Budget 2023 was no ordinary budget. Finance Minister Nirmala Sitharaman made a host of announcements affecting personal income tax for individuals. Ever since the new income-tax regime (lower tax rates, exemption-less structure) in early 2020, it was left largely untouched. But a low pick-up and lack of awareness has spurred the finance ministry. Budget 2023 has put more zing in the new income tax regime.

The measures impact all income tax slabs under the new tax regime. Individuals will now have to fish out their calculators and spend time with their chartered accountants to ascertain which tax regime minimises their tax outgo.

Also read: New slabs, more rebate — 5 big personal income tax changes in Budget 2023

Moneycontrol decodes the February 1 announcements to help you decide.

Who should switch to the new tax regime?

The answer to the most important question on all individual taxpayers’ minds depends on their income levels and exemptions they claim.

For most tax slabs, the higher the deductions (under Sections 80C, 80D, 24b on home loan interest paid and so on), the less attractive the newer regime will be because the tax breaks reduce the taxable income and tax payable under the old regime.

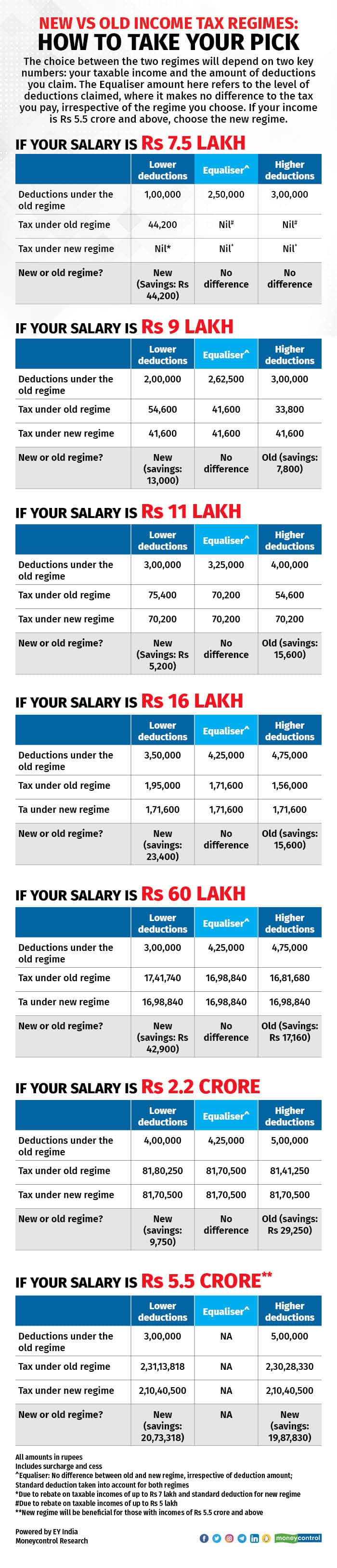

For example, if your salary is Rs 16 lakh and you avail of deductions of up to Rs 4.75 lakh, switching to the new regime will mean higher tax of Rs 15,600, as per EY India calculations. However, if you claim deductions of Rs 3.5 lakh, you will save Rs 23,400 by moving to the new regime.

For those who claim deductions of Rs 4.25 lakh, there will be no difference, though moving to the new regime will mean less paperwork. This is the breakeven point – deductions higher than Rs 4.25 lakh will make the old tax regime beneficial, while lower deductions make the new regime more lucrative.

For the super-rich – those earning over Rs 5 crore – the answer is fairly simple. Reduction in the effective tax rate to 39 percent from 42.74 percent under the new regime will sharply reduce their tax outgo. As per EY India’s calculations, such individuals will save close to Rs 20 lakh if they switch to the new regime, assuming deductions of Rs 5 lakh.

Also read: Budget 2023 | Old vs new tax regimes: Who should make the switch?

Is the new tax regime beneficial for those just starting out or for low-income earners?

For salaried individuals with incomes of up to Rs 7.5 lakh, tax under the new regime will be effectively zero. This is because of the standard deduction of Rs 50,000 introduced in the new regime, along with a rebate of up to Rs 25,000 for incomes of up to Rs 7 lakh.

However, if such individuals claim aggregate deductions of at least Rs 2 lakh under various sections, in addition to the standard deduction of Rs 50,000, their taxable income under the old regime, too, will be zero. This is because the taxable income will dip below Rs 5 lakh, making them eligible for the rebate.

Also read: Budget 2023: Earning between Rs 5 lakh and 7 lakh? Here's how much you will save

Therefore, the new regime offers the same benefit to this income bracket even without deductions and exemptions under chapter VIA and various other sections. So how should taxpayers in this income slab view tax benefits and the old tax regime now?

“People in India do not have any social security net and hence, the savings habit is deeply ingrained in many. They will have to continue investing for their own secure future. Public provident fund, term insurance policies, and health insurance covers will remain relevant,” said Chetan Chandak, director at TaxBirbal.com, a tax consultancy firm.

Also read: Highest surcharge rate on income tax goes down: Will HNIs benefit?

Besides, there are other exemptions that they could be eligible for. "Even if they don't make any tax-saver investments, house rent allowance and other allowances, too,can push the taxable income below Rs 5 lakh under the old tax regime," he adds.

Since many already are or will be making tax-saver investments - for instance, PPF that entails yearly contributions, to meet their goals or will incur expenses eligible for tax breaks in any case, the old tax regime will continue to hold merit in some cases.

“For such individuals (whose tax outgo is nil under both regimes), the only benefit that the new regime offers is less paperwork and lower compliance burden as they need not maintain records of tax-saver expenses and investments,” said Chandak.

My gross annual salary is Rs 10 lakh. Can an efficient strategy help reduce my tax outgo to zero?

In theory, you need not pay any tax under the old regime even if your gross annual salary is as high as Rs 10 lakh, provided your expenses leave scope for the same.

If you can claim deductions of at least Rs 5 lakh (standard deduction, 80C, 80D, NPS contribution, home loan interest, etc), you need not pay any tax under the old regime.

Many would be eligible for deductions such as employees’ provident fund (EPF) contribution and children’s tuition fees under Section 80C as also house rent allowance exemption under Section 10 or housing loan interest deduction under section 24b.

You can claim these tax benefits without making any additional effort to reduce your tax outgo.

Also read: Earning Rs 10 lakh per annum? Higher deductions will mean more savings under the old tax regime

What are the exemptions still available under the new tax regime?

The new tax regime is not entirely exemption-free. While it has done away with up to 70 exemptions and deductions available under the old regime, certain benefits are still allowed.

For example, if your employer contributes up to 10 percent of your salary to your National Pension System corpus, you can claim this as tax relief under Section 80CCD(2).

Maturity proceeds of life insurance policies are also tax-free under Section 10(10D) under both regimes, subject to conditions. This benefit is not available for unit-linked insurance policies (Ulips) where the annual premium is higher than Rs 2.5 lakh.

Likewise, maturity proceeds of non-Ulip policies (primarily traditional savings-cum-insurance plans) where the aggregate premium during the year is more than Rs 5 lakh will also not be completely tax-free. The objective is to curtail the tax benefits on maturity proceeds for high net worth individuals.

Can I switch between the two tax regimes if I change my mind later?Salaried individuals can switch between the two tax regimes every year after estimating their tax liability under the two systems at the time of filing returns.

“If the older regime yields minimal tax savings, you can choose the new regime as it promises less tedious paperwork and process,” said Chandak.

On the other hand, a businessperson has the option of switching to the old regime and back to the new regime only once and not every year.

“However, if in future, their businesses were to shut shop, they will have the option of choosing either of the regimes, just like salaried or pensioned individuals,” explained Tivesh Shah, founder of Tru-Worth Finsultants.

When does a salaried individual have to make this decision?

Ideally, at the beginning of the financial year. Salaried individuals must indicate their choice of regime to their employer’s administration team in April, at the time of filing the proposed investment declaration. This time round, if you wish to opt for the old regime, you will need to specifically communicate this to your administration department. However, they are free to change this decision when filing income tax returns due in July.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!