SIPs or systematic investment plans have become everyone’s favourite way to build wealth bit by bit. It’s easy, automatic and you don’t need a lump-sum investment amount to kick it off—one can start with as little as a few hundred rupees a month.

However, while SIPs are a great way to grow your money, there’s a better way to do it that can give you even better returns. A smart SIP approach helps you make the most out of your investments by tweaking how much and when you invest, making your SIP strategy work even harder for you.

Let’s understand the interplay between regular SIP and smart SIP to frame a better choice.

Regular SIP

A regular SIP is the classic approach where you contribute a fixed amount every month or your desired interval towards your investment, marked by the ease of accumulating your desired corpus over time without worrying about market fluctuations.

Also read | How to build ₹1 crore in 15 years with a ₹10,000 monthly SIP

However, regular SIPs don’t account for changes in your disposable income. As you progress in your career and your income grows, your SIP amount stays the same, which means you might not be fully utilising your increased financial capability to build wealth.

Smart SIP

This is where the two concepts of a smart SIP comes into play.

Step-up SIP: The step-up SIP approach is all about gradually increasing your investment amount according to your financial growth. With this method, you top up your SIP by a certain percentage each year. Say, you start with Rs 5,000 a month. In the second year, with a 10 percent step-up, that amount becomes Rs 5,500, and so on. This strategy aligns your SIP with your annual income increases, putting your extra disposable income to work and helping you grow your wealth faster.

Trigger SIP: Trigger SIPs take advantage of specific market events, which require a bit more tactical approach. This method allows you to invest additional amounts when a particular market event occurs, like a dip of 5 percent or 10 percent, for example. By buying more units when prices are down, you lower your average cost, which can boost your returns in the long run. But this approach requires a close watch to be kept on market movements, making it better suited for investors who are comfortable tracking the market.

Also read | Can energy-focused mutual funds power up your investment portfolio?

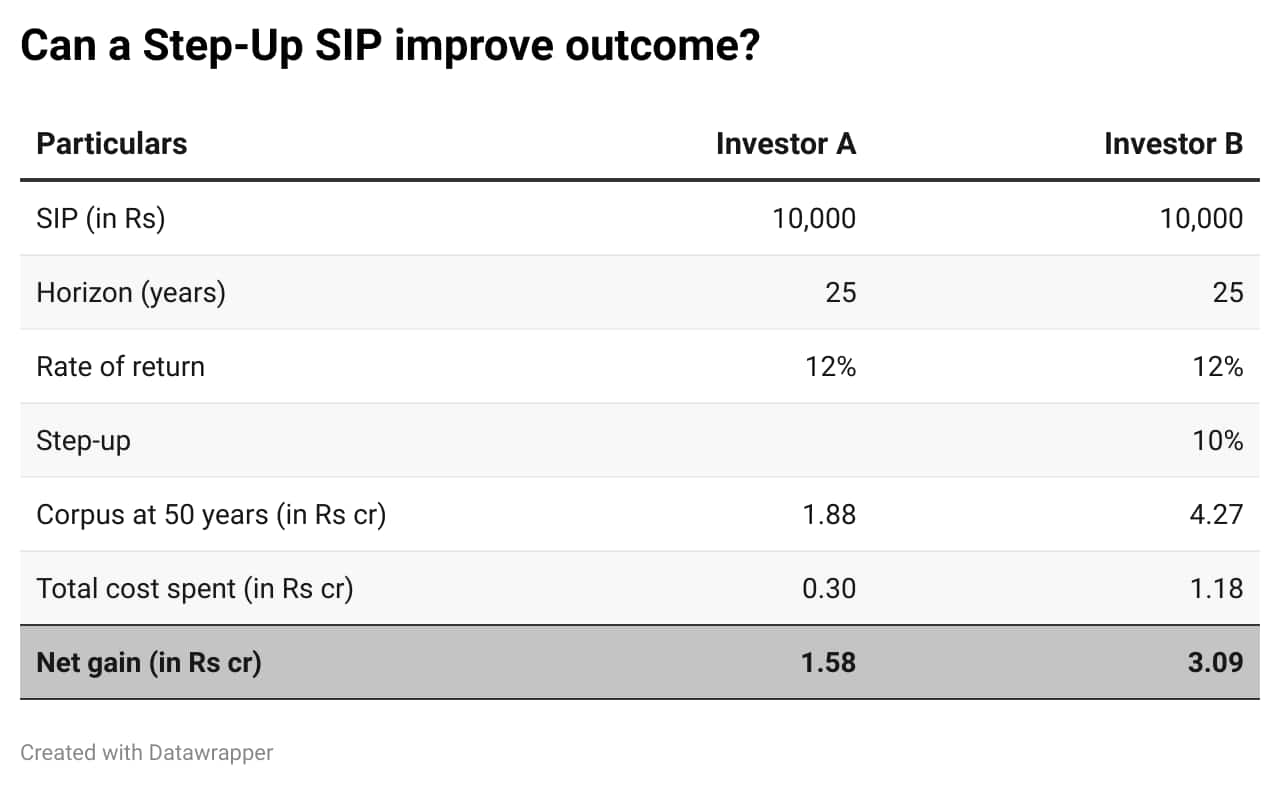

Let’s now see how smart SIPs can create a difference and boost your returns. For the purpose of illustration, assume that investor A and investor B started investing Rs 10,000 monthly from the age of 25 years, and that we track their record till the age of 50. Investor A went in for the regular SIP model while investor B opted for the 10 percent step-up in his SIP. In this scenario, we can see B created a corpus of Rs 4.27 crore, which is Rs 2.4 crore higher than that of A because by adopting the smart SIP, and his net gain was also derived at 90 percent higher than A.

This example highlights how a step-up SIP can drastically improve outcomes with the same initial investment.

Optimal asset allocation for SIPs at a portfolio level

For a well-balanced portfolio, it is essential to allocate assets wisely. A recommended equity-to-debt allocation is 80:20, targeting an estimated 12 percent return over the long term. Additionally, diversify across market capitalisations with a mix of large-cap, mid-cap and small-cap funds in a ratio of about 55:20:25. This allocation minimises concentration risk and allows you to capture growth across different segments of the market. Apart from this, you can also consider diversifying across diversified categories of mutual funds to get to the desired market capitalisation exposure.

Also read | Here are the top small-cap stock picks of PMS firms amid market correction

SIPs come with the benefit of rupee cost averaging being one the most affordable investments, allowing a relative amount of flexibility to investors. Moreover, you do not need to time the market and yet you can get a return of 12-13 percent in the long run. Investors should not simply wait for the right time to invest; instead, simply set your goals and asset allocation strategy based on risk and return appetite level.

To wrap up, SIPs are a great way to start building wealth without needing a huge sum up front. They are convenient, automatic and get you in the habit of consistent investing. But if you are looking to get the most out of your money, a smart SIP approach could really step up your game and get to a brighter financial future.

The author is the Deputy CEO of Anand Rathi Wealth LimitedDisclaimer: The views and investment tips expressed by experts on Moneycontrol are their own and not those of the website or its management. Moneycontrol advises users to check with certified experts before taking any investment decisions.Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.