Finance Minister Nirmala Sitharaman met the expectations of the salaried class in Budget 2023, who were hoping for tax relief, but there was a catch.

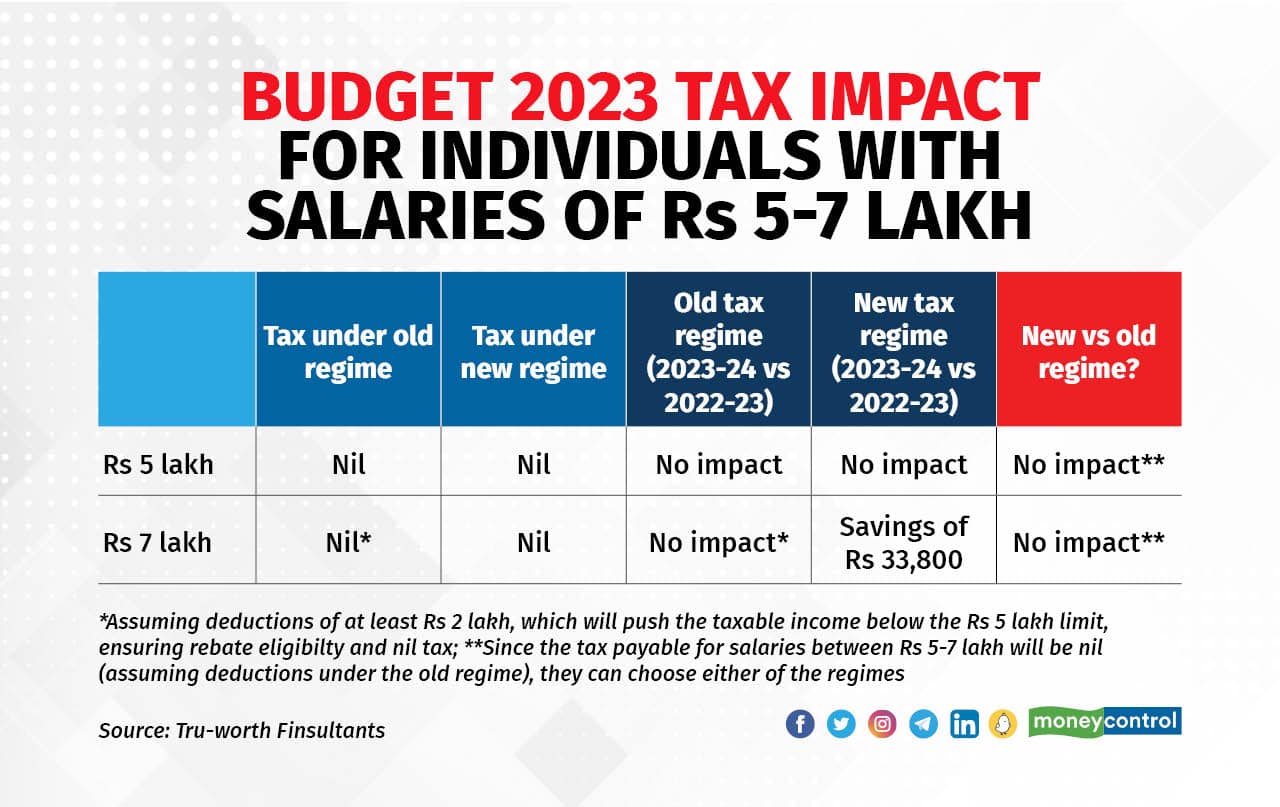

Those with an income of Rs 7 lakh will have no tax liability but only if they opt the new income tax regime. The tax rates are lower in the new regime but taxpayers cannot claim Section 80C deduction, HRA exemption, health insurance deduction and other benefits under the old tax regime.

Under the new tax regime, if your taxable income is up to Rs 7 lakh, you will be eligible for a rebate of Rs 25,000. Put simply, you will not have any tax liabiltiy, but you will still have to file your income tax return (ITR) to claim the rebate. Earlier, the rebate of Rs 12,500 was available under both the regimes for incomes up to Rs 5 lakh.

Now, those with gross salary of Rs 5 lakh-7 lakh under the old tax regime will have to pay tax at a rate of 20 percent. However, if they were to claim tax benefits of at least Rs 2 lakh (standard deduction plus section 80C deduction of Rs 1.5 lakh), their gross salary will dip below the rebate threshold, which means that effectively they will not pay any tax under this regime either.

If you had chosen the new tax regime last year and aim to stick to it in 2023-24, you will take home Rs 33,800 more, as per Tru-Worth Finsultants’ tax computation.

If you had chosen the old tax regime last year, claimed tax benefits of at least Rs 2 lakh and continue to do so in 2023-24, moving to the new regime will not mean additional savings. However, it does away with the need for making tax-saver investments and other compliance requirements.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.