Four years after finance minister Nirmala Sitharaman raised the surcharge for the super-rich in her first budget in 2019, she reduced the peak rate of 42.74 percent by almost 4 percent in her Budget speech on February 1.

The minister proposes to reduce the surcharge from 37 percent to 25 percent for those earning more than Rs 5 crore a year, bringing down the highest tax rate from 42.74 percent to 39 percent.

What is the surcharge?A surcharge is an additional tax over and above the basic tax paid by those earning higher incomes. Every taxpayer has to pay a surcharge on income if it exceeds a certain level, subject to marginal relief. The marginal relief is the difference between the excess tax payable (including the surcharge and cess) and the amount exceeding the threshold.

Also read: New versus old income tax regime — which one should you go for?As per the existing rules, a surcharge is applicable at the rate of 10 percent if net taxable income falls between Rs 50 lakh and Rs 1 crore, 15 percent for those with taxable income of between Rs 1 crore and Rs 2 crore. Those earning between Rs 2 crore and Rs 5 crore have to pay 25 percent surcharge, whereas those earning over Rs 5 crore pay 37 percent of the tax amount as surcharge.

Reduction in surcharge is only available to those who opt for the new tax regime.The benefit of reduction in surcharge

Reduction in surcharge is only available to those who opt for the new tax regime.The benefit of reduction in surchargeReduction in surcharge is only available to those who opt for the new tax regime. However, a 3 percent reduction in the overall tax rate on the total income for those earning above Rs 5 crore will certainly attract such taxpayers to opt for the new tax regime.

Given the cap on various deductions, they will not be able to save more if they go for the old regime compared to what they will save by a 3 percent reduction under the new tax regime.

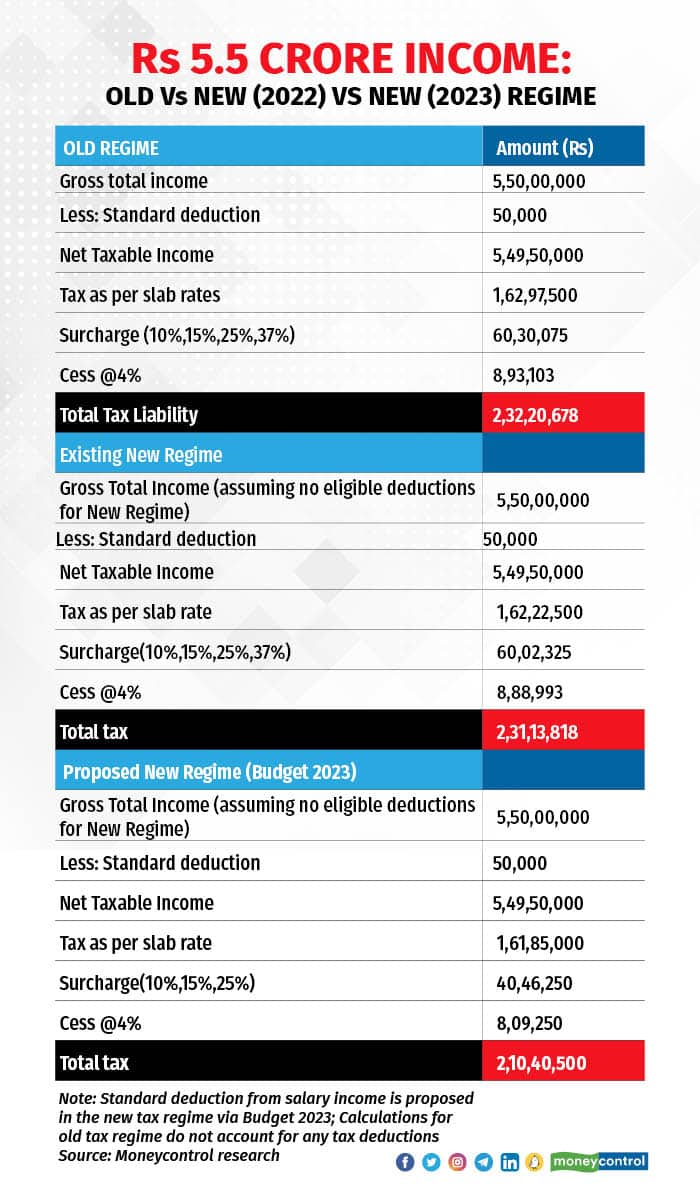

So, for instance, if someone earns Rs 5.5 crore annually, under the current new tax regime, with a 37 percent surcharge, they will have to pay a tax of approximately Rs 2.31 crore, including about Rs 60 lakh surcharge and Rs 8.9 lakh of cess.

But after taking into consideration the proposed new slab rate and the reduced rate of surcharge i.e. 25 percent in the new tax regime, total tax outgo will roughly be reduced by Rs 20.75 lakh to Rs 2.10 crore, including Rs 40.50 lakh and Rs 8.10 lakh as surcharge and cess, respectively.

A person earning Rs 5.5 crore will save around Rs 20.75 lakh because of the change in slab rates and cut in surcharge.

Sitharaman has also proposed to extend the benefit of standard deduction to the new tax regime. She said that each salaried person with an income of Rs 15.5 lakh or more will thus stand to benefit by Rs 52,500.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.