Banks have rejected the demand for a forensic audit of Jaypee Infratech's financial accounts since its inception, thus delivering a blow to aggrieved homebuyers.

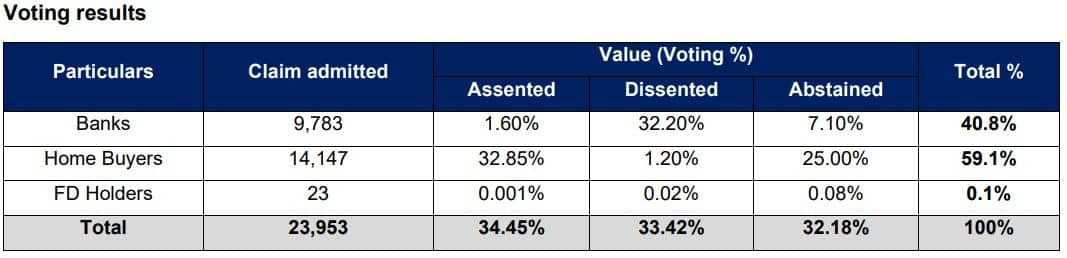

The item put to vote on February 21 was on conducting a forensic audit of corporate debtor from date of incorporation till March 31, 2014 and that the cost of the same be considered as part of the CIRP process. The Committee of Creditors required 51 percent votes to allow this to go through but only 34 percent of the lenders voted in favour of the audit.

"Banks are equally responsible or at least have knowledge of this financial mess created by Jaypee promoters. They were on the board of the company since the beginning. They do not want their wrong doings to come out in public. So all PSU banks voted against the resolution to conduct forensic audit since inception," said a Jaypee homebuyer.

Homebuyers have been demanding an independent audit to determine why Jaypee Infratech had failed to deliver the projects. Homebuyers are considered financial creditors under the amended Insolvency and Bankruptcy Code and their views are taken into account while deciding the resolution plan of the company.

The voting started on February 21 and went on until February 25, 2019. The results of voting were announced on Tuesday.

Moneycontrol has reached out to IRP Anuj Jain for his comment. The copy will be updated once he responds.

It will be another three weeks before the names of the companies that would take over the embattled firm are finalized. The two bids would be discussed at the next meeting on March 1

Lenders of Jaypee Infratech had met on February 18 to discuss the resolution plans submitted by state-owned NBCC and construction company Suraksha Asset Reconstruction Company to take over the realty firm and complete stalled projects, some of which have been delayed by over a decade.

In the recently concluded meeting of Committee of Creditors, the home buyers through their authorised representative had once again demanded for a proper forensic audit to be done of the financials of JIL since its inception.

Such resistance from the bankers’ side, creates apprehensions against the bonafide of banks itself, it is apparent that banks wish to safeguard themselves and are hence resisting demands of the home buyers for a forensic audit, homebuyers’ had said in a statement on Sunday.

Buyers also claimed that since the parent company Jaiprakash Associates had also tabled a settlement plan under the IBC, it shows that they had access to money all this while, and hence this should be looked into.

“It is imperative that such details are delved into properly through a proper forensic audit since inception of JIL. In the past the interim insolvency resolution professional had commissioned an audit of the transactions entered into/done at the behest of JIL, but with only a look back period of two years, which does not serve the purpose,” the statement had said.

“The home buyers themselves had commissioned a parallel audit of the JIL’s financials based on the freely available documents and details, and came to a conclusion that heavy siphoning of funds did occur… But such a study done at the behest of the home buyers, suffered with its own latent disabilities such as no access to exact records and a limited look back period,” the statement added.

Embattled firm Jaiprakash Associates has for the second time submitted a proposal to lenders of its subsidiary Jaypee Infratech for settling dues worth Rs 10,000 crore.

Mumbai-based Suraksha group has made an offer of about Rs 20 crore as upfront payment and land worth Rs 5,000 crore. It has promised to complete pending projects in three years.

NBCC has proposed incorporation of an NBCC SPV for the purpose of acquiring a majority stake in the corporate debtor. It has proposed pumping in an upfront amount of Rs 500 crore (part equity and part debt) within 90 days of the approval date to acquire the embattled company, sources say.

It has offered 1,400 acre land worth Rs 3,000 crore as well as Yamuna Expressway highway to lenders. NBCC has suggested that banks should raise about Rs 2,000 crore against the expressway and provide half of the amount (Rs 1,000 crore) to the PSU, which will utilise this fund as an upfront payment. NBCC will also fund the gap of about Rs 1,500 crore between estimated construction cost and receivables from customers.

In its bid, NBCC has promised to deliver flats to homebuyers in four to five years from the transfer date, subject to the availability of the cash flows from the respective projects. The delivery of plots will begin in 2020 and most of the villas and apartments are expected to be delivered by 2021 until 2024.

In October 2018, Insolvency Resolution Professional Anuj Jain started a fresh initiative to revive Jaypee Infratech on the NCLT direction after lenders rejected the over Rs 7,000-crore bid of Suraksha group.

Jaypee Infratech Ltd has an outstanding debt of nearly Rs 9,800 crore, of which Rs 4,334 crore pertains to IDBI Bank. Other lenders are IIFCL, LIC, SBI, Corporation Bank, Syndicate Bank, Bank Of Maharashtra, ICICI Bank, Union Bank, IFCI, J&K Bank, Axis Bank and Srei Equipment Finance.

vandana.ramnani@nw18.com

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.