Finance Minister Nirmala Sitharaman unveiled a slew of changes in the way the government taxes the common man, potentially bringing a huge relief to the middle, or salaried, class.

Here's a quick lowdown of the changes proposed by the Union Budget for 2023-24:

1. Change in rebate

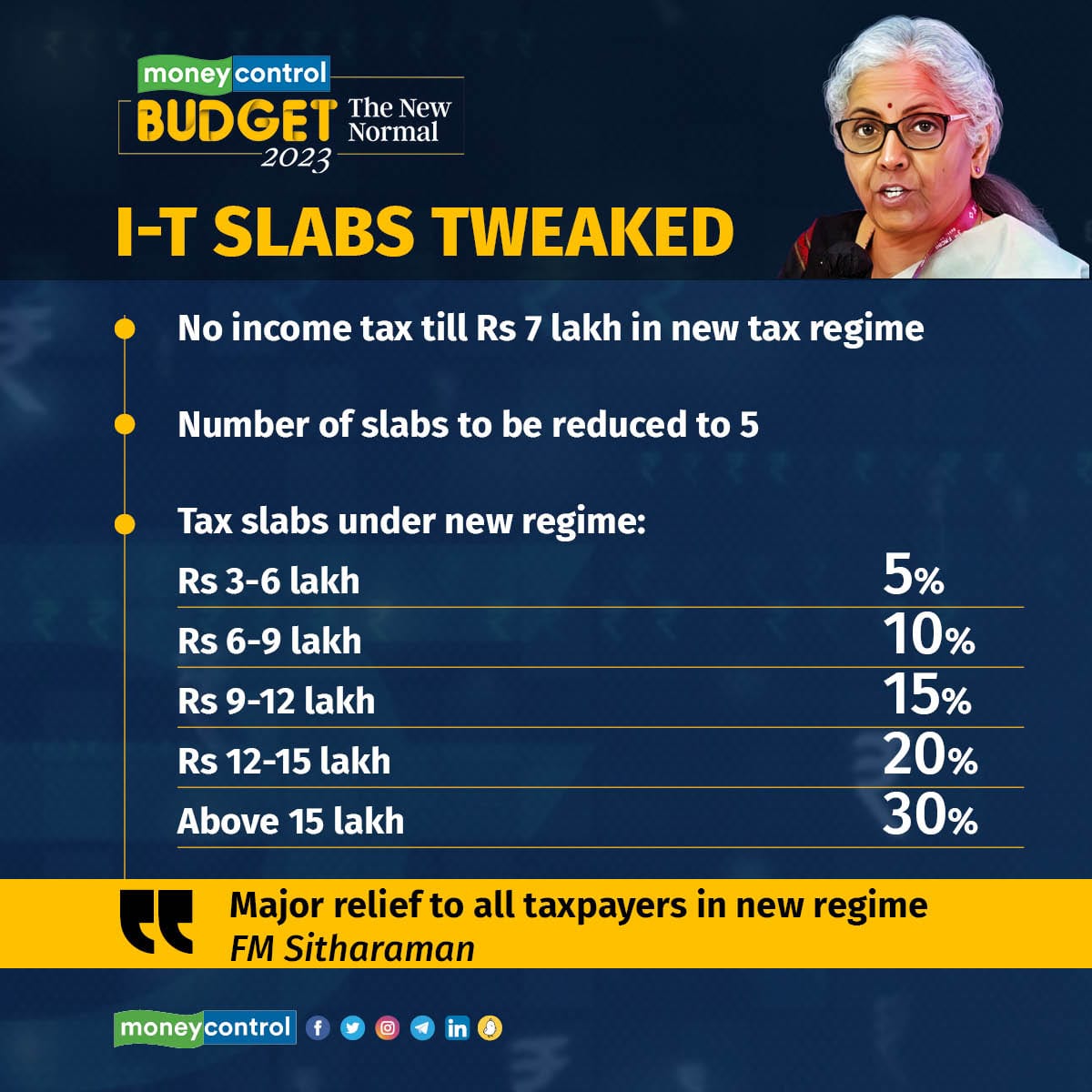

People whose earnings are up to Rs 5 lakh do not have to pay any income tax, under both the old and new regimes. The Budget has raised the limit to Rs 7 lakh in the new tax regime. In other words, people with an income up to Rs 7 lakh do not have to pay any tax.

2. Change in income tax slabs

Again, a move clearly targeted at the middle class with the general elections due in 2024. Under the new personal tax regime, the income slabs have been reduced to five. The government has also increased the basic tax exemption limit under the new tax regime from Rs 2.5 lakh to Rs 3 lakh.

The FM also provided a couple of examples on how this will work. People who are earning an income of Rs 9 lakh a year will have to pay only Rs 45,000 a year as tax. That is 5 percent of their income or a reduction of 25 percent from the Rs 60,000 they were paying earlier, she said.

Catch our LIVE Budget coverage here

Likewise, individuals earning Rs 15 lakh would be required to pay only Rs 1.5 lakh, or 10 percent, of their income. They are currently paying Rs 1,87,500 a year as tax.

3. Salaried and pensioners

For salaried individuals, pensioners and family pensioners, the FM has introduced a standard deduction under the new tax regime. Old tax regime already offers a standard deduction of Rs 50,000 to salaried employees and pensioners. Combined with the rebate, this means that salaried individuals earning up to Rs 7.5 lakh need not pay any tax under the new tax regime.

4. Change in highest tax rate

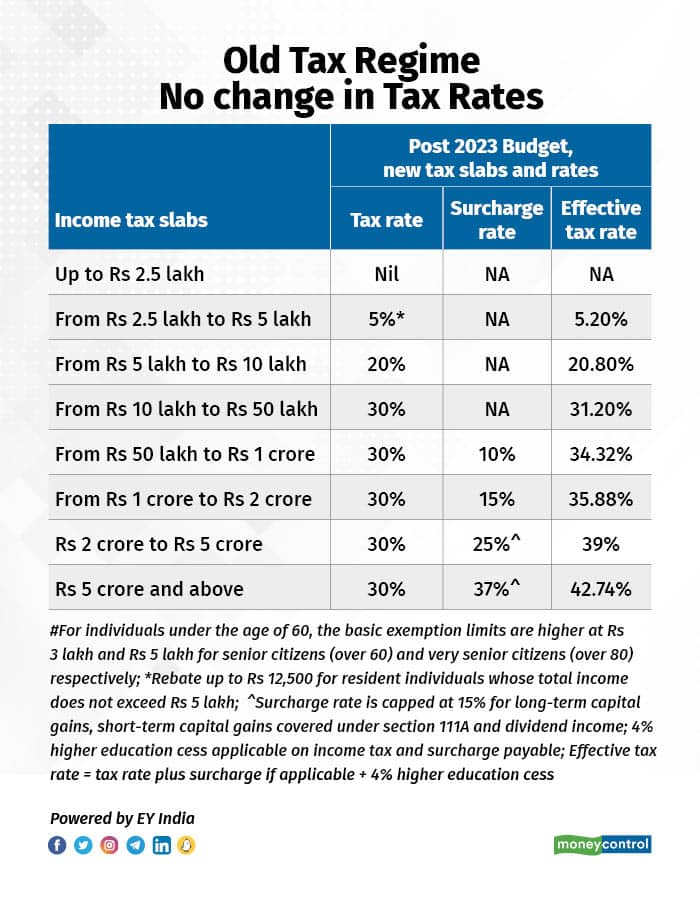

The wealthy in India — people earning above Rs 5 crore a year — now pay 42.74 percent tax, which is among the highest in the world, according to the FM. The surcharge has been reduced to 25 percent from 37 percent to in the new tax regime That means the effective tax rate for this class has reduced to 39 percent - at par with those who earn over Rs 2 crore.

5. New tax regime becomes default

The new income tax regime has made the tax arithmetic harder. And, there, the Budget has kept the option to use the old tax regime open.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.