The start of a brand new year inspires many of us to make all sorts of resolutions. Of these, the ones pertaining to money are among the most important, as proper money management helps you achieve many other goals. There’s only one problem: keeping up with them as the year goes by.

Here’s an idea.

Moneycontrol Personal Finance has a list of 12 money resolutions for you. To keep things simple, we have only one resolution a month for you to keep up with. Just set aside 12 days in the entire year (2024) for these resolutions, and you’ll be well on your way to achieving your financial goals.

January: I will file my investment declarations on timeThis is typically the month when employers ask their employees to submit proofs of their tax-saving investments made during the year. That is, if you had chosen the old tax regime while declaring your proposed investments at the beginning of the financial year.

You can make these investments until March 31. However, if you do not file your investment declaration before the deadline, your employer will calculate and deduct income tax payable without considering the tax-saving deductions you are eligible for. This will mean a higher tax outgo and lower salary in hand during the last three months of the financial year. While you can always claim a refund of excess taxes deducted, it is a hassle best avoided.

Also read: The ultimate guide that helps you choose between new and old income-tax regimeFebruary: I will make NPS a part of my retirement-planningJanuary to March is usually the time for making tax-saving investments. And we’ve got a terrific tip for you: the National Pension System (NPS).

The NPS is emerging as an effective investment tool for retirement planning. It has become more investor-friendly over the years, thanks to the government tweaking its features, and additional tax benefits.

If you have chosen the old, with-exemptions regime, you can claim tax deductions of up to Rs 1.5 lakh under section 80C, and an additional benefit of Rs 50,000 under section 80 CCD (1B) on your NPS contributions.

If your employer contributes to your NPS, a contribution of up to 10 percent of your basic salary is exempt from tax under section 80CCD(2). The deduction on employers' contribution is available under both the old and the new regimes.

March: I will not buy insurance-cum-investment policies to save taxesResolutions needn’t just be about what you should do. They could also be about things you should avoid. And when you are rushing to make your last-minute tax savings, here’s what you should avoid: insurance-cum-investment policies, such as endowment plans, and unit-linked insurance policies (ULIP).

In a hurry to claim tax deductions under section 80C, many give in to the agent’s recommendations without ascertaining the policy’s suitability. It is best not to mix insurance and investment needs. Such policies come with higher surrender charges. Returns are also far lower than competing products.

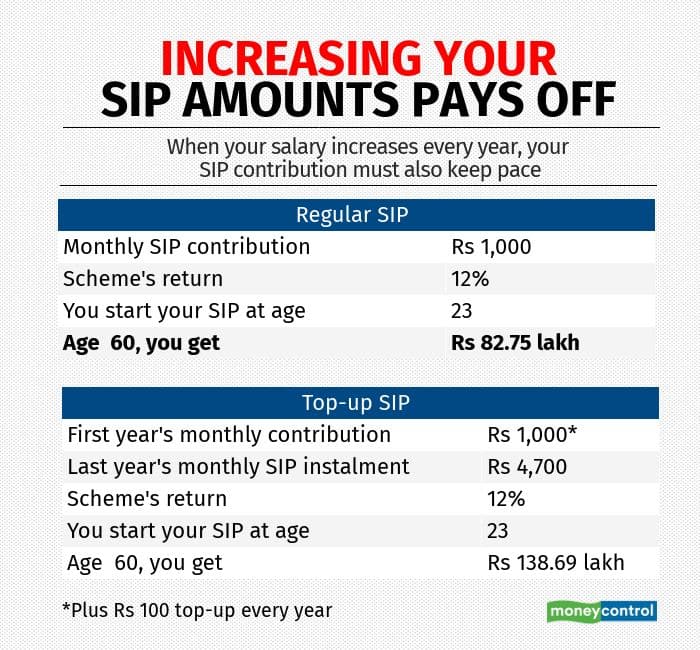

Also read: Why traditional life insurance policies aren't great long-term investmentsApril: Start a systematic investment plan (SIP)The start of the new financial year is the time to form a good habit. Save some money from your income every month and start a systematic investment plan (SIP) in a mutual fund (MF) scheme. And the sooner you start, the better, because your money gets more time to work for you (see graphic).

Here’s a tip. You can start with a small sum and increase the amount as your salary goes up over time (see graphic).

Your savings rate will also be a function of the stage of life that you are in. Kalpesh Ashar, a certified financial planner, provides some numbers. He says, “The savings rate for an unmarried person with no liabilities should be 30-40 percent (of income), and for a married person with one child it should be 15-20 percent.”

May: I will not ignore health and term insuranceBesides your investments, you also need a good health insurance cover. If you have dependents, ensure that you have adequate pure risk term cover too, that can take care of their financial security in your absence. While the right method to calculate the ideal life insurance cover is by taking into account your income, expenses, assets, liabilities, and goals, as a thumb rule, you must have a minimum cover of 10-15 times your annual income.

Likewise, health insurance is indispensable, even if you do not have dependents or are covered under your employer’s group health cover. A 35-year-old individual should have a health cover of at least Rs 10 lakh to start with. She should review it every five years to account for inflation and change in personal circumstances.

June: Don’t forget goldThe year 2024 is a prime example of why adding gold is key to portfolio diversification. After underwhelming performance in 2021 and 2022, many investors did not add gold to their portfolio. However, a 15 percent rise in the yellow metal in 2023 proved them wrong. Gold should be an important part of a diversified investment portfolio, as it can deliver inflation-beating returns and act as a hedge.

July: Make a willIt is important that your hard-earned money is taken care of even after you’re gone. If you have a spouse and/or children, then it becomes your responsibility to ensure that your money gets passed on smoothly to whoever you want to bequeath your wealth to. A will is a document that helps do just that.

Take an inventory of all your assets and decide what you want to give to whom after you’re gone. If you have property, then get your will registered. If you have one property and more than one child, you need to decide how you’ll distribute it. Whoever you intend to appoint as your executor, check with him or her first if they’re willing to come on board. And after you make your will, tell them where you have kept a copy.

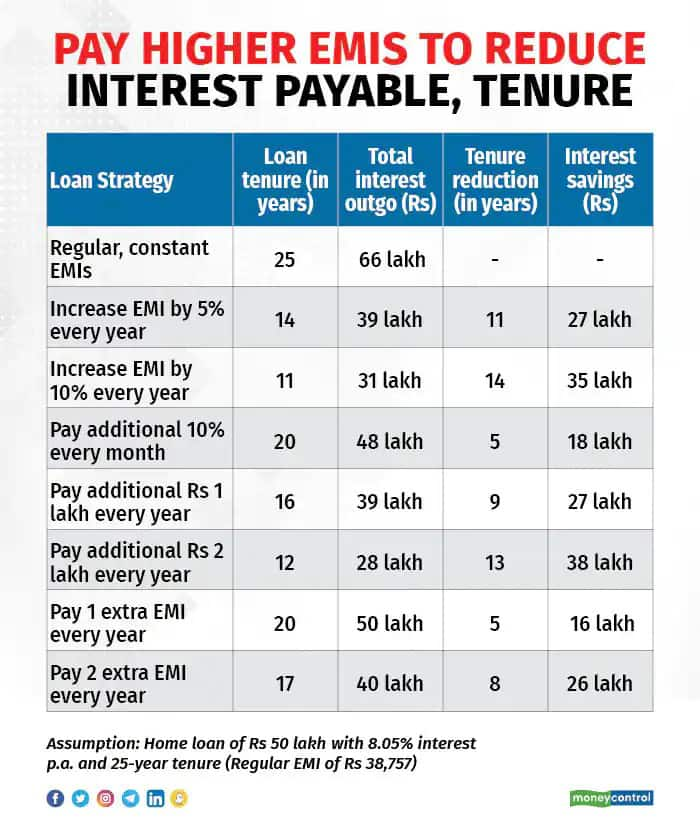

August: Reduce your home loan burdenUse your annual increments to pay off your debts. Or try to pay one or two extra EMIs (equated monthly instalments) every year. It’s always a good idea to prepay your home loans. The lower your burden, the higher the amount you can set aside for your investments.

Apart from your annual bonus, dip into the surplus cash in your savings accounts, fixed deposits, or traditional insurance plans that aren’t yielding much, and use that to pay off your home loan and become debt-free.

It’s the middle of the financial year and time for a portfolio review. Keep a close eye on your asset allocation.

In 2023, all asset classes – equity, gold and debt – did well. But make sure you aren’t over-invested in equities. Therefore, if you find that equities have gone overboard, take some money off the table and put it in other assets. This will bring your asset allocation back to where it belongs.

October: Do not overspend using credit cardsFestive seasons bring lots of shopping offers. Cards offer rewards, cashbacks and discounts to sweeten the deal. Since credit cards offer a significant interest-free period, there may be a tendency to overspend.

If you do that and cannot pay your credit card bill on time, you will incur hefty interest charges ranging from 28 to 49 percent per annum, along with late payment fees. Also, your credit score will get impacted and future borrowings might attract at a higher interest rate.

November: Teach your kids about moneyNovember 14 is Children’s Day. How about teaching your kids a few money lessons?

According to Mrin Agarwal, Founder-Director, Finsafe India, a financial education company, parents can teach their children the value of money more through their actions rather than words. She says, “Children imbibe money habits from their parents. Hence, adults need to focus on their spending and saving habits, like sticking to a budget, getting children to see price tags, and not giving into every demand of the child.”

Renu Maheshwari, a SEBI-registered investment advisor and Founder of Finscholarz Wealth Managers, says that when you go shopping, if your child wants something, sensitise your child about how much it costs and encourage her to think about whether she really needs it.

Another good lesson is teaching your kids to make money decisions. Often, on foreign holidays, we pass through numerous gift shops. Cap the number of gifts your child can have and then let them decide what they’d like to buy. This prevents them from being tempted every time you pass through a gift shop.

December: Build an emergency fundMany of us realised the importance of an emergency fund in 2020 and 2021, during Covid-19. Having an emergency corpus helps you tide over any sudden setback, like a job loss or a drop in income.

If you don’t have an emergency corpus, build one. Besides setting aside a portion of your monthly income, you could also take some money off the table if you’ve made a good profit from your equity investments.

How big a corpus do you need? Financial planners recommend at least 6-12 months’ worth of your living and non-negotiable expenses.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.