Africa to reach the west, or waiting at nearby ports for safe passage through the Suez Canal.

Even India’s tea sector remained resilient with exports rising 6.92 percent, a three-month high, to $64.90 million in January 2024 despite the Red Sea crisis.

PK Bhattacharjee, Secretary General, Tea Association of India, says this is largely due to the government’s intervention, which led to banks providing maximum credit limits and Export Credit Guarantee Corporation (ECGC) keeping insurance premium rates unchanged despite the spike in shipping costs.

Cost crisis

An unanimous impact of the Houthi attacks has been the rise in overall shipping costs.

Rerouting around the Cape of Good Hope due to the Red Sea crisis is delaying shipments by two to four weeks, which is extending delivery window dates and affecting cash flow.

In its survey, FIEO revealed that cotton yarn exporters are facing a 50-600 percent increase in costs for their shipments to Bangladesh, Europe, and Egypt.

The Drewry World Container Index, which serves as a composite measure of container freight rates, reached $3,786 per 40-foot container in the week up to February 8, up 90 percent when compared with the same week last year, and 167 percent more than average 2019 (pre-pandemic) rates of $1,420.

Soaring freight and elongated transit times are trapping working capital, thereby increasing the demand for more resources when it comes to storage or inventory. The extended cycle, with higher costs and interest outlays, may ultimately reduce demand,” FIEO noted in the survey.

For Indian exporters, the threat of order cancellations looms large.

"My company Ceekey Global Trading in Calicut was regularly supplying Basmati rice to a buyer in Glasgow at a normal freight of $1,400-1,600 from Mumbai to Felixstowe in the UK. Today the current ocean freight on the route is nearly $3,100-3,200. The buyer cancelled this order since he cannot afford the cost," Munshid Ali, Secretary, Kerala Exporters’ Forum, told Moneycontrol.

As attacks on vessels traversing through the Red Sea, which began mid-November 2023, continue, exporters in India fear a prolonged crisis that runs the risk of escalating.

'Give more support'

Given these concerns, there have been demands from the government to go beyond what has been offered so far in helping exporters manage operational costs, including, subsidies and low-interest loans as India faces comparatively higher interest costs than China.

Bhattacharya articulates this fear well.

“Despite the tremendous support from the government, tea exporters are frightened, if the Red Sea crisis, that is Houthi attacks, continues, the situation could worsen,” he said.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.